Hey FAANG FIRE!

This year many of you are going to feel the pain when you file your taxes. I am really worried that a large number of tech workers are going to get a nasty surprise when they file their 2023 taxes this upcoming April. This is particularly true if you receive a significant amount of your total compensation in RSUs and your company had a major run up this year.

It’s December, so there isn’t a lot you can do. But, do you know what sucks more than owing $50,000 to the IRS? Owing $50,000 to the IRS without having time to prepare.

But, do you know what sucks more than owing $50,000 to the IRS?

Owing $50,000 to the IRS without having time to prepare.

Today I am going to share with you how to use a tool I created to estimate whether you might be in for a painful tax bill. Don’t worry though, I’ll also walk through what you can do to prevent this situation next year.

All information is provided for educational purposes only and does not constitute legal or tax advice.

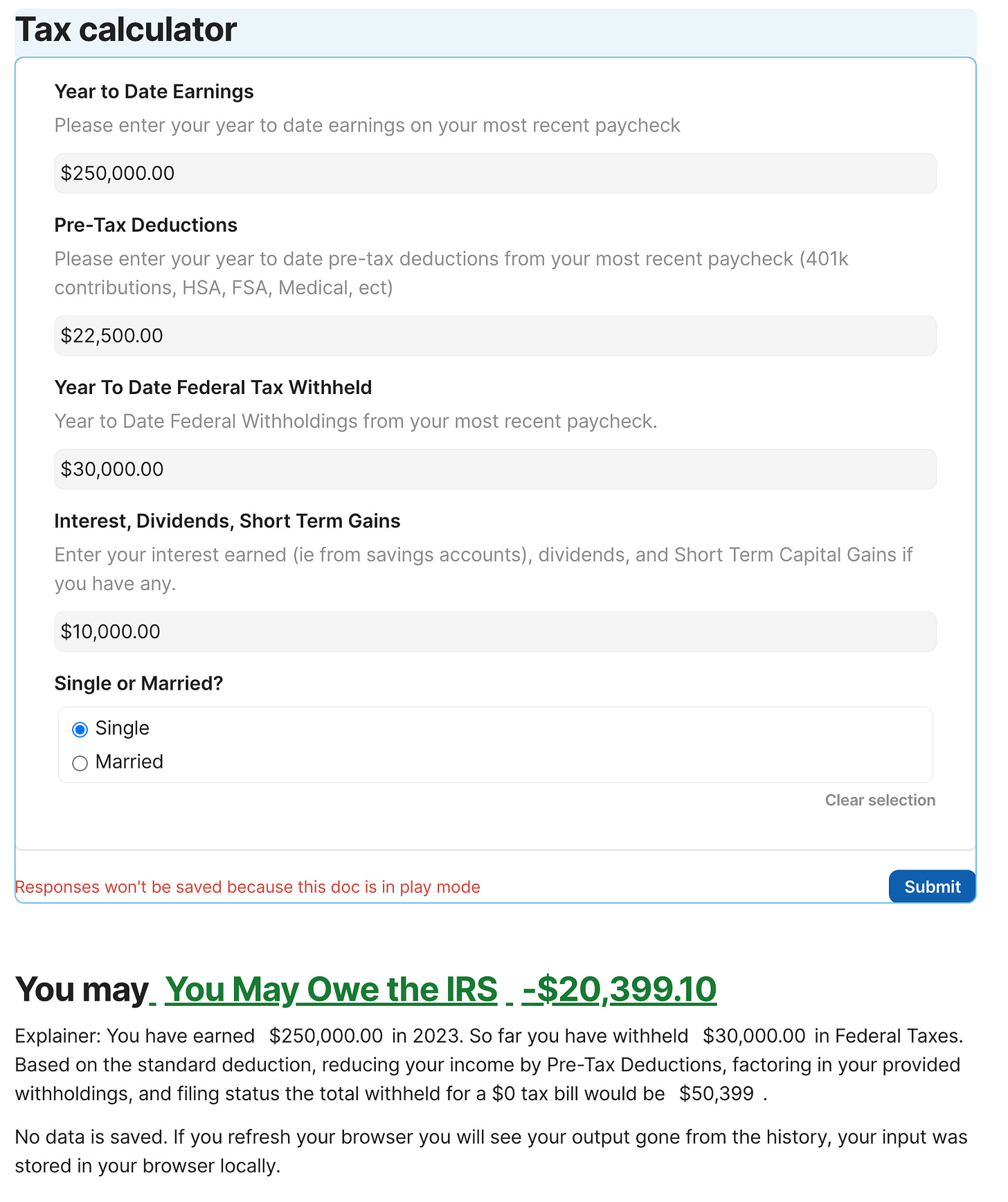

Estimating Your Tax Bill Calculator

I was annoyed that the online calculator I previously used to estimate my taxes wasn’t updated for 2023 tax data. So I decided to just build one myself. I wanted it to be simple and quickly answer roughly how much I might owe the IRS when I file my taxes.

Here is the free estimator: https://coda.io/@andre-nader/quick-federal-tax-bill-estimate-for-2023-faangfire

Calculator Walk Through

The Data Fields

When you open up the calculator you will be greeted by a simple form. Here are the descriptions of each field.

Year to Date Earnings

Overall earnings which includes Base Salary, Bonus, Imputed Benefits, and in my case Severance

Where to find this data: most recent paycheck

Pre-Tax Deductions

Deductions that reduce the amount of income subject to many taxes. Includes pre-tax 401k contributions, HSA, FSA, and Medical expenses withheld from payroll.

Where to find this data: most recent paycheck

Year to Date Federal Tax Withheld

Total federal taxes you have already given to the IRS. Only Federal, doesn’t include state, social security, or medicare.

Where to find this data: most recent paycheck

Interest, Dividends, Short Term Gains, Unemployment

All interest, dividends, and short term capital gains, and unemployment get taxed the same as income. Many have earned a decent amount this year from banks paying 5% interest, all this will need to be taxed.

Where to find this data: most recent paycheck, broker, bank

Single or Married?

This is your IRS filing status. It is used to determine whether to use Single or Married tax brackets as well as the standard deduction.

Filing Out the Fields

To get an accurate estimate you will want to use data from your most recent paycheck. If you are married, or had multiple jobs this year, add all the data together prior to entering into the form.

