In today’s post we will take a look at three different Meta Engineers’ pay stubs from their recent RSU vest to break down how the RSUs are taxed.

Vesting Pay Stub Examples:

Meta E5 in Massachusetts w/ 129 shares vesting, $95,030.43 value at vest

Meta E6 in Arizona w/ 441 shares vesting, $324,871.47 value at vest

Meta E7 in Seattle (formerly California based) w/ 887 shares vesting, $653,426.29 value at vest

Disclaimer: I am not an accountant, I am only looking at a single pay stub, and this isn’t tax advice.

RSUs Are Taxed as Income

I can say “RSUs are taxed as income when they vest” over and over and over, so let’s take a slightly different approach with this post.

But first, a reminder:

RSUs are taxed as income when they vest. This is true whether or not you sell. They receive the exact same tax treatment as if your company gave you the amount of the vest in cash.

There is also a distinction between taxes withheld from your paycheck and taxes you actually owe. Throughout the year, your employer withholds taxes from each paycheck based on your Form W-4 and any supplemental withholding elections you’ve made. When you file your tax return by April of the following year, you’ll calculate the difference between the amount withheld during the year and the amount of taxes you actually owe. If you owe more than you withheld then you will have a tax bill. If you withheld more than you owe, you will be due for a refund.

OK! With that out of the way, let’s look at 3 Meta Engineering RSU Pay Stubs across 3 different levels and 3 different states.

At Meta, whenever there is an RSU vest, there will be a corresponding $0 paystub within Workday (their payroll vendor). These are those paystubs.

