FIRE in San Francisco: Updated Projections After Taxes, Social Security, and Housing Scenarios

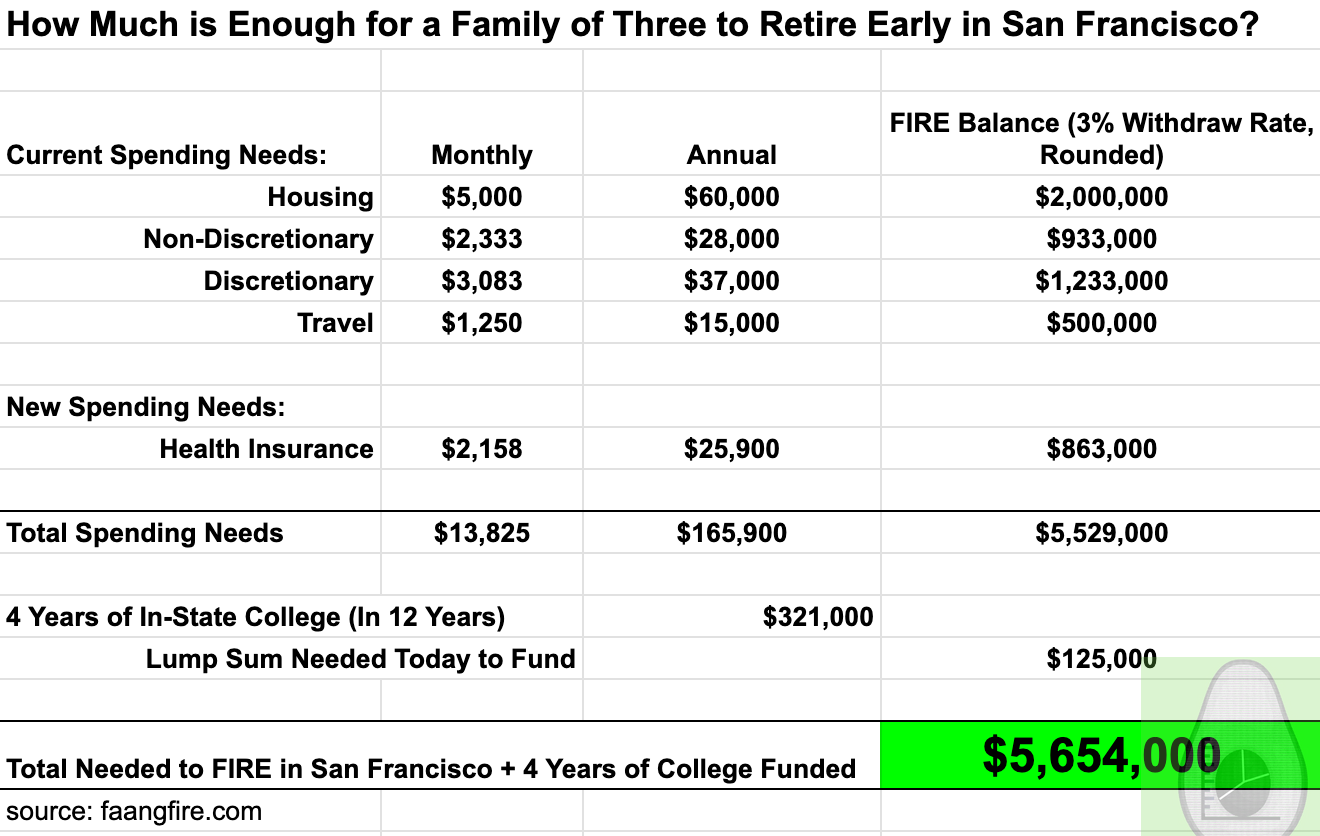

I received many questions after concluding in my post “How Much is Enough to FIRE in San Francisco” that $5,654,000 was enough to cover my current and planned future spending needs.

The biggest question by far is “What about Taxes?” In this post we are going to attempt to understand how taxes play a role in FIRE while also laying the groundwork to be able to answer other “What about X” type questions.

A Recap of “Enough” in San Francisco:

The original “Enough” calculation focused on a few key things:

What is my current spend?

What new spend will I have in FIRE? (mainly health insurance)

What are my large upcoming expenses? (college in 12 years)

From there I simply calculated “Enough” using a very conservative 3% withdrawal rate, a more conservative sibling to “the 4% rule”.