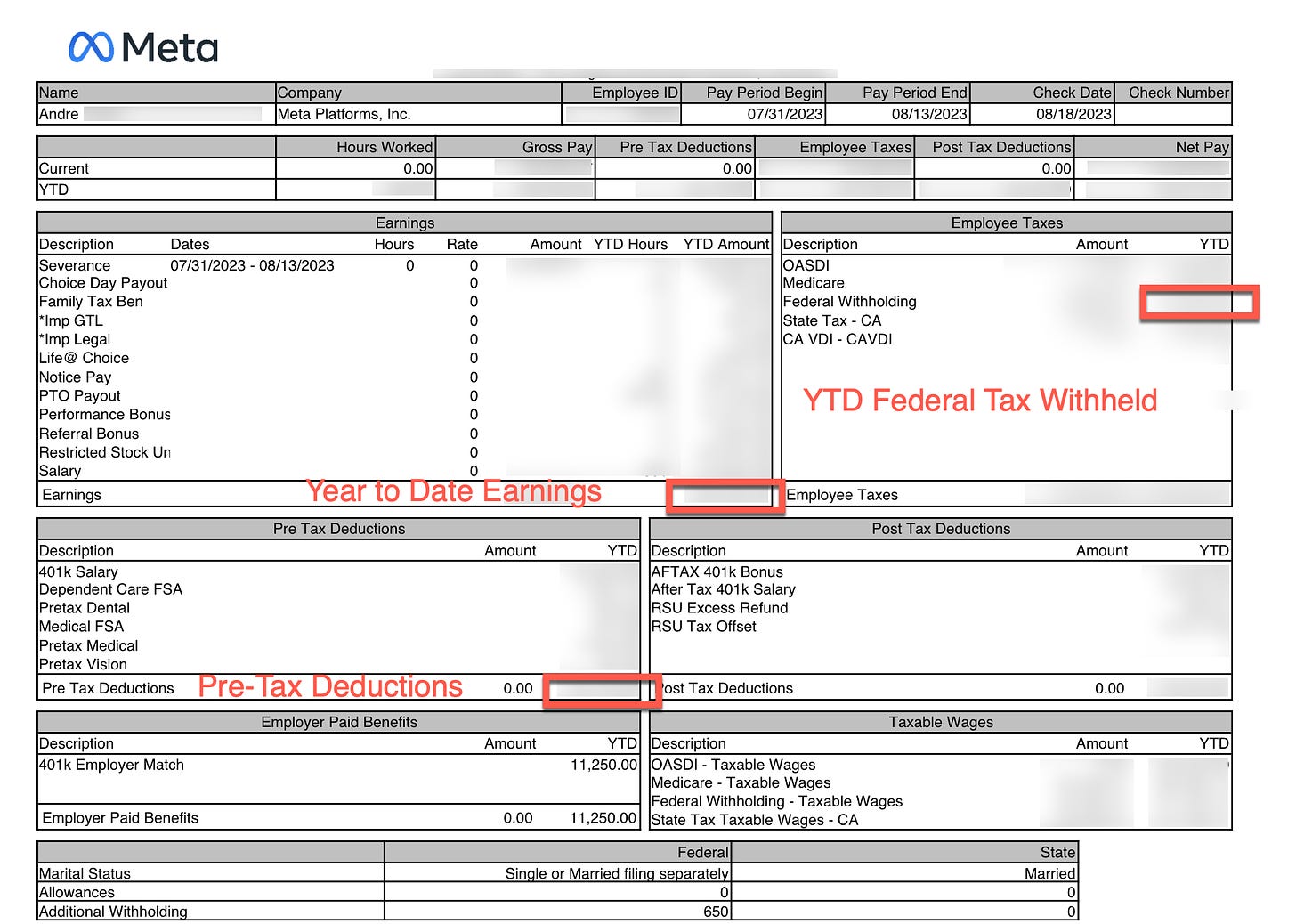

Paycheck

You will be able to get most of the information for the form from your most recent paycheck; Year to Date Earnings, Pre-Tax Deductions, and Year to Date Federal Tax Withheld.