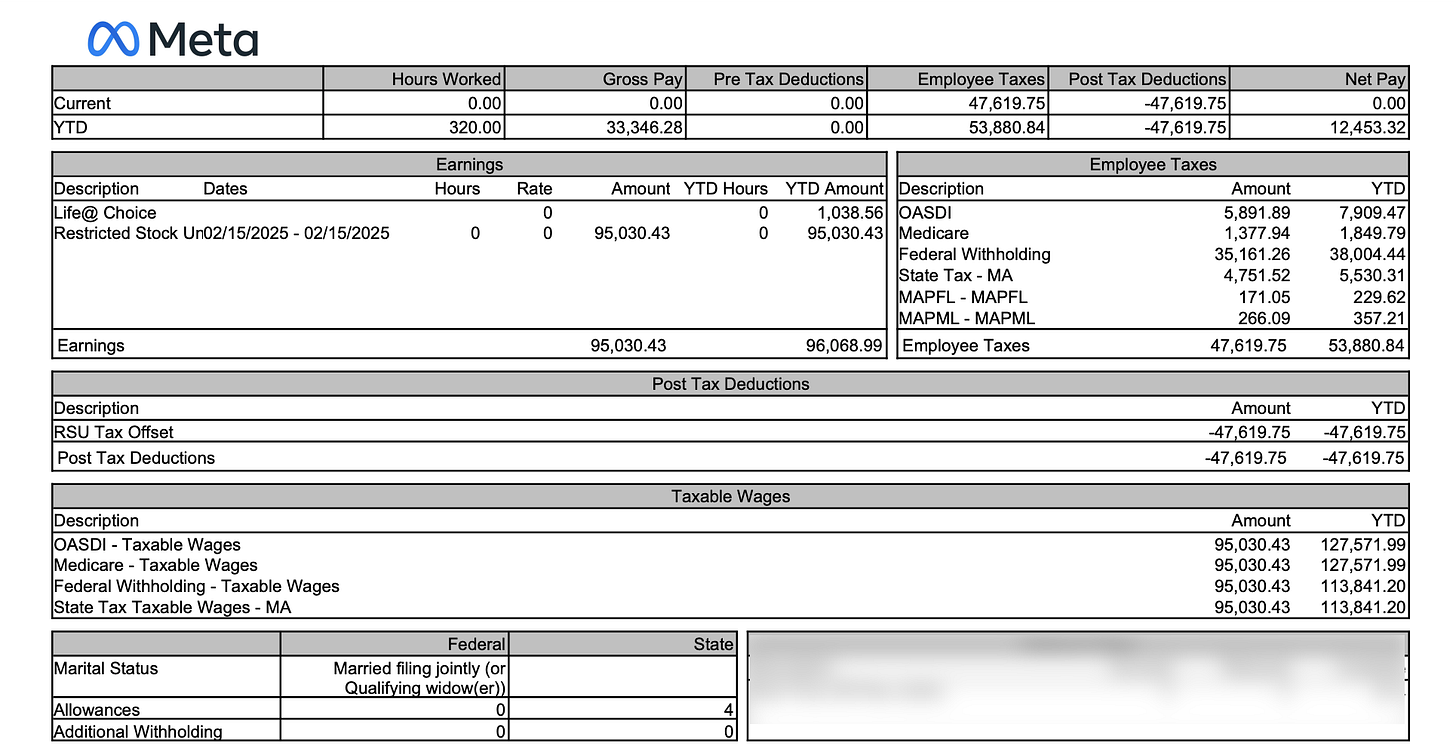

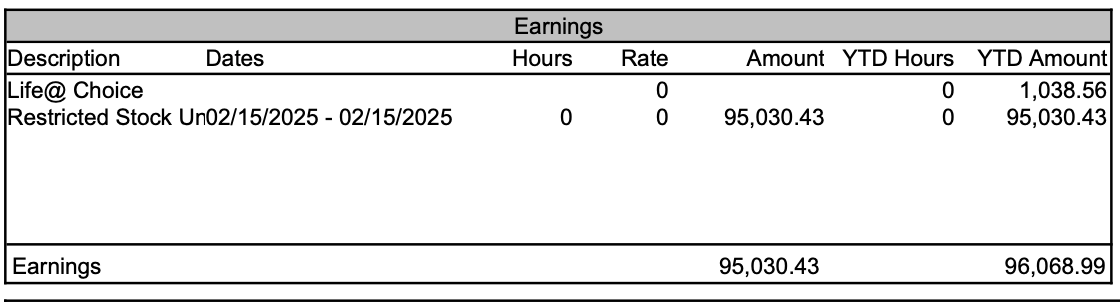

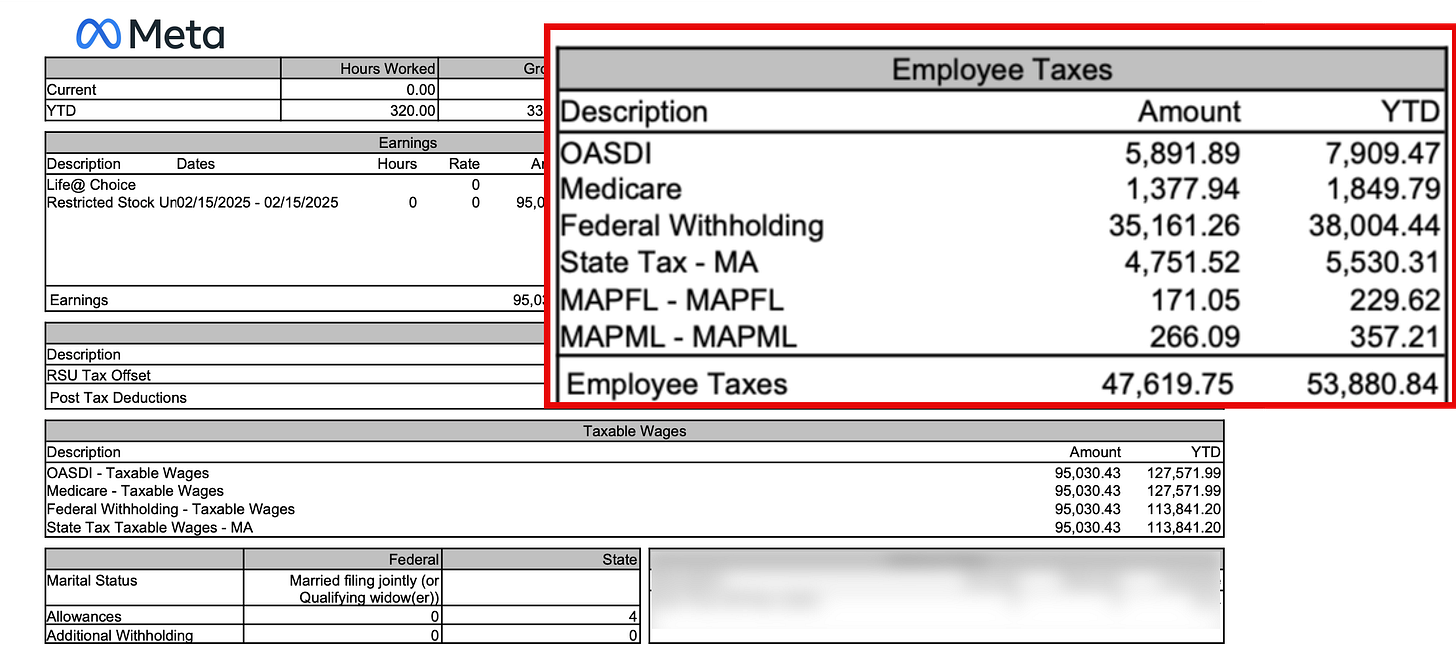

Meta E5 in Massachusetts

The first thing to look at is the Earnings box.

Restricted Stock Un02/15/2025 - 02/15/2025

Amount: $95,030.43

Shares Vesting: 129 (explained below)

The Amount and the YTD Amount is the same. So this tells me this is Mass E5’s first vest of the year. This tracks since we know from the Meta Benefits & RSU Details doc that Meta vests RSUs quarterly on 2/15, 5/15, 8/15, 11/15.

The value of the RSUs at vest is typically determined by taking the number of shares vesting and multiplying it by the close price of the previous trading day. This can vary across companies and isn’t always consistent.

Shares vested on February 15th, so the previous trading day was February 14th.

Meta Closed at $736.67 per share on that day.

So we can back out the number of shares that Meta E5 Mass had vesting:

$95,030.43 / $736.67 = 129 Shares

Did you know that RSUs are taxed as income? That entire $95,030.43 will be taxed as income.

Let’s zoom into Employee Taxes

Total Taxes Withheld: $47,619.75 or 50%

OASDI 6.2%

Old-Age, Survivors, and Disability Insurance aka Social Security

Employees withhold 6.2% of gross wages up to the max of $176,100 in income for 2025.