If you want more background into how I calculated the original $5,654,000 be sure to check out the original post:

Questions I Received

I received a lot of questions after that post! It is exactly these types of “What if?” analysis that are extremely helpful to pressure test your FIRE plans.

“What about taxes?”

“What if you added social security?”

“What if healthcare increases more than inflation?”

“What about end of life expenses?”

“What if you buy a house?”

“What if you end up spending more?”

“What about large periodic purchases like cars, health events, family support?”

The main issue is that most of these questions start to stretch my spreadsheet abilities. Sure I could definitely model out each one of these, but to quickly test out changes it would end up being a tremendous amount of work.

Luckily there are a number of tools out there that will make answering these questions much easier!

Get a free 1-year trial to all the tools referenced in this post and more by joining the $200 Extra Guac tier. A nearly $1,500 value! Learn More at https://www.faangfire.com/p/extra-guac or by upgrading your subscription to Extra Guac today.

Affiliate Disclaimer: Some links included in this post are affiliate links. This means that if you click through and sign up, I may receive a commission (at no extra cost to you).

Q: What about taxes?

One of the first questions I often get is how taxes factor into my enough number. My default answer is that taxes are just another expense, already included in my overall spending estimates. Additionally, taxes should be relatively low, as most funds will come from long term capital gains and the original cost basis of the stocks I’m selling. However, this isn’t a satisfying answer!

My original estimate of $5,654,000 ignored taxes and also didn’t factor the different account types that money sits in. So much of what I have written on FAANGFIRE is about how to take advantage of things like Mega-Backdoor Roth, Pre-Tax 401k, and Backdoor Roth IRAs, that it feels like a miss to not factor this in somehow.

Let’s Fix That!