Here is an example of what a Meta paystub looks like, with the data you need highlighted.

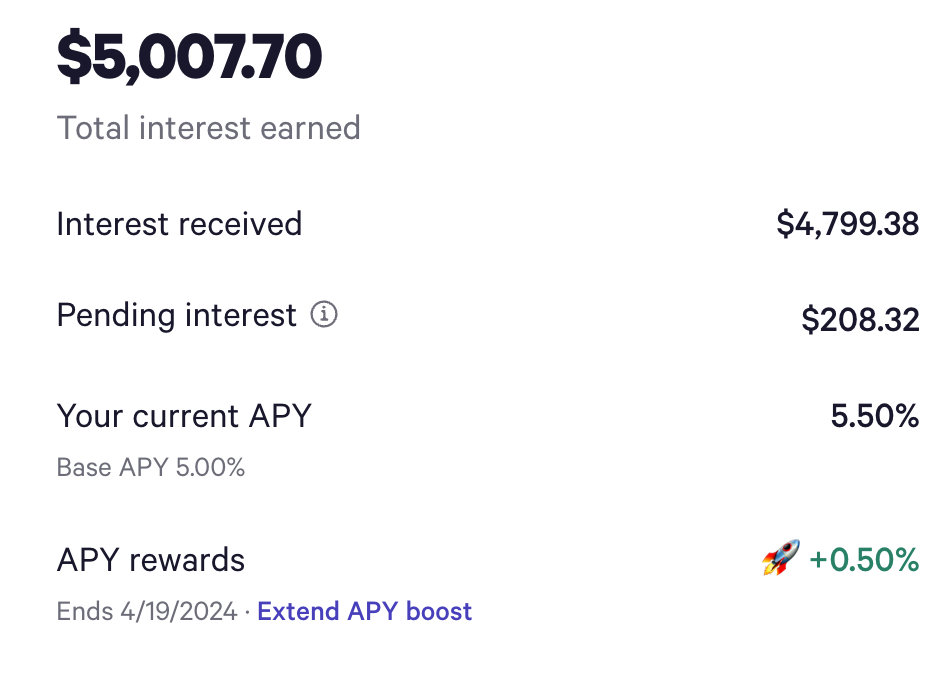

Bank Interest

If you are like me you also may have your emergency fund + additional savings earning >5% interest which will also be taxed as income.