6.2% x $95,030.43 = $5,891.89

Medicare 1.45%

Employees withhold 1.45% of pay on all wages with an additional 0.9% on wages above $200,000

1.45% x $95,030.43 = $1,377.94

Federal Withholding 37%

Default supplemental Rate: 22% for those earning under $1,000,000 in supplemental wages.

It looks like Mass E5 adjusted their supplemental withholding rate manually to the max of 37%.

37% x $95,030.43 = $35,161.26

Note: When viewed in isolation, 37% in this case is potentially too high.

So far YTD they have overpaid more than $25k in federal taxes.

State Tax - MA 5%

Massachusetts has a flat tax of 5%

5% x 95,030.43 = $4,751.52

MAPFL - MAPFL 0.18%

Massachusetts Paid Family Leave which is a state mandated benefit

Employees withhold 0.18%

MAPML - MAPML 0.28%

Massachusetts Paid Medical Leave which is a state mandated benefit

It looks like employers must pay at least 0.42% out of a total of 0.7% benefit leaving a Meta employee to withhold the remaining 0.28%

Shares Remaining After Taxes

Total Shares Vesting: $95,030.43 / $736.67 = 129 Shares.

Taxes Withheld: $47,619.75

Remaining Shares: $47,410.68 / $736.67 = 64.358 shares after tax

Actual Shares Deposited: 64

RSU Excess Refund: $363.73

I confirmed that 64 shares landed in their Schwab account the remaining $363.73 will show up in the next paycheck as RSU Excess Refund.