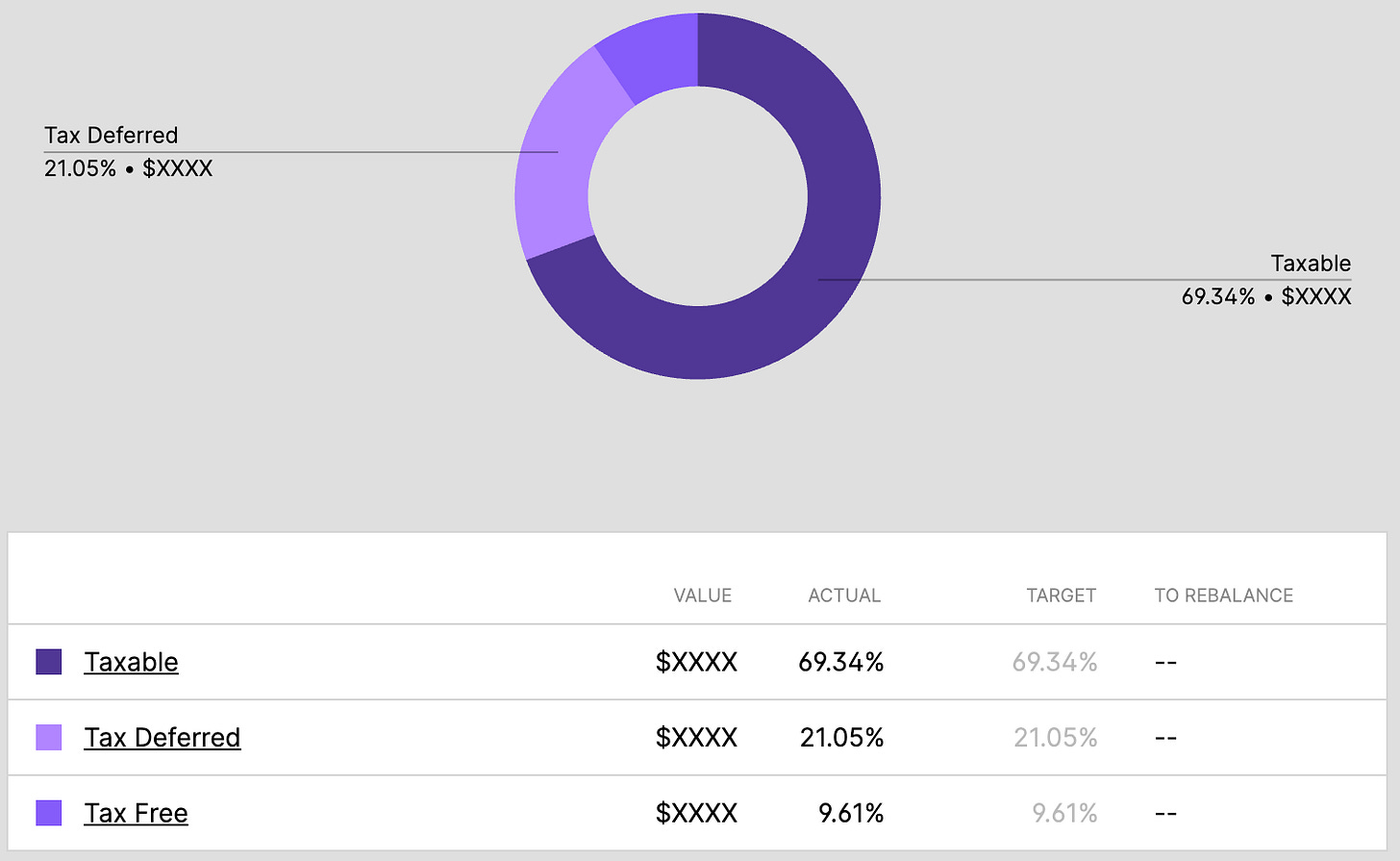

We will start by understanding the 3 primary tax groupings different FIRE funding sources will have. Mainly:

Roth accounts where they wouldn’t be taxed if used after 59.5

Pre-Tax accounts which will be taxed as income when they are withdrawn after 59.5, force withdrawn once Required Minimum Distributions kick in at ~73, or if any Roth conversions are performed

Taxable accounts where the gains would be taxed at capital gains tax rates when sold as well as all dividends taxed

To begin answering the tax question we now need to determine the makeup of $5,654,000 across those different tax groupings.

I want this to mirror my personal situation as much as possible. That means looking at my current breakdown across tax types to use as a baseline for breaking down how taxes impact my FIRE plans.

Luckily this is fairly easy for me to pull by logging into my Kubera dashboard where I can immediately see that my current investment breakdown by tax type!

Current Tax Type Breakdown (light rounding):

Taxable: 70%

Pre-Tax: 20%

Roth: 10%

Side note: Very often I get asked how I plan on FIREing with so many of my investments going into my 401k + Mega-Backdoor 401k, Backdoor Roth, etc. The above breakdown is my actual split. At very high dual FAANG salaries, much of your investment balance will end up being in un-restricted taxable accounts by the nature of the tax advantaged accounts having contribution caps.

In addition to my investments, based on my personal cash flow waterfall I also want to maintain 1-month of expenses in a checking account, 1-year of expenses in a HYSA, and I also have my daughter’s 529 tracked separately from the above breakdown.

