Happy Vesting + RSU Workshop

Hey FAANG FIRE,

Many of you will have RSUs landing in your accounts this week. I wanted to make sure you knew where to find all the FAANG FIRE RSU resources. I’ll also be hosting a Live RSU Workshop + Q&A on Friday. More on that at the end of this email.

RSU Question of the Day

Q: “Hey Andre, I just got my vest and it is much smaller than I thought it would be. Where did it all go?”

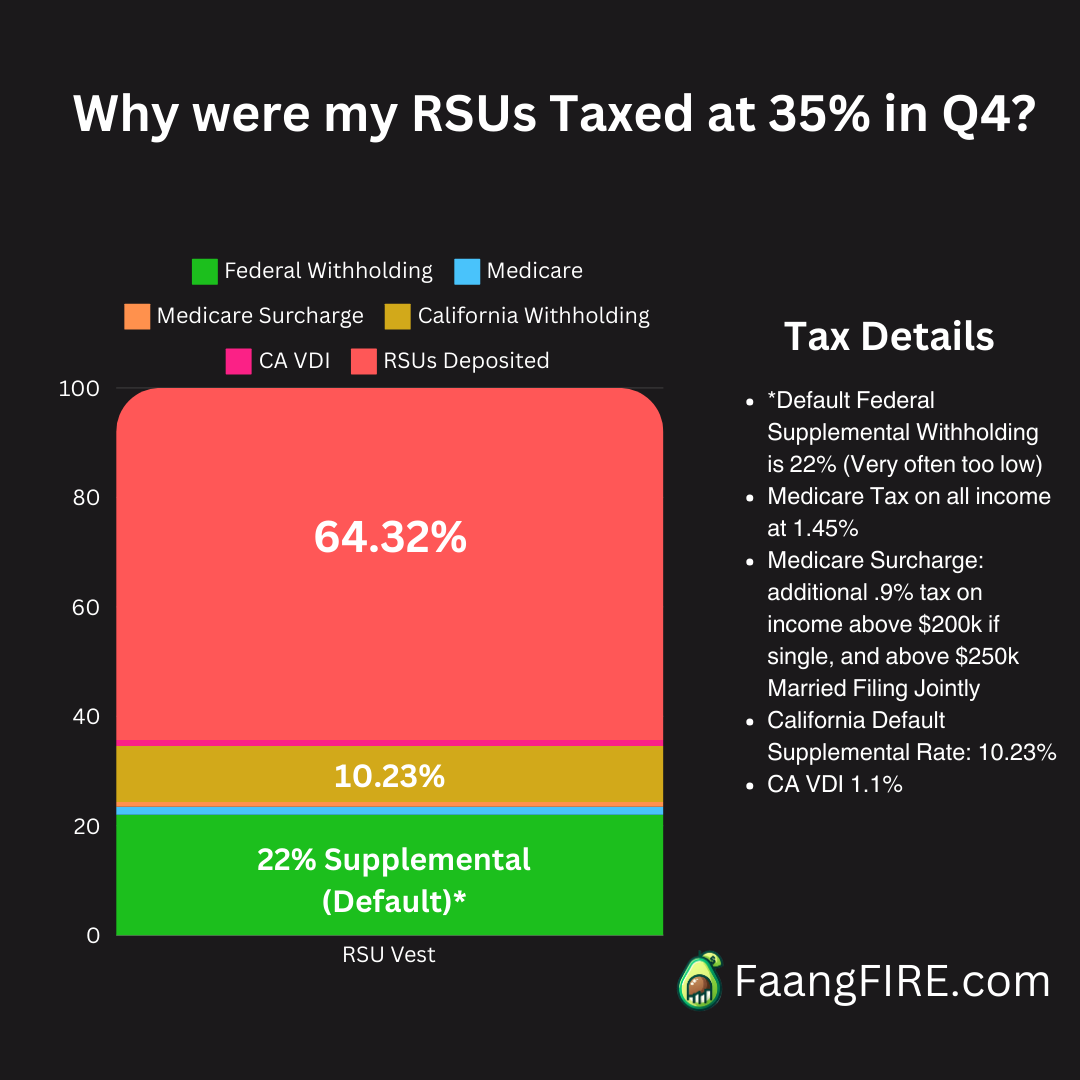

A: Hey Reader, the likely answer is taxes. A portion of your RSUs are automatically sold to cover some of your taxes since RSUs are income. You can see the example below for a California resident.

Follow Up Question: Why are my taxes higher than your example? I am in California too.

A: I am guessing your numbers are ~15% higher than in the image. That means your total compensation has passed $1M for 2024. That increases the default federal supplemental withholding from 22% to 37%.

What did my RSU plan look like?

During my decade at Meta, and after more than 30 different RSU vesting periods, I nearly always sold my shares within a few weeks of vesting.

I would simply log into Schwab after each vest and sell all my Meta shares at the market price.