I have the majority of my emergency fund in Wealthfront which currently earns earns me 5.5% thanks to their base of 5% per year + 0.5% “boost” thanks to those who signed up through my friend referral link (you will receive a .5% boost for 3 months).

Dividends + Short Term Gains

If you have a taxable broker it is likely you will also have dividends. Many of the mutual funds I hold will pay their final dividends in the final weeks of the year.

If you have sold stock within your taxable broker as well as your RSUs for a gain, include the portion of your short term gains. (The calculator doesn’t currently factor in long term gains. I will add it in a future iteration.) Be sure to subtract out your losses if you sold some shares for losses.

Unemployment

If you were laid off and received unemployment benefits, remember that these payments are taxable. If you chose to have federal taxes withheld by the unemployment office, include this amount in the 'Pre-Tax Deductions' field.

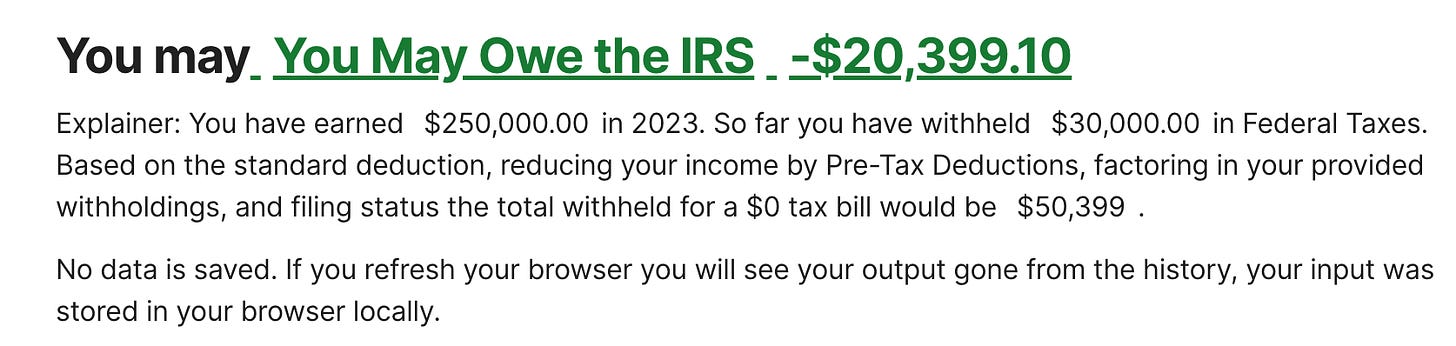

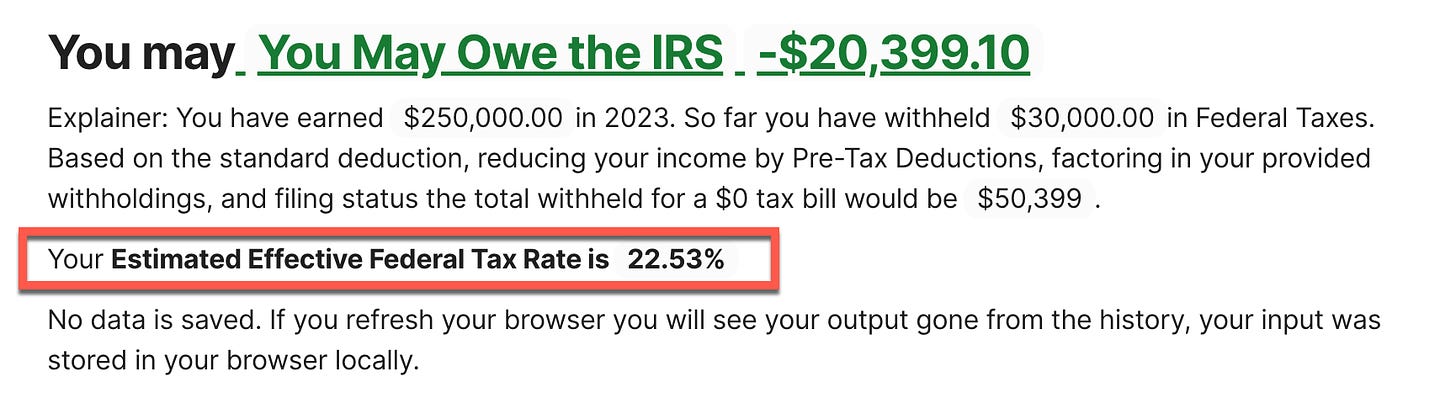

Calculator Output

After entering all your information and pressing “Submit” the document will update with a quick summary and whether you might owe at the federal level or potentially be getting a refund.

