Q: Should I sell my RSUs? How do I sell my RSUs? Do I need to worry about wash sales? Can you help me out?

I get a flood of RSU related questions each and every vesting cycle. Today we will go through a number of different approaches you can take to confidently create a plan on what to do with your RSUs.

We will dive into 5 different approaches and how to execute each of them. On top of that I cover the most common tax implications that come with RSUs as well as a guide to help you understand and navigate wash sales!

Primer on Wash Sales & RSUs

There is a lot of confusion around Wash Sales. I will try to simplify things a little bit and focus specifically on how Wash Sales impact selling your company stock.

The IRS doesn’t want you to sell a stock for a loss and then immediately buy it again. So they developed the wash sale to prevent this. If a wash sale occurs, you don’t get to claim the loss (the loss is disallowed). The “gotcha” for employees that are compensated with stock is that RSU vests and ESPP purchases count as purchases which will trigger a wash sale.

Let’s go straight to the IRS (PDF) with the explanation:

“A wash sale occurs when you sell or trade stock or securities at a loss and within 30 days before or after the sale you:

Buy substantially identical stock or securities,

Acquire substantially identical stock or securities in a fully taxable trade,

In order to navigate wash sales it is important to understand what actually happens when you trigger one. A wash sale doesn’t fully eliminate the loss, it just disallows it in the moment. The mechanism they use to disallow it is that they make you take the loss and add it to the cost basis of the new purchase that triggered the wash sale.

Here is a specific example from the IRS that applies here:

You are an employee of a corporation with an incentive pay plan. Under this plan, you are given 10 shares of the corporation's stock as a bonus award. You include the fair market value of the stock in your gross income as additional pay. You later sell these shares at a loss. If you receive another bonus award of substantially identical stock within 30 days of the sale, you cannot deduct your loss on the sale.

Let’s walk through the example using actual numbers.

On May 1st Jane sold 100 shares of Meta for $240. The original price of those 100 shares were $300 when they originally vested. This results in a $6,000 loss.

On May 15th Jane receives 100 more shares of Meta as part of an RSU vest with the value of Meta sitting at $230 on vest day.

Jane can’t claim the $6,000 loss due to it being a wash sale. The $6,000 gets added to the cost basis of the new purchase.

The “new purchase” was the RSU vest. The cost basis was $230 x 100 = $23,000. Due to the wash sale, the new cost basis will be $29,000. This essentially makes the new set of RSUs have a cost basis of $290. So when Jane sells the new vest, they will then get the original loss back since the new cost basis is increased by the same amount.

Understanding this is really valuable because then you might realize that all is not lost. If you wanted to still realize the loss now, what Jane could do is sell the entire new RSU vest that triggered the wash sale.

If you are wanting to sell shares for a loss right before a new vest, it’s important to sell the new vest to allow you to capture the loss.

Don’t worry if you think this is complicated… because it is! If you do all of this at the same broker, the broker should manage all the reporting (it will show up on your 1099-B). But I would always try and double check or if you have a particularly complicated situation talk to a professional that is familiar with RSU compensation.

If you want a few more practical examples as well as a detailed breakdown of why monthly vesting schedules make a wash-sale loop hell KB Financial Advisors wrote up an excellent guide with really good examples.

Deciding Which Lots to Sell

If this is your first RSU vest or if you plan to sell all your shares you don’t need to worry about this section.

However, if you have not sold your RSUs before, you probably have shares with both Gains and Losses. After deciding how much you want to sell, you will then need to decide which specific shares to sell. Depending on which shares you sell will result in different tax consequences. (See the Tax Primer Above).

