Q2 Earnings and Supplemental Taxes on RSU Vests

A look at how adjusting supplemental withholdings on stock vests can prevent a large tax bill

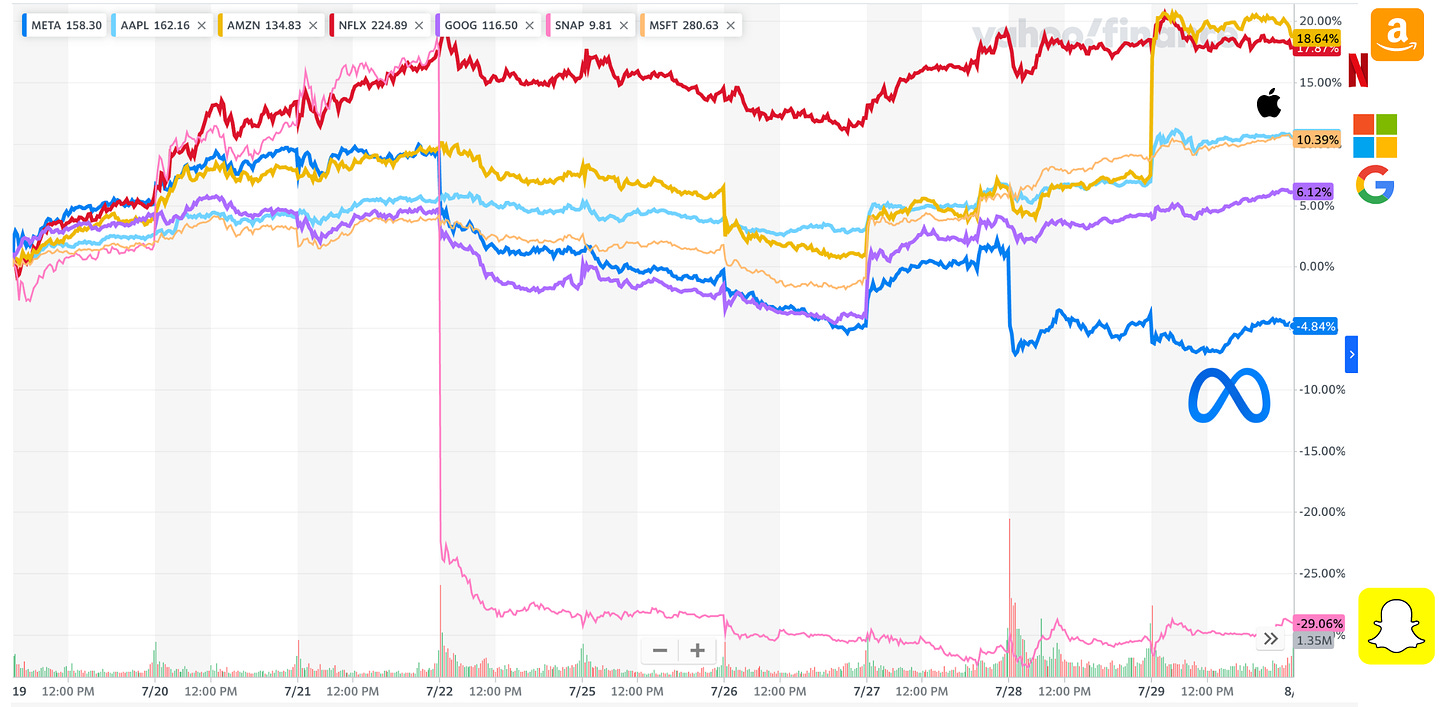

FAANG earnings just finished up after an eventful week. Below you can see stock performance starting on 7/19 which is when Netflix kicked off FAANG earnings. I am also including SNAP in the mix since they really set the tone by really lowering expectations across all advertising heavy companies on 7/22.

Big winners were Amazon, Netflix increasing >15% followed by Apple, Microsoft increasing 10%, Google +5%. The losers were Meta -5% (many were celebrating mostly flat movement post earnings but you really need to track this back to when SNAP released earnings).