Why Might You Owe The IRS?

First, take a breath! I know it can seem stressful if you owe a large amount. While it isn’t a fun surprise, know that it happens really often and you will probably not even owe very much in penalties. One of my first posts was on “Shocked by Your Tax Bill” (so hopefully those who have been following me are not shocked!).

Blame Bad Defaults

Taxes on RSUs are the #1 reason FAANG workers owe a large amount when they file. It all comes down to, what we in the product growth world would consider, bad defaults.

From the IRS perspective, Income is Income is Income. When you file your taxes, income from your base salary, bonuses, RSUs (value at vest) gets added up and taxed the exact same. You would think that since “Income is Income is Income” the IRS defaults would be simple… well they are not. Income is Income, but apparently withholdings (the amount removed directly from your pay for taxes) are different for Wages, Bonuses, and RSUs??

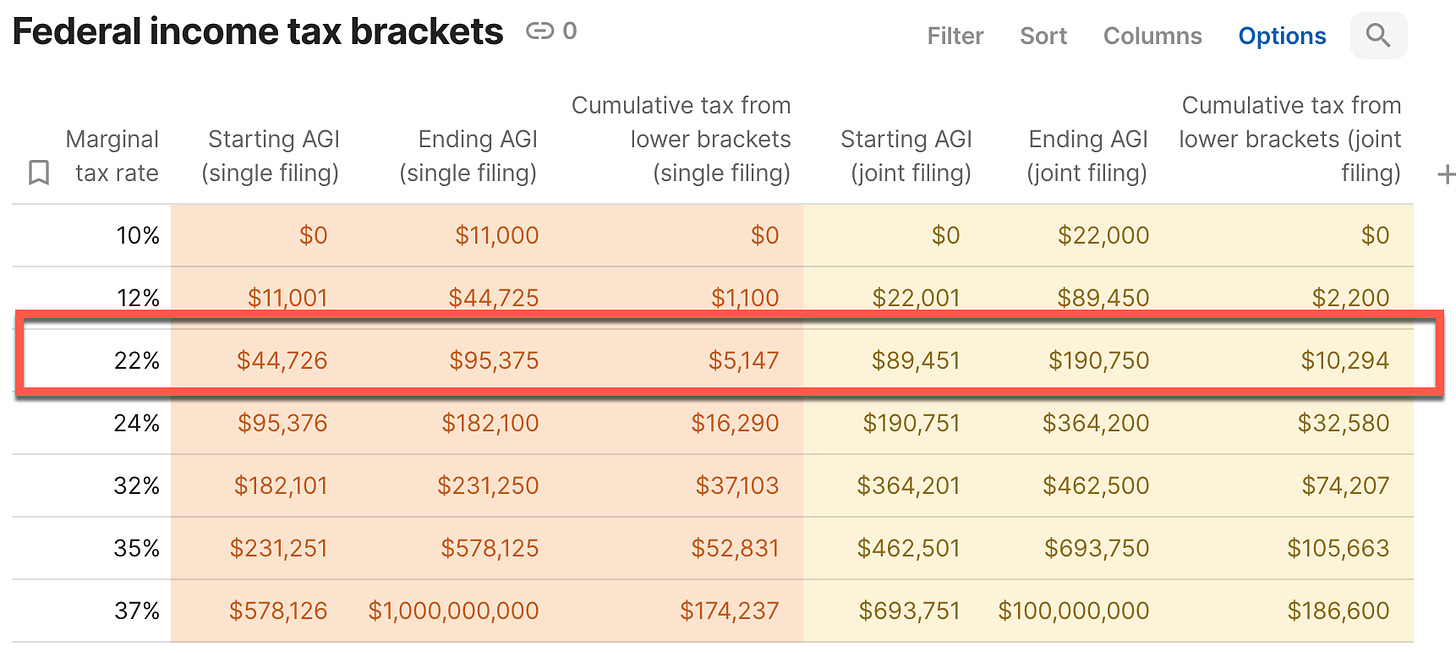

RSUs are referred to by the IRS as “Supplemental Wages”. The default federal withholding on RSUs is 22% unless you earn more than $1,000,000 then it increases to 37%.