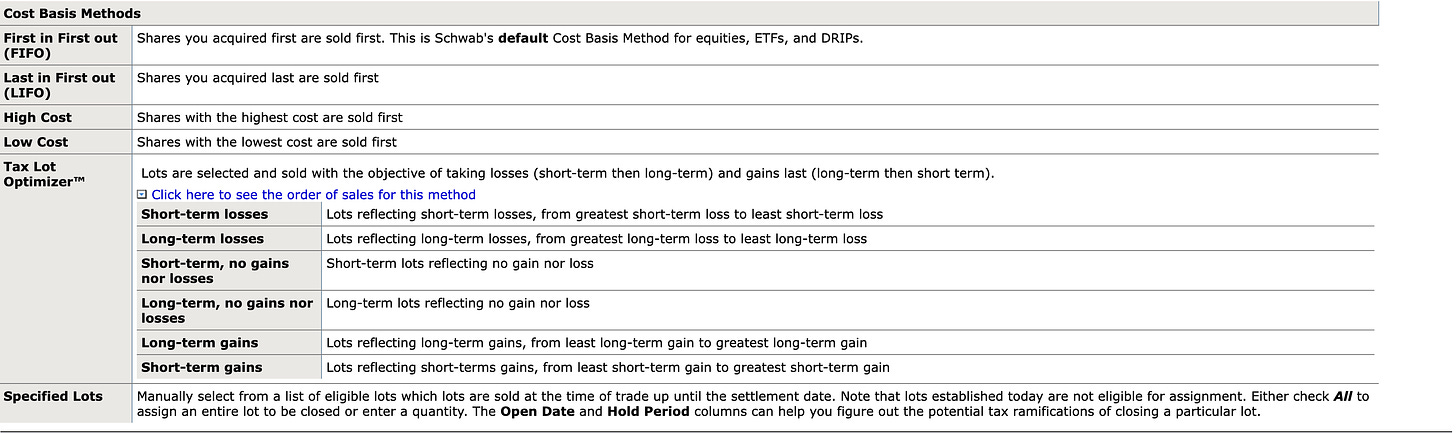

Many brokers will help you optimize selling in a tax efficient way. Schwab for example has something called “Tax Lot Optimizer” which you will see as an option while you are selling. The table below outlines the different options and how they decide which shares will be sold. You can also select “Specific Lots” which will let you manually select which grouping of shares you want.

The ideal selling order is exactly like what “Tax Lot Optimizer” uses (ST Losses, LT Losses, LT Gains, ST Gains) with the one addition of also selling your most recent vest if you have losses that you want to capture.

Some people like to hyper optimize the price they sell their RSUs for. They set specific price limits at high points from the week and sit back and wait. I tend to not stress too much about the price movements and just use market orders, or limit orders at the current market price, during the trading day (not after hours or over a weekend). The small differences up or down tend to not really make that much of a difference in the long run.

Again, I would start with determining how much you want to sell, before focusing on the most tax optimal way to sell.

Tax Withholding of RSUs

I mentioned in the Tax Implications section that your RSU vests are taxed as if they were income.

“When your RSU’s vest, they are taxed as normal income. If you were to immediately sell at the exact same price you vested, you would owe $0 more in taxes.”

This doesn’t mean that they are withheld the same though! Withholdings are the amount that is — withheld for tax purposes. Or in the case of RSUs, the amount of stock that is automatically sold to cover your taxes.

By default, at the federal level, your RSU’s will be taxed at the supplemental withholding tax rate which is 22% unless you earn more than $1MM which would result in a 37% default rate.

Since the supplemental rate is often much lower than your true tax rate you can end up with a huge surprise tax bill! Luckily, most companies will now let you set your withholding rate. For specific instructions be sure to see my guide to setting your withholding rates.

My Approach to RSUs: Selling Everything Every Vest

Each and every quarter I want you to expect a post from me with some version of the following:

I sold all my shares.

I am not selling because I want to beat the market. If anything I am selling because I want to reduce volatility and more closely match the overall market. By nature of my employment I am long META. All my unvested shares continue to ensure I have significant skin in the game.