It would then take 2 days for the cash from the trade to settle in my account. Afterward, I would transfer the cash from the sale to my taxable brokerage at Fidelity. You can keep it at Schwab, but I liked having all my investments within one account.

I would then use the cash to buy simple low cost mutual funds that matched my asset allocation —primarily VTI (US) and VXUS (International).

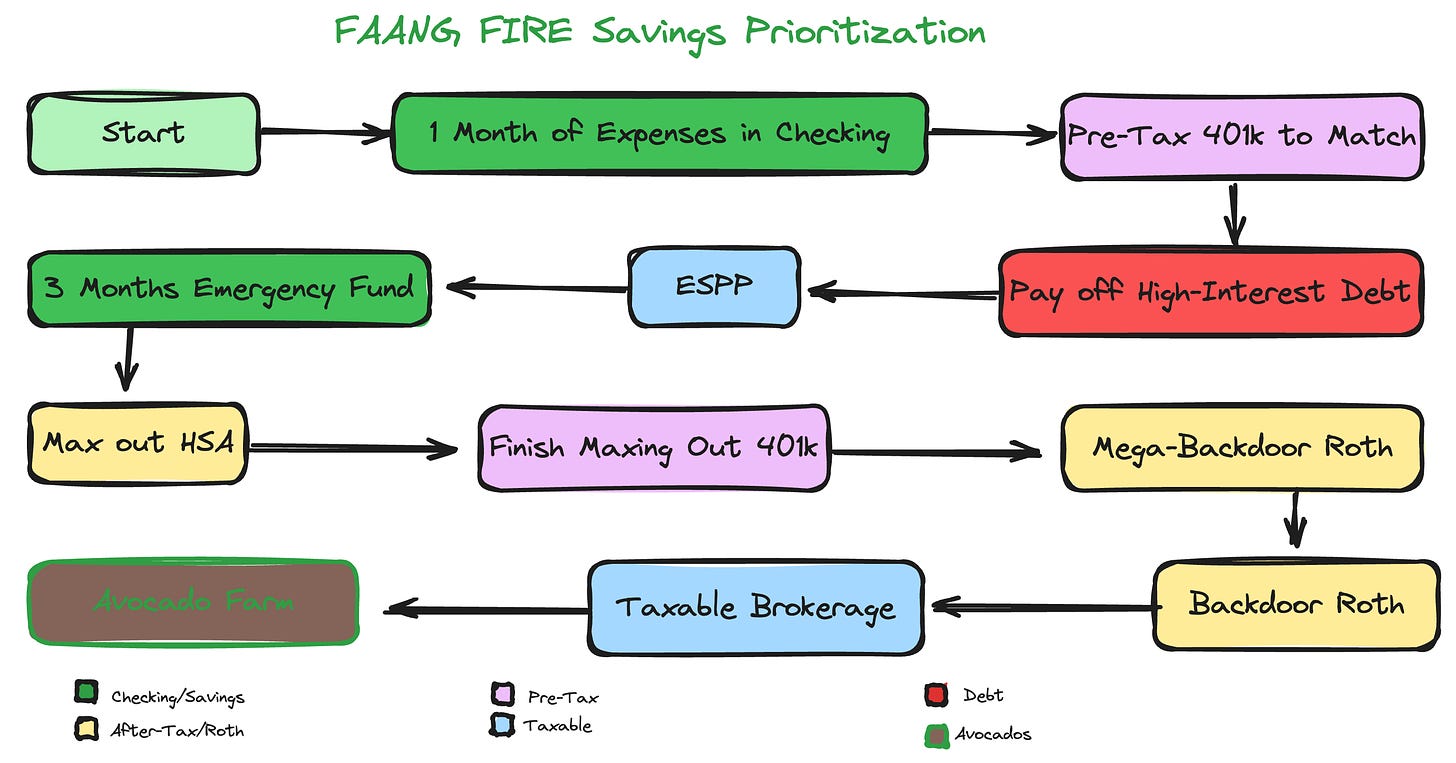

I did this because I already had an emergency fund. I didn’t have any debt. I was already maxing out all my tax advantaged accounts (401k, mega-backdoor, backdoor, FSA, DFSA…..). I wasn’t saving money for any major short term purchases (like a house). Because I was already doing all of that, I was able to simply transfer the cash from selling my RSUs into my Fidelity account, and then invest in my taxable brokerage account.

The key thing to remember is that RSU income is income. If you sell on vest, treat it like you would any other income.

I would simply take the proceeds and go through the FAANG FIRE prioritization flow.

For example, if you haven’t finished maxing out your 401k, maybe increase your contribution % for the final 2-3 paychecks of the year. Then use the proceeds from selling your RSUs to fund your monthly expenses as your paycheck gets funneled straight into your 401k. RSU income, is income.

Live RSU Workshop

In addition to all the free resources available above, I’ll be hosting a live RSU Workshop for paid subscribers this Friday at 12pm PST. I’ll be going through the fundamentals of RSU vesting and holding an open Q&A.