Quick note: I frequently get asked why Netflix is still within FAANG while Microsoft isn’t (or why Meta gets to keep its F). In the context of a newsletter focused on financial independence Netflix deserves to stay. They consistently have some of the highest total compensation among FAANGs. As for Microsoft, they likely deserve to be included. They just tend to operate better with a chip on their shoulder so I am going to continue to exclude them from the acronym.

Speaking of Microsoft, their fiscal year just ended. That means Microsoft employees will be due their annual refreshers. All eyes are on MSFT as their CEO announced back in May that many employee total compensation bands will be increasing by 25%.

Strategies Around Upcoming Vesting Periods

Meta employees have their RSU’s vest quarterly. The next vest is 8/15/2022. This next vest will be slightly different though. For the first time ever Meta employees will have the opportunity to adjust the supplemental withholdings on their vested shares.

I previously posted in February that new FAANG workers are often shocked by their tax bill every year. The primary reason being that “Many companies, Meta/Facebook included, withhold equity vests at the “supplemental rate” which is a flat 22%. This means regardless of whether you are a VP earning millions or a new IC3 with a little less, all your RSU vests will automatically withhold 22% for taxes (technically supplemental withholdings for those earning >$1M jumps up to 37%).”

The only way previously to avoid a giant tax bill was to manually pay the IRS quarterly or significantly adjusting your W4 withholdings.

Now there is a new, much better way. Meta employees can now manually choose what percent, between 22-37%, they want automatically sold to cover federal taxes on RSU vests. For the upcoming August 15th vest you have until August 8th to make the adjustments.

Meta employees can make these changes within Workday. Google employees are able to access this through go/supplementalwithholdingelection. Google and Apple employees have long already had this feature and it is great to see Meta add this. If you work somewhere else and this is a frequent problem you face be sure to reach out to your benefits team and ask if they can look into adding this feature to your plan.

Should I Change My Supplemental Withholdings?

This is very much a micro optimization. It will not meaningfully impact you very much in the long run. If you don’t have any issues with getting a large tax bill each April you can just leave things as they are. The penalties in most cases tend to be rather small. I owed >$50k last year and the penalty was ~$150.

I love micro-optimizations though. In 2023 I plan to more carefully tune my withholdings to only owe the IRS <$5,000 to just make my monthly expenses a bit more predictable. For now I am just increasing withholdings up to 37% for the rest of the year. Since I always sell everything and diversify this will make my life a little easier, giving me a way to auto-pay the IRS the taxes I'll eventually owe. Remember, at the end of the day this is just about when you pay your federal taxes. Either during each vest, or at the end of the year when you do your taxes. Worth noting that if you want to hold your Meta shares long term you may want to consider keeping things at 22% since that will result in you keeping more of the shares you vest.

What Else Am I Reading?

I am finishing up Financial Samurai's new book “Buy This, Not That”. I am surprised at how much I like it. I have a few differing opinions around how Sam approaches Real Estate and withdrawal rates but the book is much more than that. I really resonated with the mindset Sam was advocating for in his first published book. Viewing life decisions in ways that allow you to take strategic 70% probability bets. I resonated heavily due to Sam reaching FIRE in San Francisco, currently having small kids, and career parallels that I previously didn’t realize we shared. Once I finish i’ll share a dedicated write up, but I am going to go ahead and recommend this as one of the best FIRE books that isn’t just regurgitating the existing dogma that proliferates the many existing FIRE books.

There was a surprise resurrection of the “Inflation Reduction Act” which is slated to make its way through the Senate. I was keeping a close eye because the previous incarnation of Biden’s “Build Back Better” plan would have led to significant changes to many key FIRE strategies, particularly around Mega Backdoor Roths. That doesn’t seem to be the case this time around. I am not seeing any of the prior concern areas in the new act. We shall see how it fares through the House before celebrating another year of mega backdoor roth access.

I am also re-learning what the definition of a recession is?