That means I treat every new vest the same way I treat any cash bonus. I use the proceeds to buy index funds (like VTI & VOO) to match my desired asset allocation. I keep it simple and I am consistent. Regardless of whether META is $100 or $350.

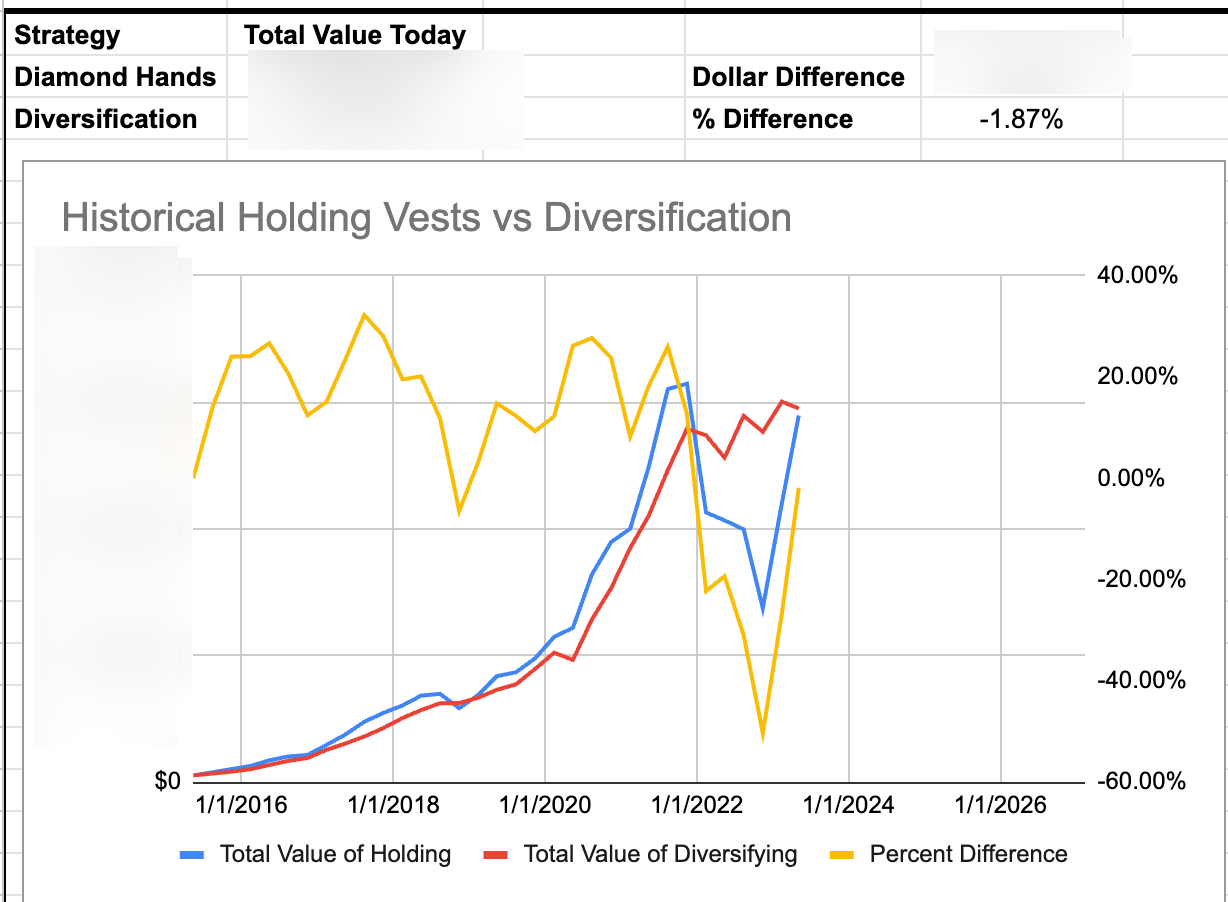

If you are curious about the actual impact of holding your RSUs vs Diversifying, I built the Total Compensation Dashboard in part to help answer that question. You can see below that over my entire 9 years of vesting META stock I am exactly even between if I held the entire time vs diversified. Look at how wild that ride has been though!