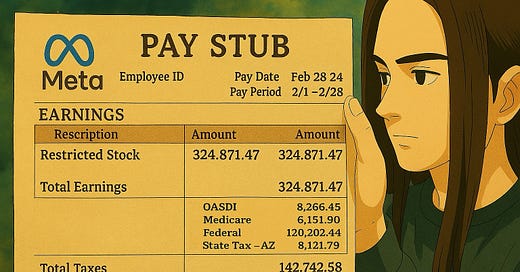

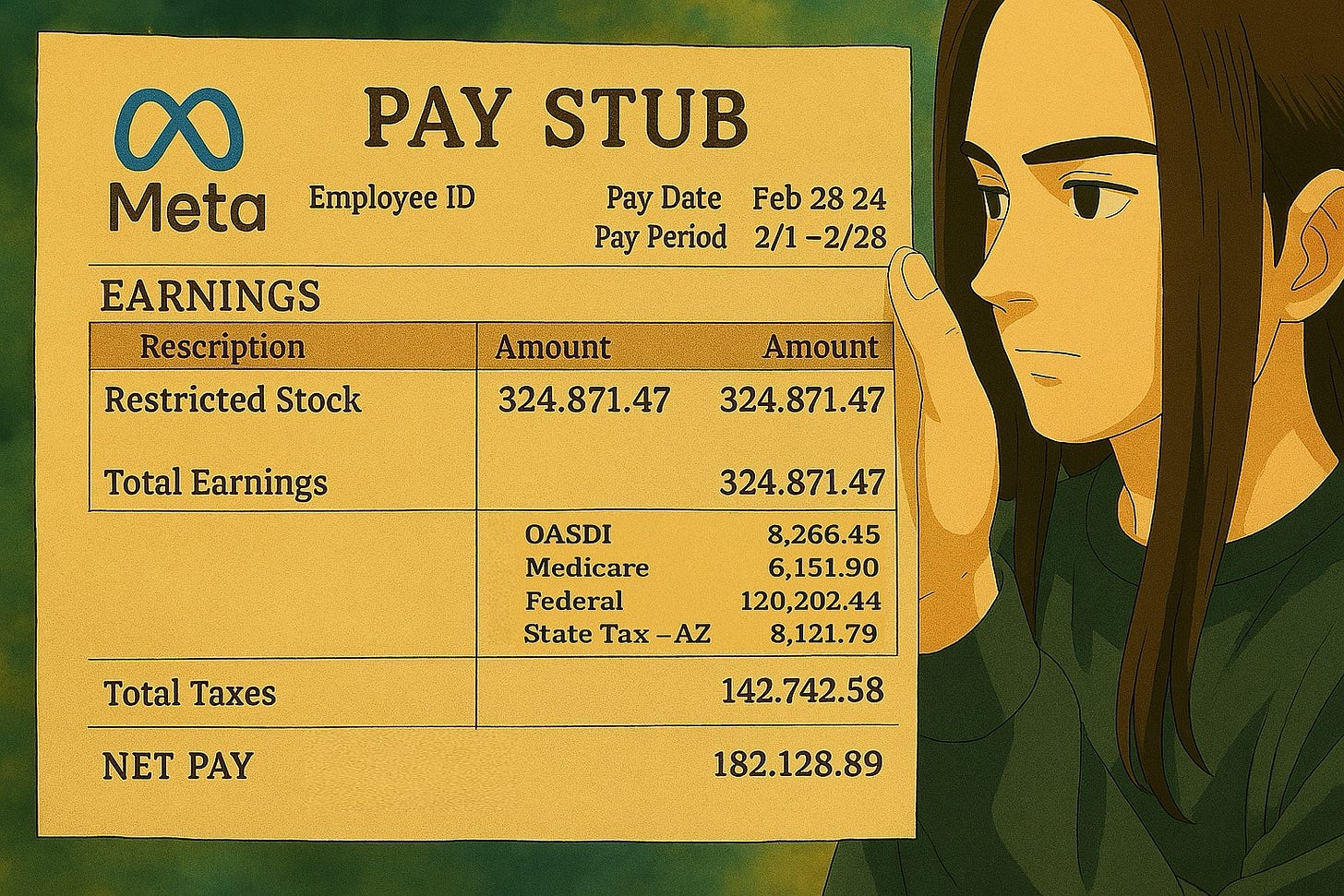

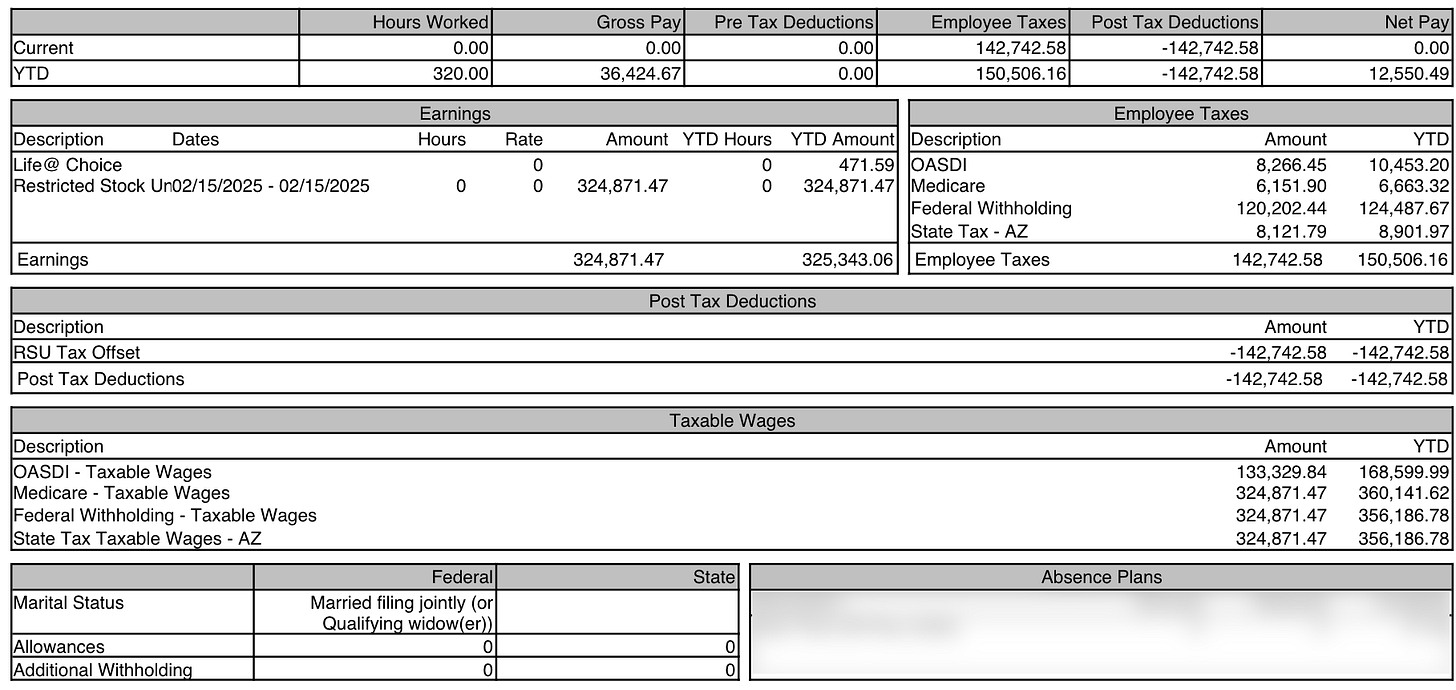

Meta E6 in Arizona

Our second RSU pay stub example is from a Meta E6 based out of sunny Arizona:

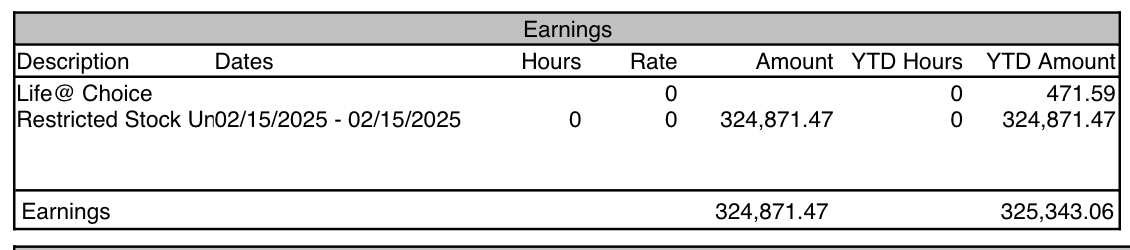

The first thing to look at is the Earnings box.

Restricted Stock Un02/15/2025 - 02/15/2025

Amount: $324,871.47

Shares Vesting: 441 ($324,871.47 / $736.67 = 441 Shares)

The value of the RSUs at vest is typically determined by taking the number of shares vesting and multiplying it by the close price of the previous trading day.