A very casual glance at the Federal Tax brackets should make it clear that 22% is simply not enough for anyone earning more than $95,375 while single or $190,750 is married and filing jointly. This means that a new grad earning $100k in their first partial year of employment will have their RSUs withheld at the exact same rate as many directors (many because if they surpass $1M only then are the supplemental withholdings by default increased to 37%).

If you want to understand more about how federal tax brackets work, see my Federal Tax Explainer.

A Few Other Reasons

While bad defaults on supplemental earnings are the biggest cause for FAANG workers. It isn’t the only reason. Some other causes:

Incorrect W4 Withholdings: If you configured your W4 withholdings incorrectly, the amount taken out of each paycheck might not be sufficient.

Interest/Dividends: You earned a significant amount of money on your cash sitting in a high interest account and/or your hold stocks/bonds in your taxable broker that pay out significant dividends. (Keep those bonds/high interest funds in your 401k/roth see Tax Location vs Tax Allocation)

Capital Gains: Selling stock for a gain is subject to normal income tax rates if held for <1 year, and long term rates if held longer.

Side Hustles: If you have a side hustle and are not paying quarterly taxes

Is Owing Taxes Bad and are There Penalties?

The IRS has some scary language that says “If you don’t pay enough tax through withholding and estimated tax payments, you may be charged a penalty.” However if you keep reading you should sigh in relief “Generally, most taxpayers will avoid this penalty if they owe less than $1,000 in tax after subtracting their withholdings and credits, or if they paid at least 90% of the tax for the current year, or 100% of the tax shown on the return for the prior year, whichever is smaller.”

Those last two pieces are the key provisions that prevent most FAANG workers who owe large federal tax bills to walk away without any additional penalties. As long as you paid the lower of “90% of the tax for the current year, or 100%* of the tax shown on the return for the prior year” you shouldn’t run into significant penalties. These are referred to a “Safe Harbor” rules for underpaying your estimated taxes.

*Edit: A reader correctly called out that there is a slight difference for most reading this. It should be 110% of the tax shown on the prior year for those earning > $150k per the IRS “If your AGI for 2022 was more than $150,000 ($75,000 if your filing status for 2023 is married filing a separate return), substitute 110% for 100% in (2b) under General Rule, earlier.”

So, even if you owe $50k in federal taxes you might not owe any additional penalties!