I diversify fully anticipating that META may outperform the overall market. I am not trying to beat the market! As a highly compensated FAANG employee I don’t need to be trying to hit home runs. What I do want, is the highest probability chance of success so I can reach my FIRE goals. That entails diversifying — and if META kills it, I still get to benefit in the form of future vests.

How to Execute This Strategy:

In an ideal situation your employer would give you the ability to automatically “Sell All on Vest”. I know this functionality exists at Google, Uber, and likely many other tech companies. Unfortunately for META employees, to execute this strategy, it will require manually selling shares each quarter.

Typically on the day after your vest day, called V+1, in financial lingo, you will be able to see your shares in your broker. Then, during the trading day (between 6:30am-1pm for those on the west coast), I log into my broker and execute a sell for all my shares.

Since I have sold all previous shares, the only shares in my account are my newly vested shares. Since the market is currently open I am able to execute a market order. It takes a few additional days for the cash to settle in my account where I then transfer it to my primary broker and purchase low cost ETFs or Index Funds like VTI or VOO.

Note: It is important to understand the tax implications of any transaction. I go into more detail further below but in most cases if you sell your RSUs right after vest the additional tax liability should be minimal. If you have other shares from past vests it may be worth waiting an additional day for the cost basis of the new shares to properly show up. As always, be sure to consult with a tax professional to discuss the particulars of your situation.

4 Other approaches

Selling everything and diversifying is right for me. That doesn’t mean it’s right for you. Perhaps you want even more “skin in the game” or have a much higher risk tolerance than me. The important thing that I want to emphasize is the importance of having a plan in place and having the confidence to consistently execute against that plan going into each vest.

Ignoring your RSUs or Panic selling when things drop are two situations I want to help you avoid!

Let’s walk through a few different approaches and how to execute them.

The 5% Rule (and other flavors of X%)

The 5% Rule States: You never want an individual stock to make up more than 5% of your overall portfolio.

It can be very easy for your RSUs to accumulate and make up a very significant percent of your portfolio balance. The 5% rule is all about helping you avoid large concentrated positions. The old idiom “Don’t keep all your eggs in one basket” applies here.

5% is just a rule of thumb, depending on your level of risk you may decide on a higher percent. Maybe that is 10%, 15%, or more. The important thing about this rule is to figure out what you are comfortable with and then stick with it.

How to Execute This Strategy:

Anytime the value of your vested shares exceed 5% of your invested portfolio you sell enough shares to keep it under 5%. As always, you would then use the funds to purchase low fee index funds at the broker of your choice.

This strategy is simple, but does require regularly tracking and monitoring your overall portfolio to execute properly. It requires being able to know at all times what percent of your assets your company stock makes up.