Shares vested on February 15th, so the previous trading day was February 14th. Meta Closed at $736.67 per share on that day.

$324,871.47 / $736.67 = 441 Shares

Did you know that RSUs are taxed as income? That entire $324,871.47 will be taxed as income.

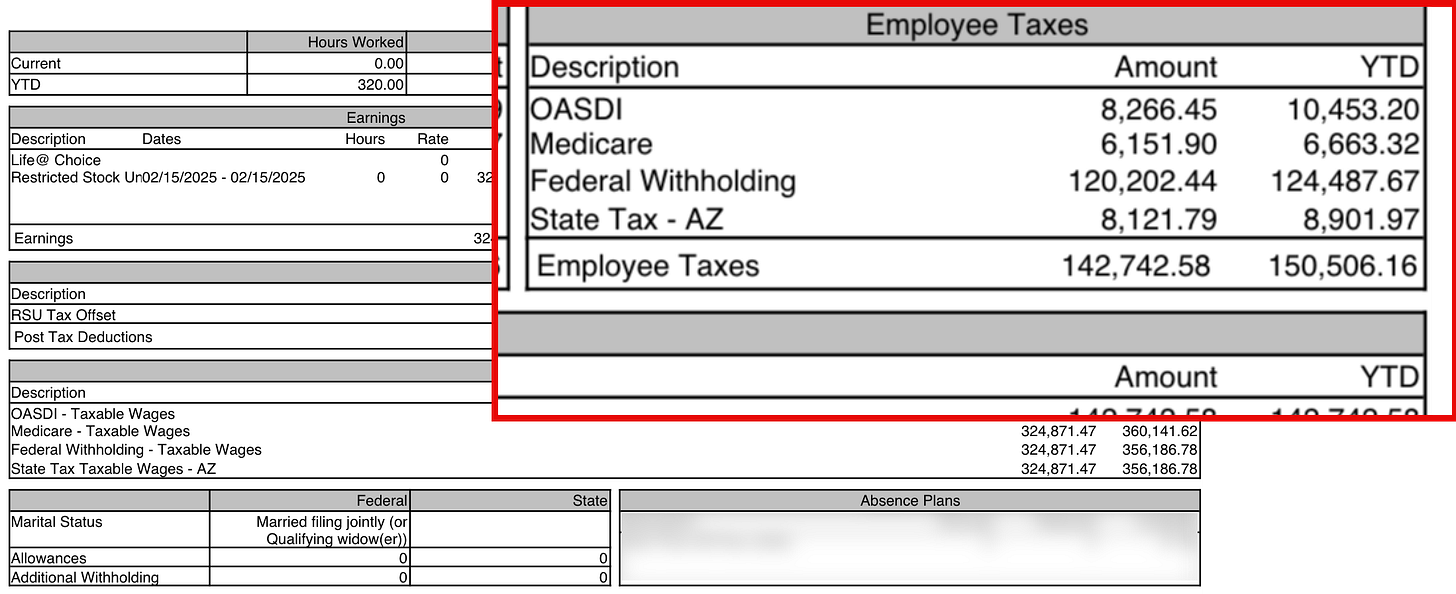

Let’s zoom into Employee Taxes

I already know this will be a tricky one! We are going to be dealing with Social Security income caps and additional Medicare taxes

Total Taxes Withheld: $142,742.58, or just shy of 44%.

OASDI 6.2%: Old-Age, Survivors, and Disability Insurance aka Social Security

Employees withhold 6.2% of gross wages up to the max of $176,100 in income for 2025.

This RSU vest pushed them past the annual 2025 cap of $176,100.

For some reason Meta seems to be using the 2024 cap though which was $168,600 in annual income.

The correct amount should have been $8,731.45 bringing the YTD to the max of $10,918.20

Note: I confirmed with Arizona that the remaining difference came out of their next paycheck. I am guessing there was some payroll math that split things across half a pay period.

Medicare 1.45% + 0.9%

Employees withhold 1.45% of pay on all wages with an additional 0.9% on wages above $200,000

1.45% x $324,871.47= $4,710.63

0.9% x $160,140.40944444 = $1,441.263685

All future earnings can simply be multiplied by 2.35%

Federal Withholding 37%

Default Supplemental Rate: 22% for those earning under $1,000,000 in supplemental wages.

It looks like Arizona E6 adjusted their supplemental withholding rate manually to the max of 37%.

37% x $324,871.47 = $120,202.44

Note: When viewed in isolation, 37% in this case is potentially too high. While they will comfortably be in the 37% marginal tax bracket, their effective federal tax rate will likely be lower. I would spot check estimated taxes during the summer and adjust as needed.

State Tax - AZ 2.5%

Arizona has a flat income tax rate of 2.5%

2.5% x $324,871.47 = 8,121.79

Shares Remaining After Taxes

Total Shares Vesting: $324,871.47 / $736.67 = 441 Shares

Taxes Withheld: $142,742.85

Remaining Shares: $182,182.62 / $736.67 = 247.305 shares

Actual Shares Deposited: 247

RSU Excess Refund: $244.68

Interestingly Arizona E6 only had 245 shares deposited and then an RSU Excess Refund of $1,644.74. Perhaps there was some funny rounding that occurred as they crossed the different tax treatments.

