The idea of simplification was a core tenet within the growth teams I worked on at Meta.

How can we reduce steps in the sign up flow to increase conversions.

How can we remove unnecessary fields.

How can we make it so people clearly understand what is happening without needing to think so hard.

One challenge is that growth teams are constantly in optimization mode. They are rapidly iterating over small changes.

Adding a green button here.

Adding another button at the bottom of the screen where people’s thumbs are.

Optimize the text on the button.

Add a red dot when they have an unread notification

Add a push notification…..

If you are not careful, you can end up with a tangled web of optimizations held together with duct tape.

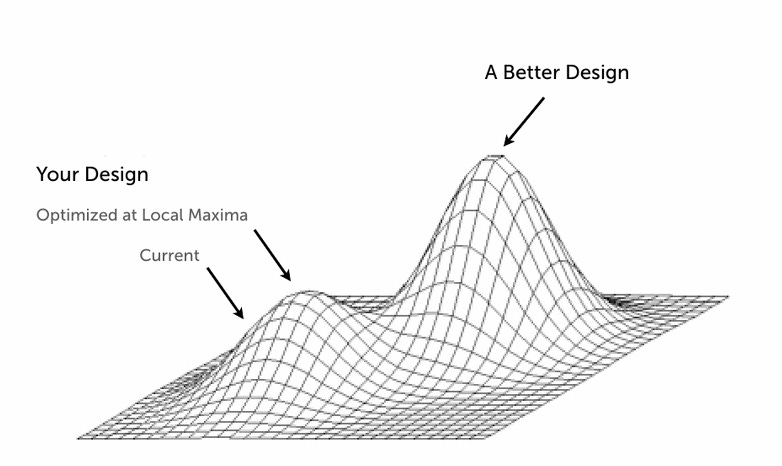

With optimizations alone, it can be easy to get stuck in a local optimum. You iterate and iterate, but you get stuck because no single small change will break you out of that local maximum.

But this post isn’t about product growth. This is about creating a path to financial independence.

Over Optimizing My Financial Life

I am an optimizer. I have spent my personal and professional life identifying 1% improvements. Just as you can run into a local maxima in product growth, I think I have reached a local maxima in my financial life.

Over time, I have made hundreds of small optimizations to my accounts. I have a web of bank accounts from past sign up bonuses. Dozens of credit cards from my past of churning credit card points. Investment accounts scattered across institutions from past employers.

Then, while reading Ramit Sethi’s “Money for Couples” I hit this paragraph:

Eventually I’m going to die, and if I go first, I want Cassandra to feel confident knowing exactly what to do with our money.

(There’s an epidemic of women who are left unequipped to handle their finances when their partners pass away. They’re easy targets for predatory financial sharks. I will never leave my wife in this situation, and I look forward to her laughing and hanging up on the worthless Goldman Sachs wealth advisors who might call her after I die. I’ll be watching with popcorn from heaven.)

There was also a clear theme within a prior bookclub book “How to Retire” where an entire chapter was dedicated towards the financial challenges women face. The reality is that women live longer. They are the most likely to need to eventually manage their finances whether they want to or not.

After finishing the 1st chapter of “Money for Couples” my wife and I asked her what questions she had about money.

Then she hit me with:

Her: “Where is our money?”

Me: Where is the money! You can see all the accounts here in Monarch, or Empower, and in all my spreadsheets that I have shared with you!

Her: “Help me understand it.”

For some reason this hit me like a ton of bricks.

This felt like a major failure on my part. I spend every day helping people understand their own finances yet I dropped the ball at home. Not to worry! I am sure I can clear this up by just walking through one of the financial tools I use.