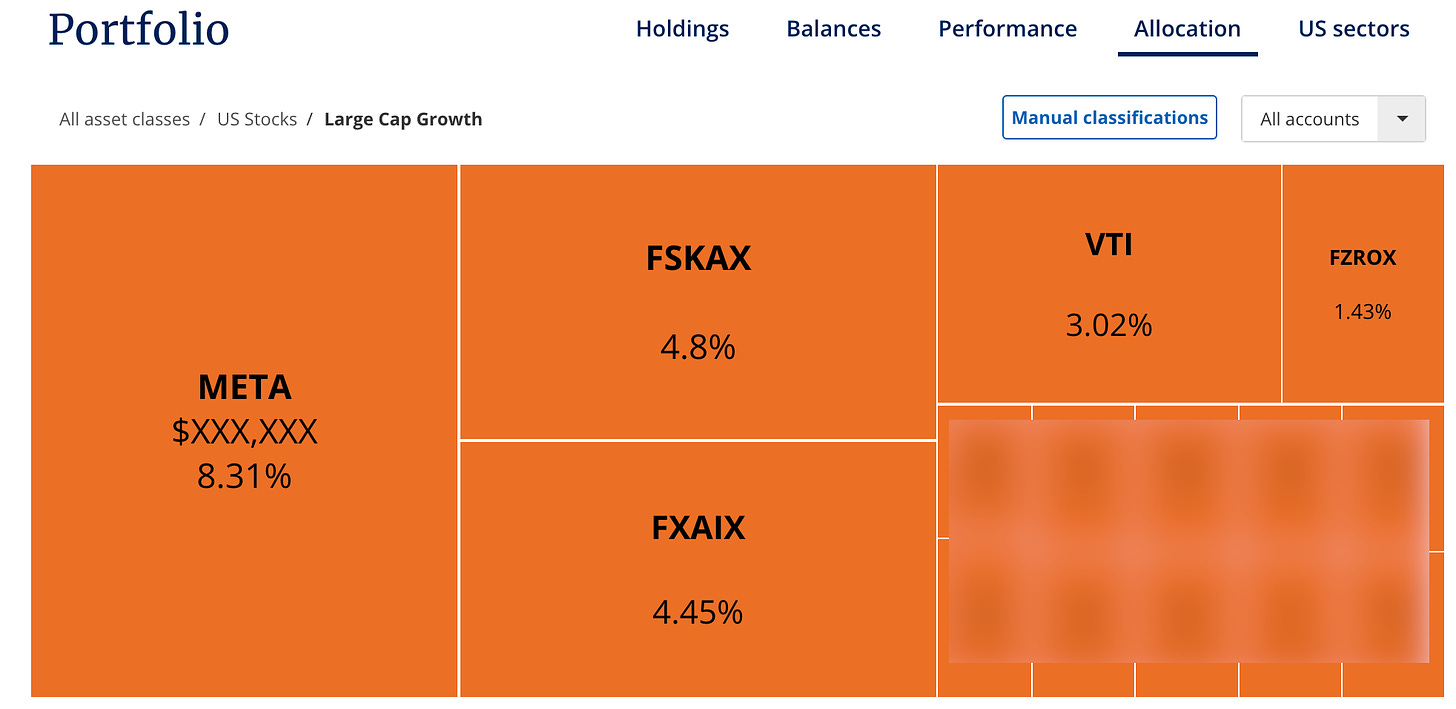

One free tool that I really like that can help with this is Empower1 (formerly called Personal Capital). Within their investment dashboard you can drill down into your overall investment allocation to see exactly how much of your portfolio any given stock has. You just need to find which asset class it is categorized under.

In the above example the person has 8.31% of their portfolio in Meta. If they wanted to stick to the 5% rule they would need to sell enough Meta to stay under 5%.

Since you are likely subject to blackout dates as an employee, you could make a plan to review your asset allocation every 3 months after each new vest (if you vest quarterly like Meta).

Quick Example on the Math Behind Getting Under 5%:

Total Portfolio Value: $2,000,000

Current Meta Value: $166,200

Current % of Portfolio Value for Meta: 8.31%

Goal: 5%

Goal value: .05 x 2,000,000 = $100,000

Amount of Meta needed to sell to reach Goal Value: $166,200 - $100,000 = $66,200

Fixed % Approach

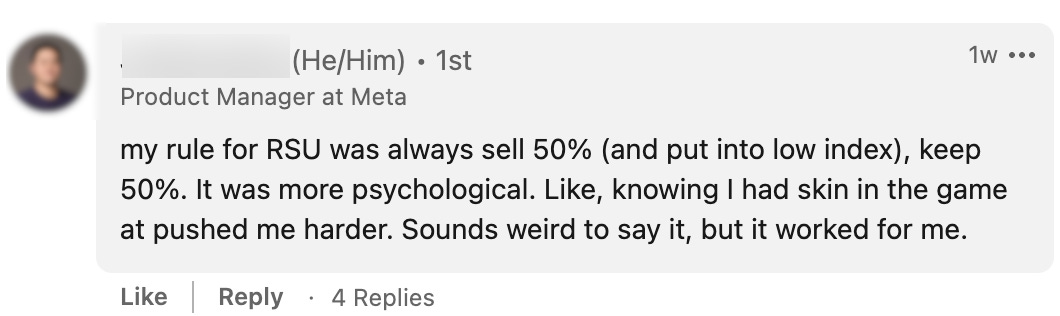

Some like the idea of diversifying but want to keep even more skin in the game by systematically keeping 50% each vest. I refer to this as the “Fixed % approach”. It involves keeping a set % of each vest while selling the rest and diversifying.

The first question I typically ask someone following this approach is: “When you get a cash bonus, do you also use 50% of that to buy more of your company shares?” I have never actually met anyone who replies that they do buy more shares with their cash bonus!

How to Execute This Strategy:

Set the percent of company stock you want to keep, for example 50%. Each new vest you would simply sell 50% of the shares that land in your account.

I would encourage those who go down this route to combine this approach with the “5% Rule”. What that would look like is selling 50% of every vest to diversify… until your company shares reach 5% of your portfolio. Once you are beyond that amount you would continue to sell shares to keep you at or under 5%.

Sell Nothing — Inertia

If you choose not to sell your RSUs it is the exact same as if your employer handed you cash and you turned around and bought your companies shares with the cash. There is zero difference. Both from a tax perspective and a pure monetary perspective.

Did you receive a bonus in the past few months? I did (even if it was a little less than I was planning). Did you turn around and use that bonus to buy more shares in your employer? I definitely didn’t, and I doubt you did.

Why is it that people tend to treat money from RSUs different than money from a cash bonus? Money is money, or in economics terms — money is fungible. It isn’t different just because it came from your paycheck, a bonus, or your RSUs.

You know what though? If you did this, I don’t blame you at all. If you have been in tech for the last decade you have been rewarded by doing nothing. In fact, you are probably reading this article due to the fact that the past 2 years you have seen your RSUs drop in half and partially recover.

A lot of it is also FOMO. The fear of deep regret you want to avoid if the stock doubles right after you decide to sell. Particularly if you have not sold any RSUs in the past. Maybe it will double right again!

I don’t have a problem if you choose to go this route. My one ask though is that you consciously choose it vs letting inertia and the ease of doing nothing guide your decision (or non-decision).

How to Execute This Strategy:

This is the easiest strategy to execute. Just do nothing. Let it roll!

The Panic Approach!

The Panic Approach is what happens when someone is doing the Sell Nothing approach but realizes that after their company stock drops 50% they need to do something. They then sell everything while the stock is down, but once the stock starts going up again, they go back to the Sell Nothing approach.

This is the most dangerous group to be in!

How to Execute this Strategy:

You blissfully ignore all vests like those in the Sell Nothing group. That is until the stock drops 70%. Then you start researching that “diversification” thing. Realize that the better approach would be to sell your stock and diversify.

Wait — this is good right?

Yes, at this step it could be viewed as moving in the right direction. You went through a hard downturn and realized that your actual risk tolerance was much lower than you thought. You are no longer comfortable having such a large concentration in a single stock.

Instead of then making a plan for what to do going forward, you simply go back to doing nothing. Followed by more panic selling after the stock drops more.

If you were to look at this approach objectively you will see that it involves buying high and selling low.

Factoring in Tax Implications

I am an advocate of initially ignoring taxes and determining what your ideal plan for your RSUs is. Only after defining your plan should you start factoring in the most tax efficient way to execute against it. The popular financial advisor saying that applies here is “Don’t let the tax tail wag the dog”.

A VERY TLDR on Taxes:

I’ll add another disclaimer here: It's always a good idea to consult with a tax professional for advice tailored to your individual situation.