Edit: The funny rounding is due to Meta running these calculations at the individual grant level. This results in multiple instances where fractional shares from each grant can total more than an individual share.

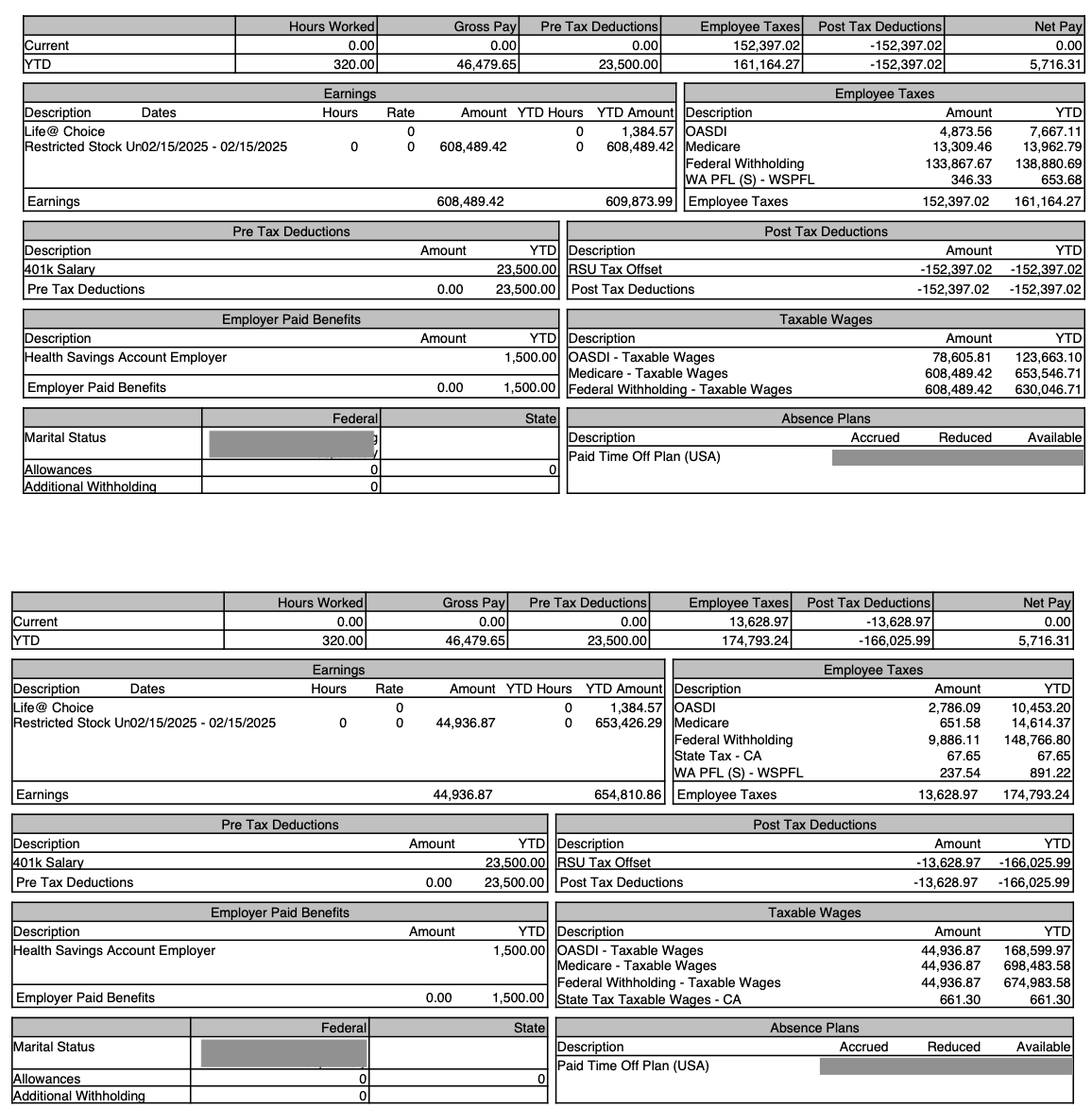

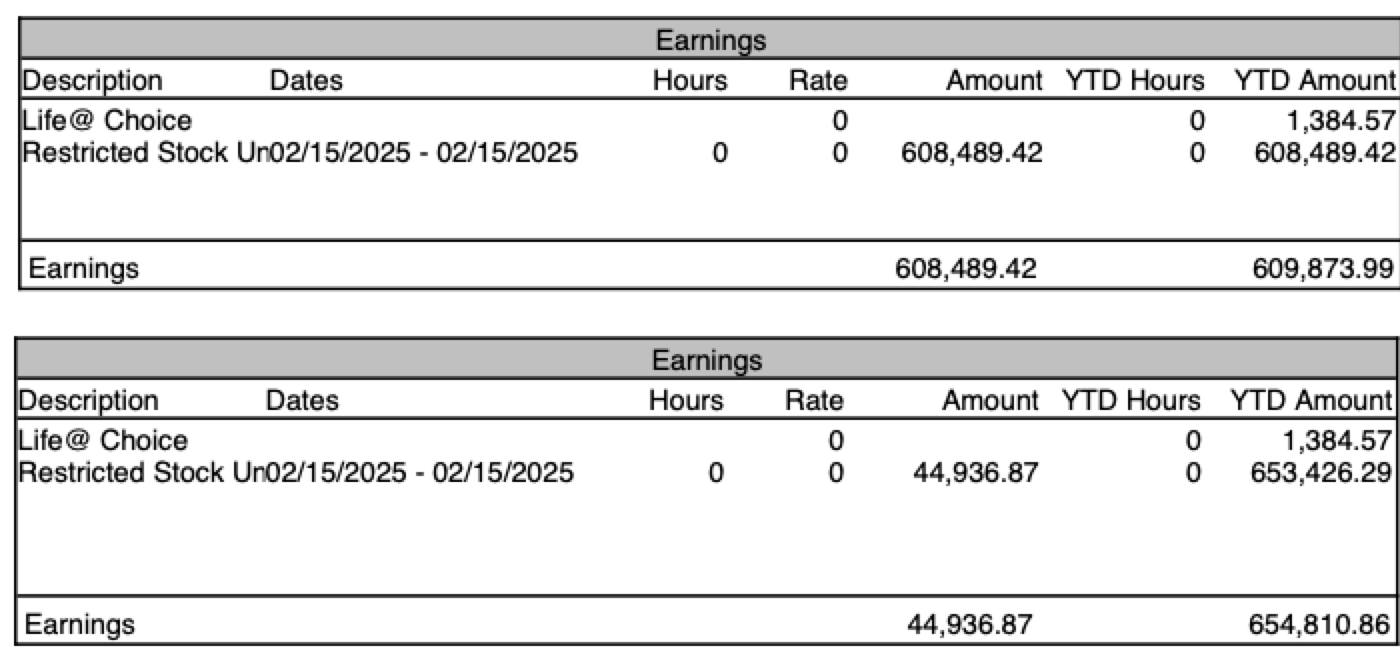

Meta E7 in Seattle (ex-California)

If the prior example wasn’t confusing enough, now we have another fun one! An E7 in Seattle where there is no state income tax! However, they began their Meta career in California. That means California will still want a prorated amount of the RSU vest based on the ratio “California workdays from purchase date to vesting date ÷ Total workdays from purchase date to vesting date”. Just one of the fun tax implications of leaving California!