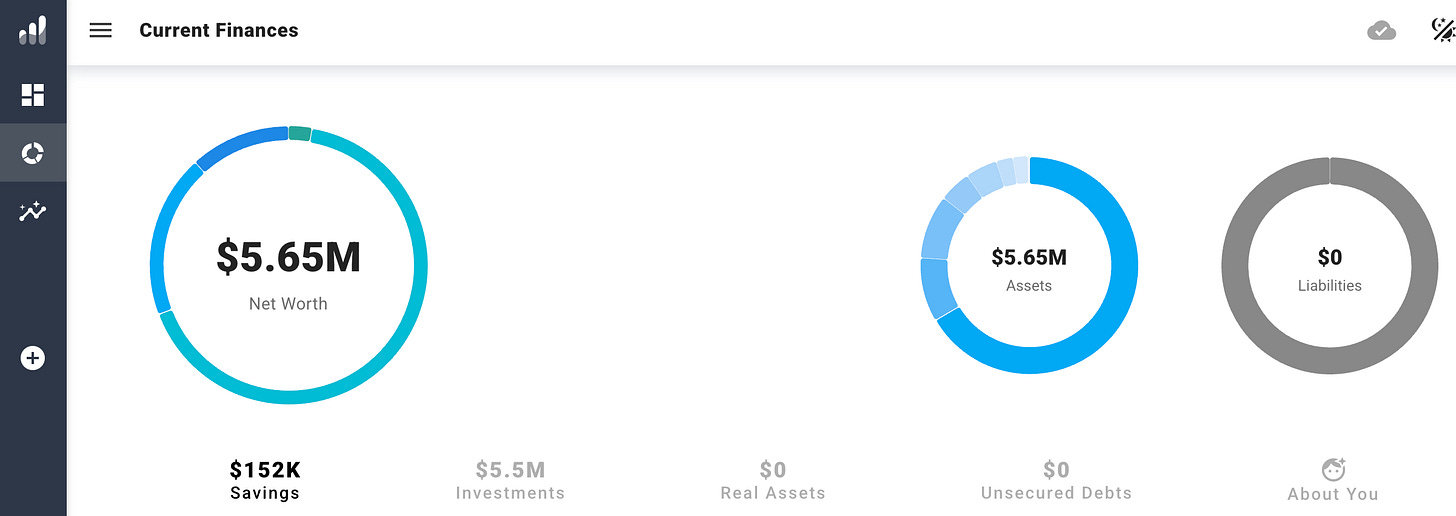

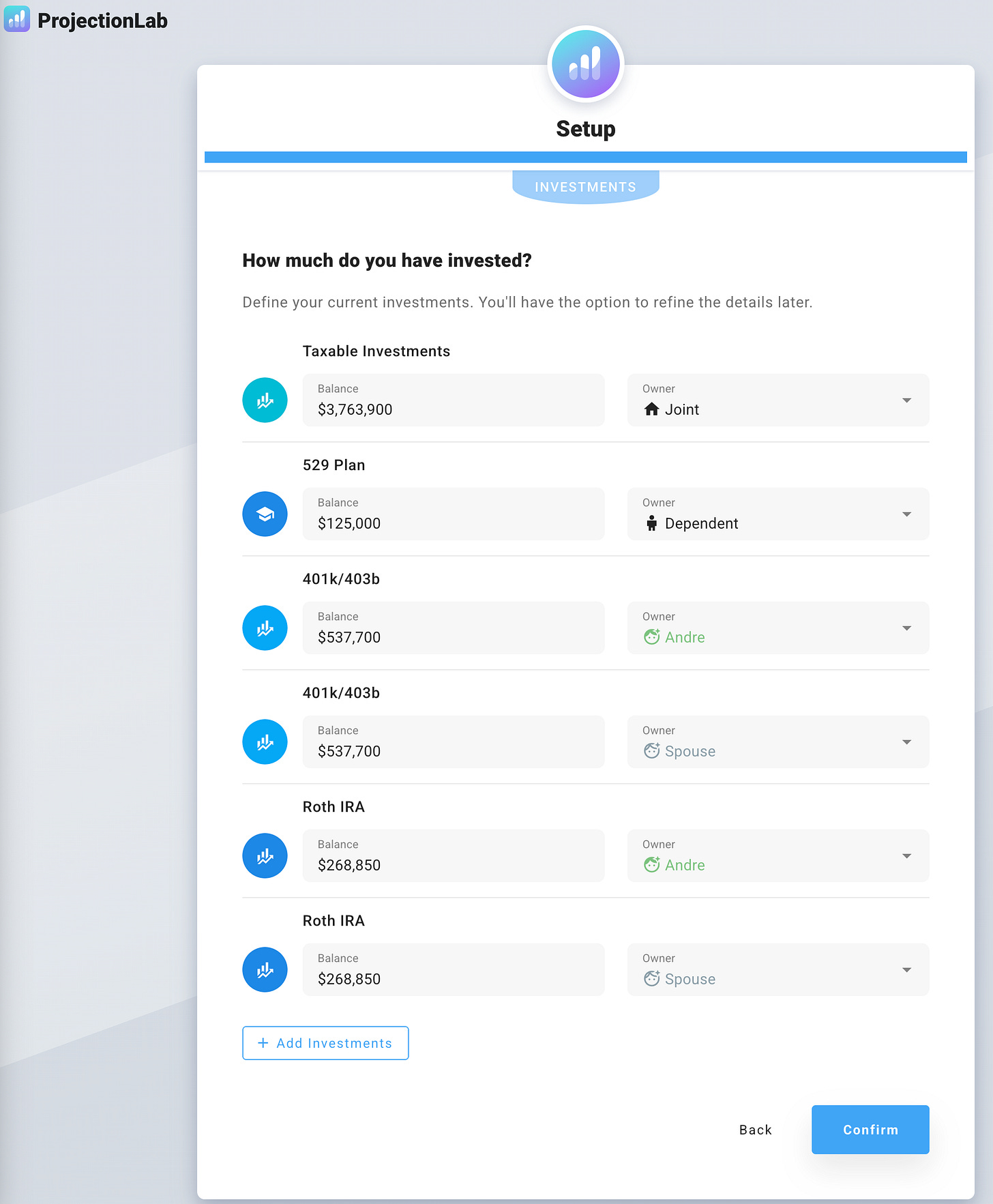

The Initial Account Balances

$12,000 in Checking Account (represents 1-month of expenses)