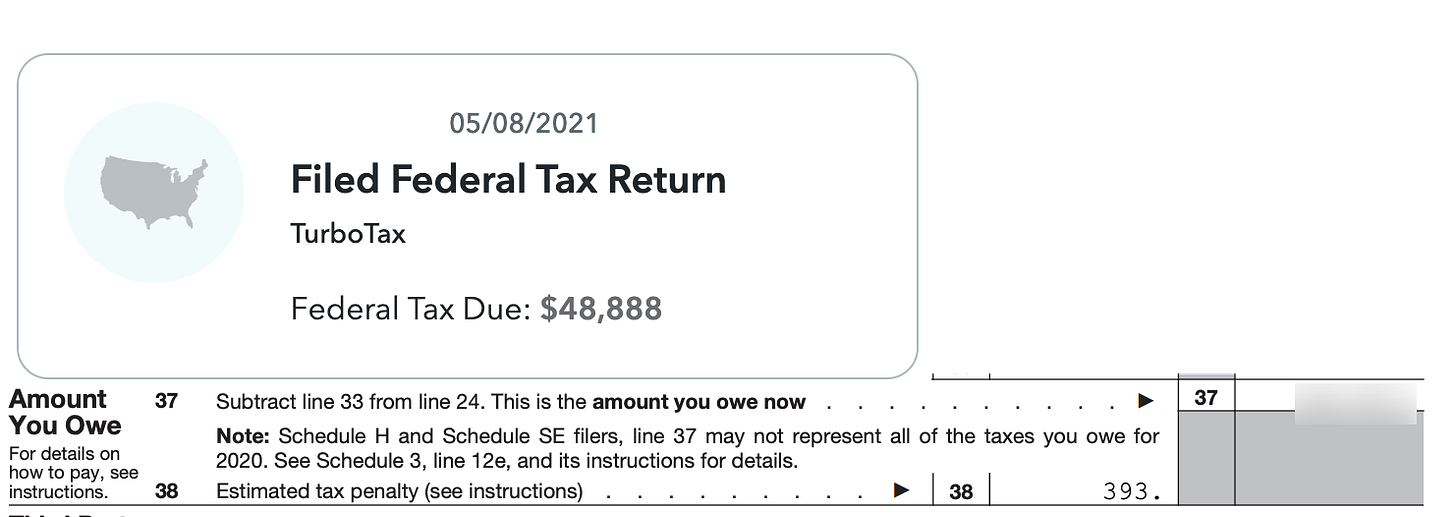

My personal tax bill history:

In 2019 I owed >$30k and paid $0 in penalties

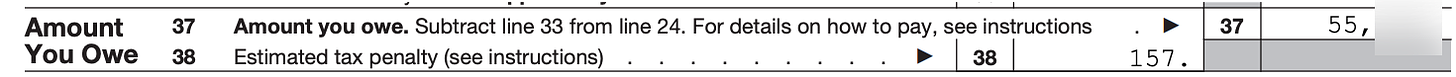

In 2020 I owed $50k and paid $393 in penalties

In 2021 I owed >$55k and paid $157 in total penalties

In 2022 I owed >$15k and paid $0 in total penalties

If you don’t fall under the safe harbor provisions, then you will likely be subject to more penalties in addition to interest on under withholdings which is currently 8%!

How To Avoid Under Withholding in 2024

If you are walking through this section I want you to know that you are awesome. It is December 2023 and you are already thinking about how you can help your future self avoid the stress you might be feeling right now. You have 4 months to plan for your April tax bill and 12 months to avoid it from happening again!

Update Your Supplemental Withholdings

By now you know and understand that bad defaults, in the form of 22% supplemental withholding rates, are the cause of the majority of your tax bill. Luckily, many of you will be able to directly change this default.

Meta, Google, Apple, Uber all let their employees directly update their supplemental withholdings anywhere from 22-37% manually.

Meta Employees can change this in workday, search Life@ for "Federal supplemental tax rate election for RSUs" (Equity → Compensation)

Google Employees can access their settings by going to go/supplementalwithholdingelection

Uber Employees can update through Solium (Only available quarterly I believe)

If your employer doesn’t allow you to make this update; ask them to! Reach out to your benefits/RSU/payroll teams to let them know more and more companies are allowing their employees to update their supplemental withholding rate. They may not even be aware this is an issue and/or there is a way for them to add the functionality.

What to Change Your Supplemental Withholding Rate To?

The short answer: more than 22%. A good starting point would be to use your effective federal tax rate based off your current taxes (or at least prior years taxes).

Effective Federal Tax Rate: Total Annual Federal Taxes Owed / Total Annual Income (less deductions). If you used the Tax Bill Estimator I updated it to include this quick calculation based on your provided data.

Halfway through the year I would again estimate your taxes (ask me to update the doc with 2024 tax rates :) ) and make adjustments going forward to make up for the shortfall.

Update Your W4

I would recommend always starting with your supplemental withholding rate if possible. If you can’t do that, the next best thing might be to update your W4.