When your RSU’s vest, they are taxed as normal income. If you were to immediately sell at the exact same price you vested, you would owe $0 more in taxes.

Each time you buy or vest RSUs it creates a new “Stock Lot”. This is simply a historical grouping of shares that were purchased/vested on the same day for the same price.

You only pay additional taxes on GAINS. Gains are calculated for each “Stock Lot” by subtracting the price you sold by the price you paid/vested that Lot (if the number is negative, then you have a LOSS).

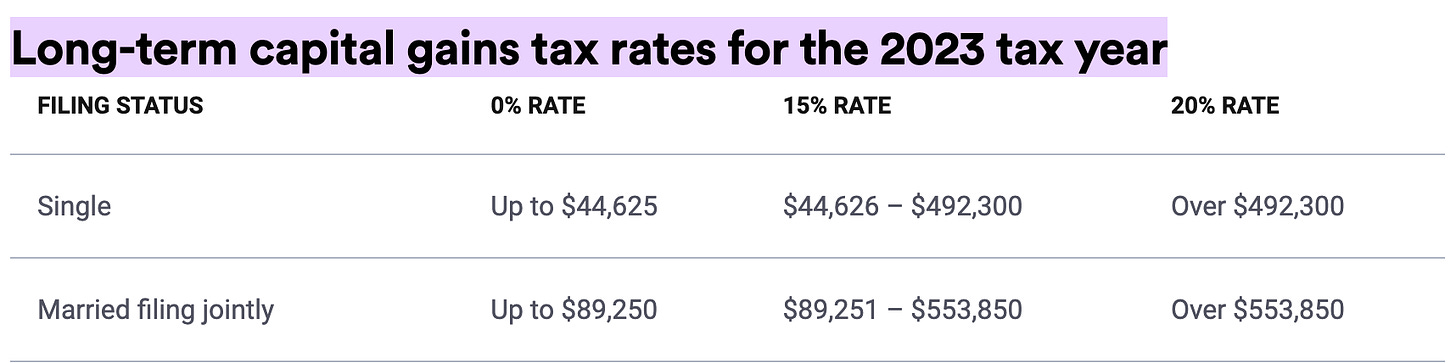

Taxes on Gains depend on how long you held each Stock Lot. If the lot was held <1 year you have Short-Term capital gains, which are taxed just like income. If you held for >1 year you will have Long-Term capital gains, which are taxed at a lower rate (15-20% for most reading this, but potentially 0% during FIRE).

Losses can be used to offset Gains. Short-Term losses are first used to offset Short-Term gains, then Long-Term losses are first used to offset Long-Term gains, and after the remaining losses will offset the remaining gains of either type.

If you have more losses than gains, up to $3,000 of income can be reduced.

Additional Losses beyond $3,000 will be carried forward into future years, this is called tax loss harvesting.

You can not deduct losses if you buy OR VEST within 30 days (before or after) of selling for a loss. This is a WASH SALE. Wash sales only apply to losses, not gains.

You didn’t think you would be reaching so much on RSUsdid you? Well I am glad you did! I hope you left with more confidence in whatever approach you decide to take on. You got this! If you have any questions just reply to this newsletter or leave a comment.

This is an affiliate link and I receive a small commission of you create a new account. I have been a happy Empower user for 10 years and would never endorse a product I didn’t actually use.

I joined Uber about two months ago so have to decide whether to immediately sell the RSUs I'll soon be receiving at a much lower price than what they were when I signed on. Do I receive any tax benefits from selling at this 'loss'? Would it make sense to hold a bit if I anticipate the stock returning to previous levels, or would any gain from this be offset by the short-term capital gains taxes I'd face?

Can you explain why selling ST loss first than LT loss helps if you have never sold RSUs before ? Isn’t selling LT loss accumulate more realized loss which can be used for tax loss harvesting ?