Workday deals with this complexity by splitting it across two separate pay stubs. I originally thought the split was based on State, however the actual split seems based on the individual vesting lots. So the first pay stub below are the more recent vests that were granted to Seattle E7 while they lived in Washington state. The second are from RSUs granted while they were based in California.

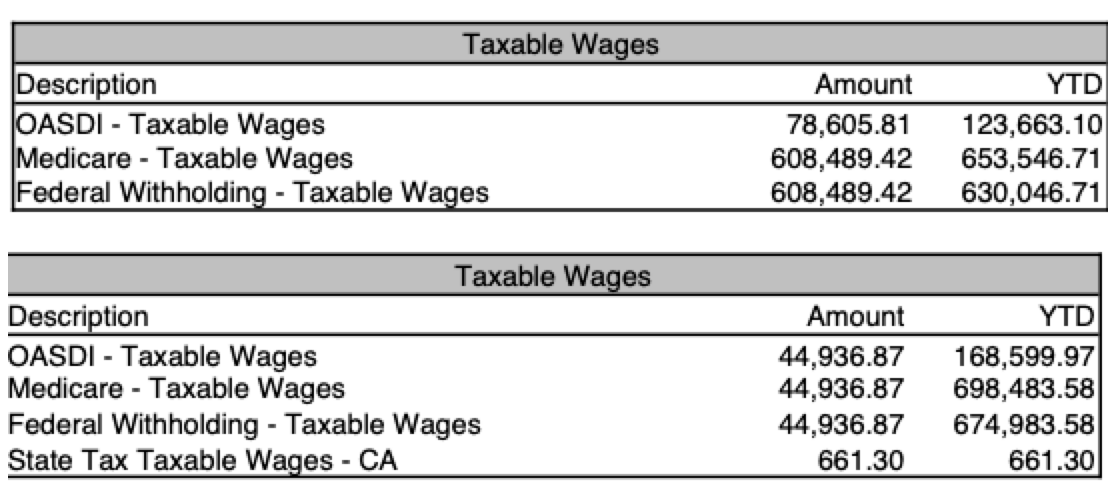

The first thing to look at are the Earnings boxes.

Restricted Stock Un02/15/2025 - 02/15/2025

Total Amount: $653,426.29

Shares Vesting: 887 ($653,426.29 / $736.67 = 887 Shares)

In this case we will also want to look at the Taxable Wages box to understand the per state splits.