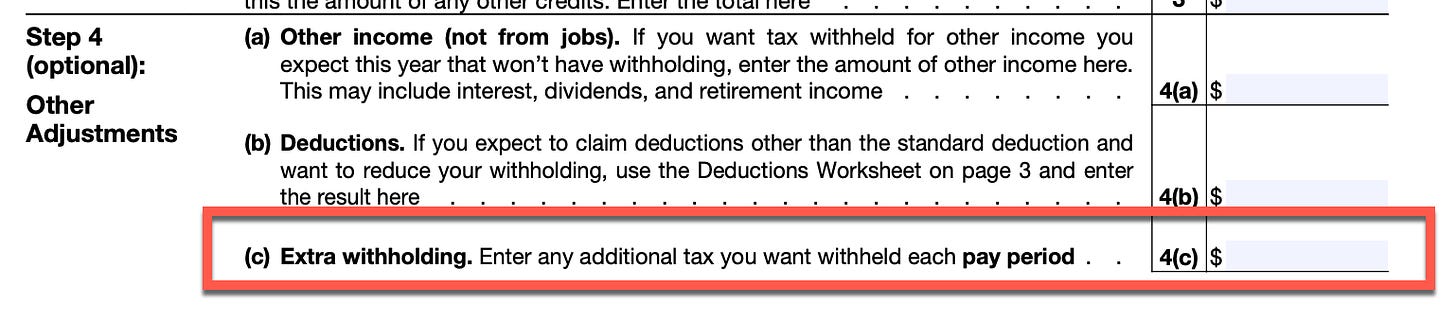

It is important to know that no amount of playing with the number of withholdings will make up for a significant gap caused by supplemental withholding rates on RSU income. You will need to find the section on your W4 (available through your payroll provider) called Extra Withholdings. Whatever number you enter in this box will be taken out of each paycheck.

If you want to have your entire shortfall taken care of by the Extra Withholding on your W4 you can divide your total amount you of shortfall you owe in federal taxes (the shortfall between how much you withheld and how much your actually owe) by the number of pay periods your have.

Example: You estimate that you will owe $25,000 when you file in April 2024 and you get paid bi weekly (26 pay periods). $25,000/26 = $961.53. If you enter $961.53 additional dollars would be taken from each paycheck. Not super fun, make sure your cash flow prior to RSU vests/bonus are in a good place prior to this.

Paying Quarterly

Updating your W4 to have additional taxes taken out of each paycheck to make up for an under withholding on your RSUs can feel shitty and still be imprecise. Luckily there is yet another option, simply paying the IRS quarterly based on your actual estimated taxes owed. The US Department of the Treasury offers a free tax payment system through EFTPS.gov where you can submit payments.

All you need to to is log into EFTPS.gov every 4 months and complete an ACH payment. You can precisely calculate your current shortfall or just estimate the shortfall based on the prior year’s tax bill.

Asking the IRS to Fix This

I really wish that the IRS would make changes to how they deal with supplemental withholding rates. People shouldn’t have to understand this level of detail just to avoid owing tens of thousands of dollars. It seems like it would be in everyone’s interest to have this change. I submitted my suggestion to the IRS Taxpayer Advocacy Panel and recommend you do the same.

Here is what I wrote:

“The default supplemental withholding rate of 22% is broken for employees who receive significant restricted stock units. This results in many employees owing the IRS tens of thousands of dollars unnecessarily.

I am suggesting that the IRS default for supplemental wages be more dynamic than simply 22% unless your income is more than $1,000,000. Either similar to how the supplemental rate on bonuses are treated or adding additional income tiers.”

Closing Thoughts

In two weeks I'm heading out to visit family in Texas and Florida. Looking forward to spending time with loved ones, and dive into some reading. I'm particularly excited about starting two books on my Christmas list – "Same as Ever" by Morgan Housel and "Pathfinders" by JL Collins. I loved the previous books by both authors (Simple Path to Wealth and The Psychology of Money).

I’ll have one more newsletter before the end of the year going over my final end of year preparations. While I no longer need to worry about performance reviews and work related goal setting, I still am very much into applying the same Understand/Identify/Execute framework into my own personal annual planning.

On that note, if you're looking to jumpstart your financial journey into 2024, I have something special for you. I'm offering my "Path to Fire" coaching session, which for a limited time includes four meetings designed to set you on your path to financial independence. If you're interested in a 1:1 deep dive before the year ends, make sure to book this week. Our initial session, lasting an hour, goes through a comprehensive understand of your current landscape. This is an opportunity to lay a solid foundation for your FIRE journey. I'll be available until my vacation starts, so let's make the most of this time!

Let me know what you think about the free Tax Estimator Tool in the comments or by replying to this email. What is useful? What improvements would you like to see to make it more useful for next year to help get ahead of things?

Thanks for the blog. Wanted to point out that the "YTD Federal Tax withheld" is highlighting the wrong field in your example Meta paycheck.

Since the majority of folks who read this would be income earners > $150K I recommend calling out the safe harbor is 110% instead of 100%. Maybe add that sentence to avoid having folks still underpaying.

From IRS publication -> https://www.irs.gov/publications/p505

"Higher income taxpayers. If your AGI for 2022 was more than $150,000 ($75,000 if your filing status for 2023 is married filing separately), substitute 110% for 100% in (2) above. This rule does not apply to farmers and fishermen."

Same applies to 2023 I think