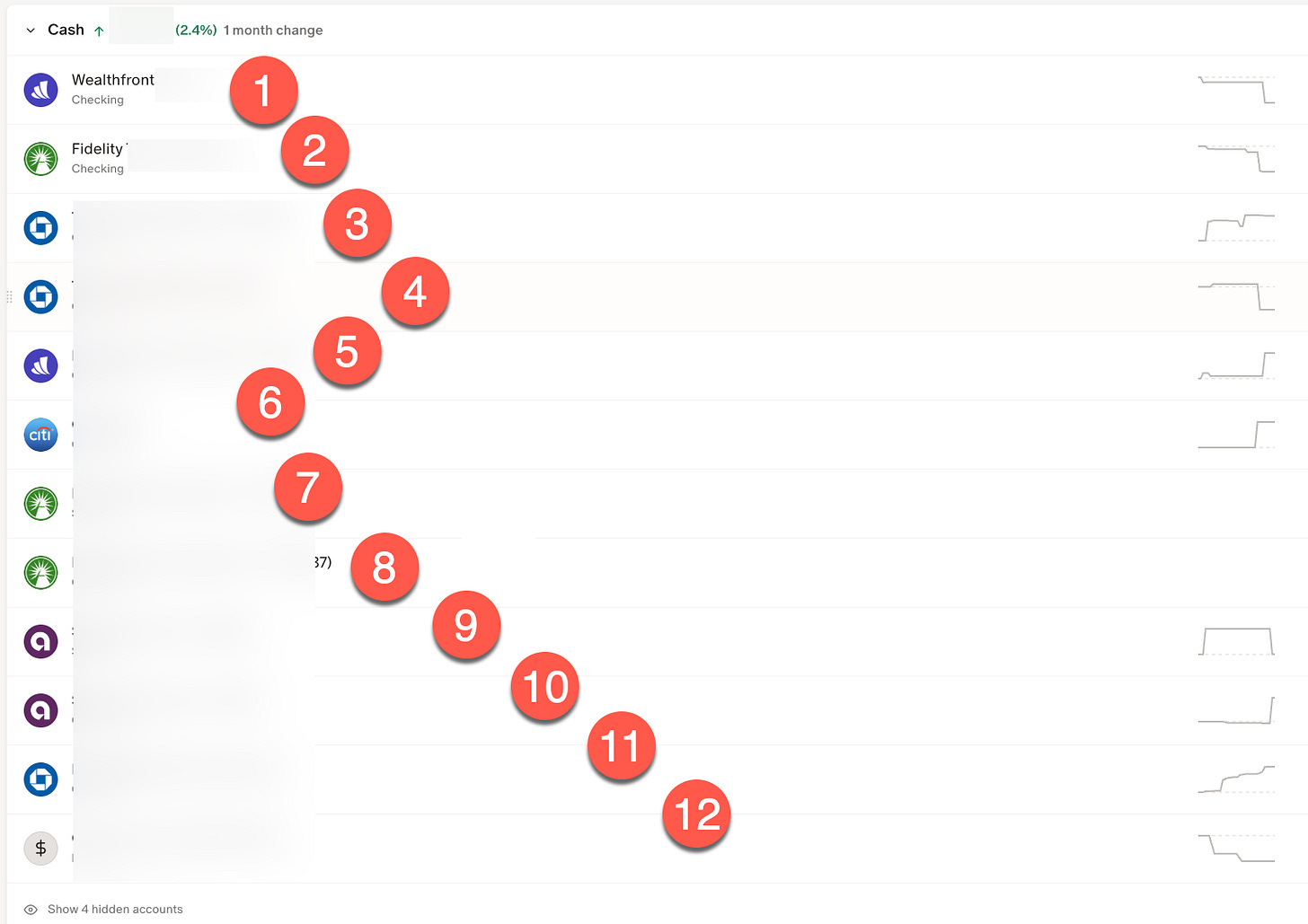

So we opened up Monarch, and I was ready to walk through each account…

I started walking through each account line by line explaining its purpose:

We each have individual joint-accounts that are linked at our local bank.

My high yield savings account over at Wealthfront because they have had the highest rates and are part of my emergency fund.

I have another Wealthfront account because their Trust accounts don’t have full functionality so I have a separate individual account.

That old Citi account that I just have kept open since 2006.

Then there is that Ally account that ended up being the only way that I could pay our landlord rent.

The Fidelity Cash management account which used to be our primary bank account but I have been transitioning away from.

Your credit cards get paid out your checking.

I manually keep the balance around $10k to cover any of your expenses so you don’t need to think about it. Then if it goes over I…..

Man… I have too many accounts.

It shouldn’t take me so long to explain why there are so many accounts.

This was just the Cash,Savings,Checking accounts. We didn’t even get to the investment accounts.

I have reached diminishing returns. I optimized myself into a web that only I understand.

New goal for Q1: Simplification… starting with non-investment accounts.

What are some of the guiding principles:

I want to have a bank account at an institution that is local. It is 2025, but you still randomly need to go into a bank for some annoying signature (looking at you Treasury Direct and your damn Medallion Signature requests).

I want an online bank that consistently has among the highest interest rates without hoops.

I want all accounts owned by the Trust I setup as part of my estate planning

I want my wife to fully understand why we have each account and how to access it

I think with those principles I can go from 12 accounts down to 4.

Local Bank Checking Account owned by Trust

Online Checking Account owned by Trust

Online High Yield Savings Account owned by Trust

FAANG FIRE Checking Account to Keep Business Transactions Separate

Let’s Simplify Together

Taking a step back to simplify my finances will not only make my life easier, but it also gives me peace of mind knowing I won’t leave behind a tangled web. Streamlining my accounts frees me up to focus on the things that truly give me purpose, rather than chasing a 0.001% increase in savings.

This can be intimidating to do alone. If you ever need help gaining clarity into your own financial landscape I invite you to check out my 1:1 FIRE Coaching programs where we can do an “Understand” analysis together on your current financial state. Or, if you’re a hands-on optimizer like me, make sure you have the logging in place using tools like Monarch and Empower1 — two tools I personally use to stay organized. Make this quarter the one where you finally embrace the simplification to start looking at your accounts with confidence.

FTC Disclosure: Monarch and Empower may compensate FAANGFIRE for new sign ups through links on this website. These are tools that I personally used prior to any affiliate relationship and tools I continue to use.

I feel like you should make this a whole series Andre.

1. Simplifying accounts (getting rid of accounts which don't add value).

2. Communicating where the money is, and how to access it.

3. Documenting & educating on taxes (where to get tax forms, how they're used).

4. Documenting & educating on investments (what you invest in, and why, and how that should change in the future if at all).

5. Documenting & educating on spending (how you take money out, how / where you sell from)

For example, I have a step-by-step document on our taxes, including links to references of why I do things a certain way. This is useful for me each year so I remember. It's useful if I ever get audited, because I can point at the references if the IRS says I'm wrong. And it's useful to my wife if she ever has to take over the taxes without me around.

Looking forward to seeing the final list that includes the minimum number of accounts for brokerage, 401k, etc. We also have too many accounts