State Split:

Washington: 886.10 Shares

California: 0.8976 Shares (looking at the $661.30 in State Taxable Wages)

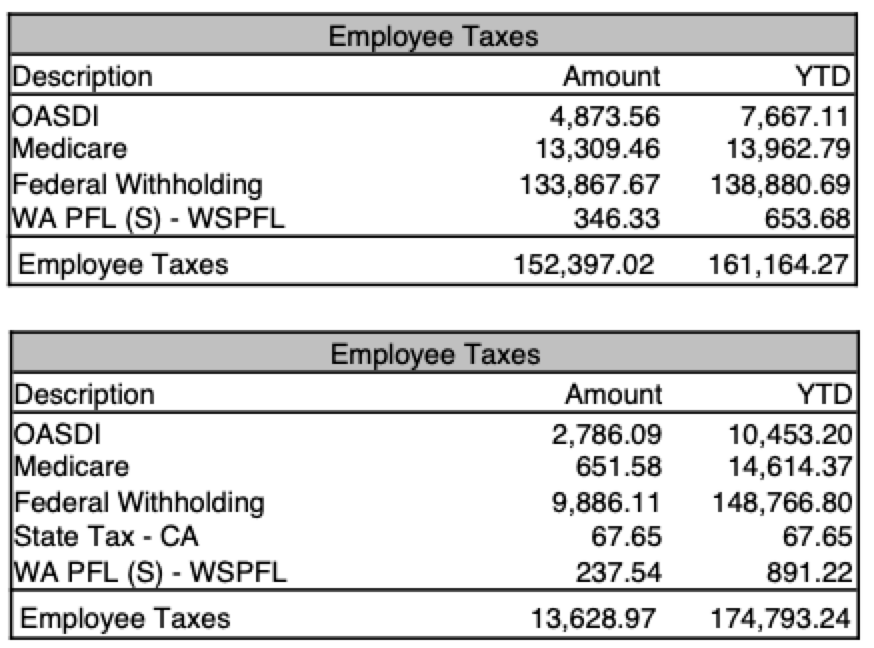

Let’s zoom into Employee Taxes

Total Taxes Withheld: $166,025.99, or 25.4%

OASDI 6.2%: Old-Age, Survivors, and Disability Insurance aka Social Security

Employees withhold 6.2% of gross wages up to the max of $176,100 in income for 2025.

This RSU vest pushed them past the annual 2025 cap of $176,100.

For some reason Meta seems to be using the 2024 cap though which was $168,600 in annual income.

The correct Amount should have been $7,667.11 bringing the YTD to the max of $10,918.20

Note: I confirmed with Seattle E7 that the remaining difference came out of their next paycheck. I am guessing there was some payroll math that split things across half a pay period.

Medicare 1.45% + 0.9%

Employees withhold 1.45% of pay on all wages with an additional 0.9% on wages above $200,000

1.45% x $653,426.29= $9,474.68

It is a little confusing here because in the California taxed pay stub (which was processed after the Washington one) only 1.45% was withheld again. So only the total income above $200,000 on the first pay stub was taxed the additional 0.9%.

It all works out when we aggregate everything together. Their prior Medicare Wages were $45,057.29. So the first $154,942.71 of new income would be taxed at 1.45% ($2,246.669) with the remaining $498,483.58 to be taxed at 2.35% ($11,714.364) for a total of $13,691.03.

Total Shown: $13,961.04

All future earnings can simply be multiplied by 2.35%

Federal Withholding 22%

Default supplemental Rate: 22% for those earning under $1,000,000.

It looks like Seattle E7 didn’t adjusted their supplemental withholding rates and has the default of 22% withheld

22% x $653,426.29 = $143,753.78

Note: When viewed in isolation, 22% in this case is way too low. However, after bonus, additional paystubs, and another RSU vest they should pass the $1,000,000 annual income threshold which will see their last 2 RSU vests of the year automatically withheld at 37%.

State Tax - CA 10.23% (only against the $661.30 in CA income)

The default California supplemental withholding rate is 10.23%

CA Tax: 10.23% x $661.30 = $67.65

This is likely their very last vest impacted by California! Congrats Seattle E7!

WA PFL (S) - WSPFL

Washington State Paid Family and Medical Leave which is a state mandated benefit

Employees pay a ~0.658% tax on wages with employers covering 0.262% up to the Social Security Wage Cap of $176,100

Actual Withheld: $583.87

Year to Date Withheld: $891.22

This is a little more complex since companies can elect to have a voluntary plan.

Shares Remaining After Taxes

Total Shares Vesting: 887 ($653,426.29 / $736.67 = 887 Shares)

Taxes Withheld: $166,025.99

Remaining Shares: $487,400.3 / $736.67 = 661.62637

Actual Shares Deposited: 660

RSU Excess Refund: $1,198.10

Closing Thoughts

You don’t need to understand your taxes at this level of nuance!

What I do want you to know:

RSUs are taxed as income at the moment of vest!

Different companies calculate the value at vest differently. Meta uses the closing price of the previous trading day.

Federal Supplemental Withholding Rates default to 22%, or 37% after gross income passes $1,000,000. Employers like Meta do allow manually adjusting these rates.

Withholding Rates and Actual Tax Rates can be different. The default 22% withholding rate is often way too low while 37% is likely too high.

Social Security taxes are capped on income up to $176,100 in 2025. How this is calculated is always a popular news topic during conversations on tax reform and social security solvency.

State level taxation can vary drastically, and there can also be taxes on paid family and medical leave.

If you owed a significant amount in taxes see the FAANG FIRE guide to modifying your withholdings for 2025.

Thank you to the volunteers who shared their pay stubs. It is awesome to have different examples across different levels and the nuances that can occur depending on where employees are based. It also looks like April will get to feature another Wash Sale post as tech stocks are down double digit percentage points since March.

-Andre

This is an incredible breakdown! So helpful!