$140,000 in a High Yield Savings Account (represents 1-year emergency fund)

$125,000 in a 529 College Savings Account (estimated to fund 4 years of college in 12 years)

$3,763,900 in a Taxable Investment Account (based on 70% calculated above)

65% of this is assumed to be the starting cost basis (my actual current basis)

$537,700 in Roth Investment Accounts (split evenly across two people)

$1,075,400 in Pre-Tax Investment Accounts (split evenly across two people)

Utilizing ProjectionLab

Now that we have the baseline numbers we are going to input them into ProjectionLab which will be powering most of this post’s projections (and has 1-year included with an Extra Guac membership).

I have gone ahead and added our starting parameters. Next we can start building out our initial plan!

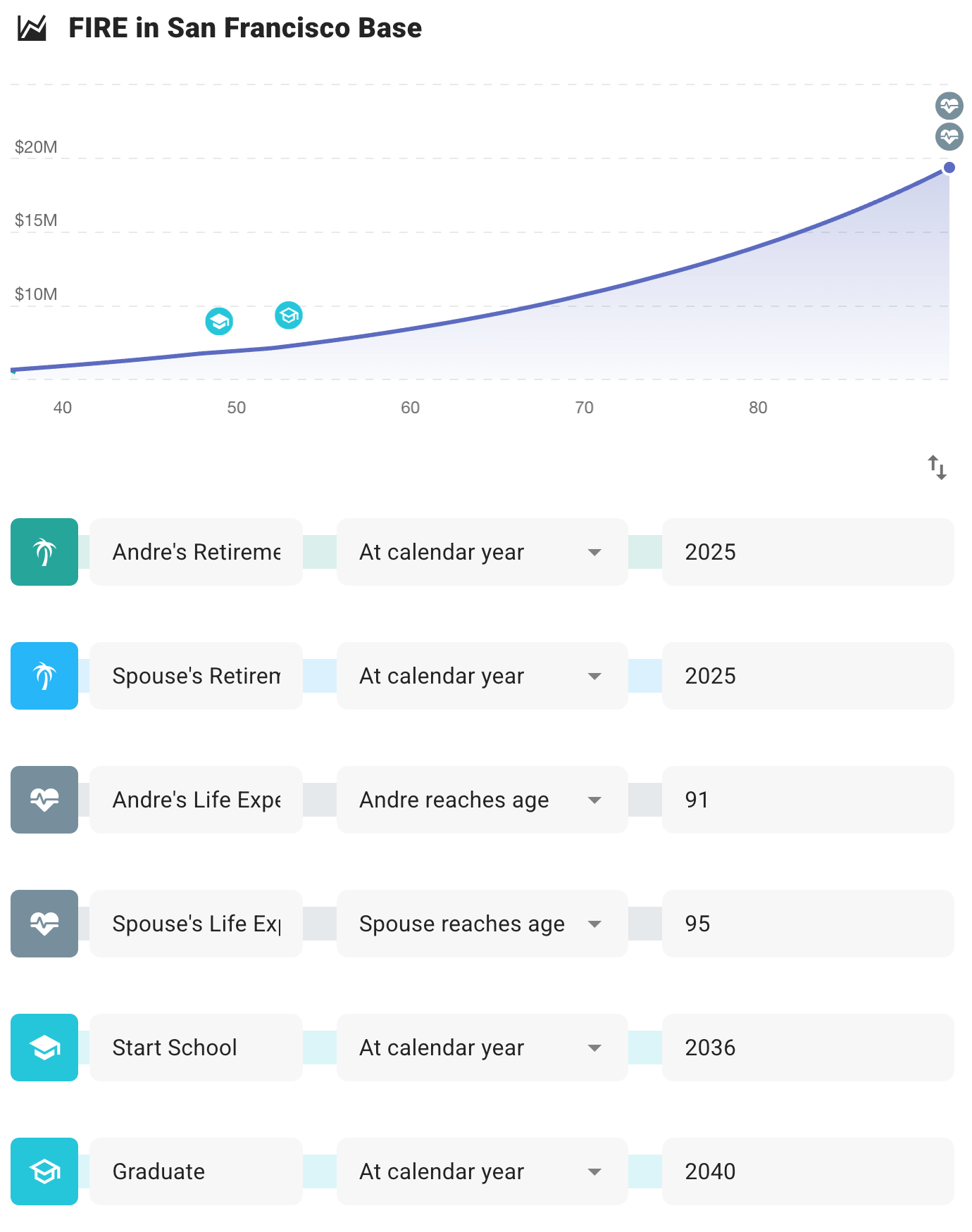

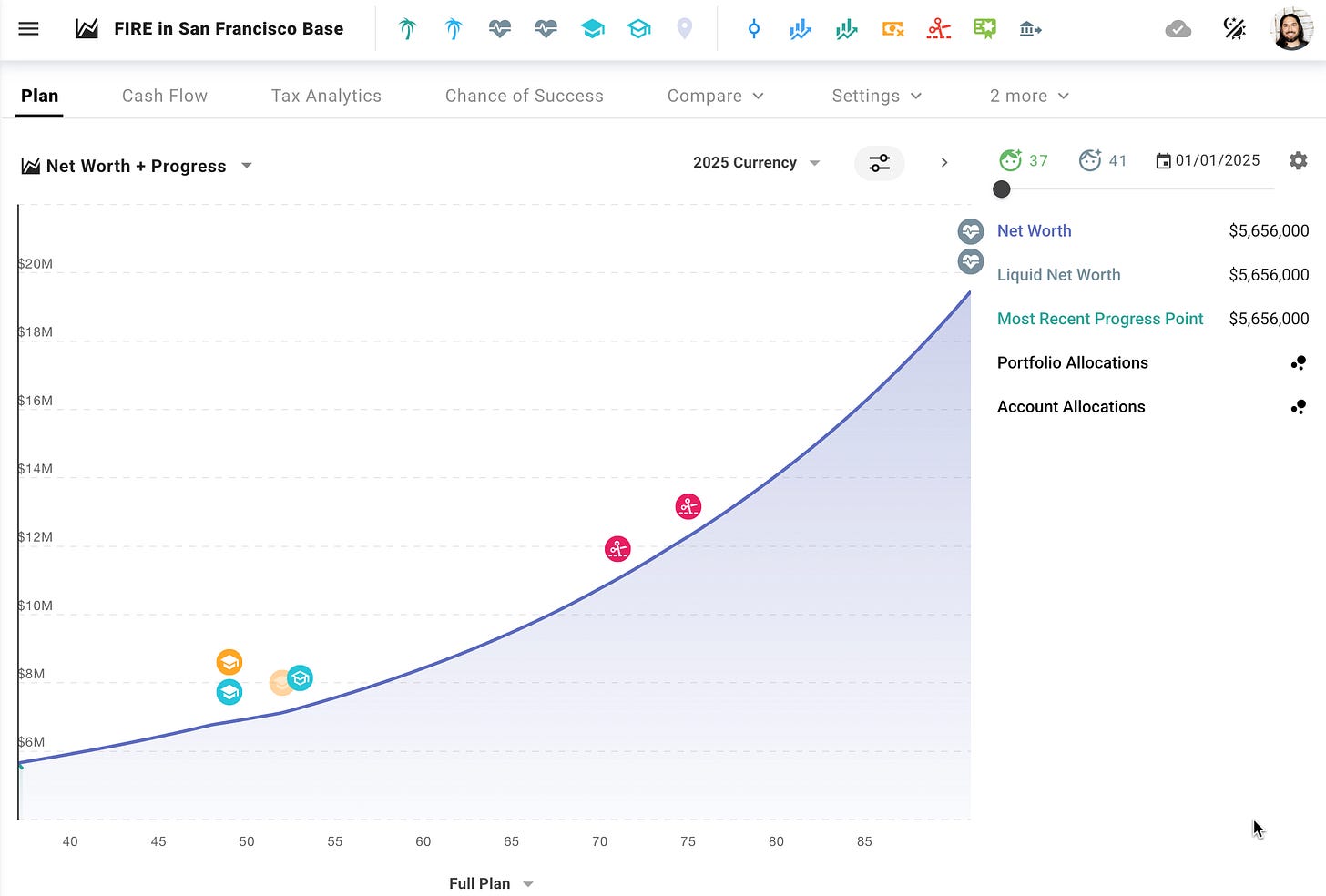

To build out a FIRE scenario I am going to have it setup where the plan starts at the beginning of 2025 and both people are retired. You can see all the milestones I added in ProjectionLab:

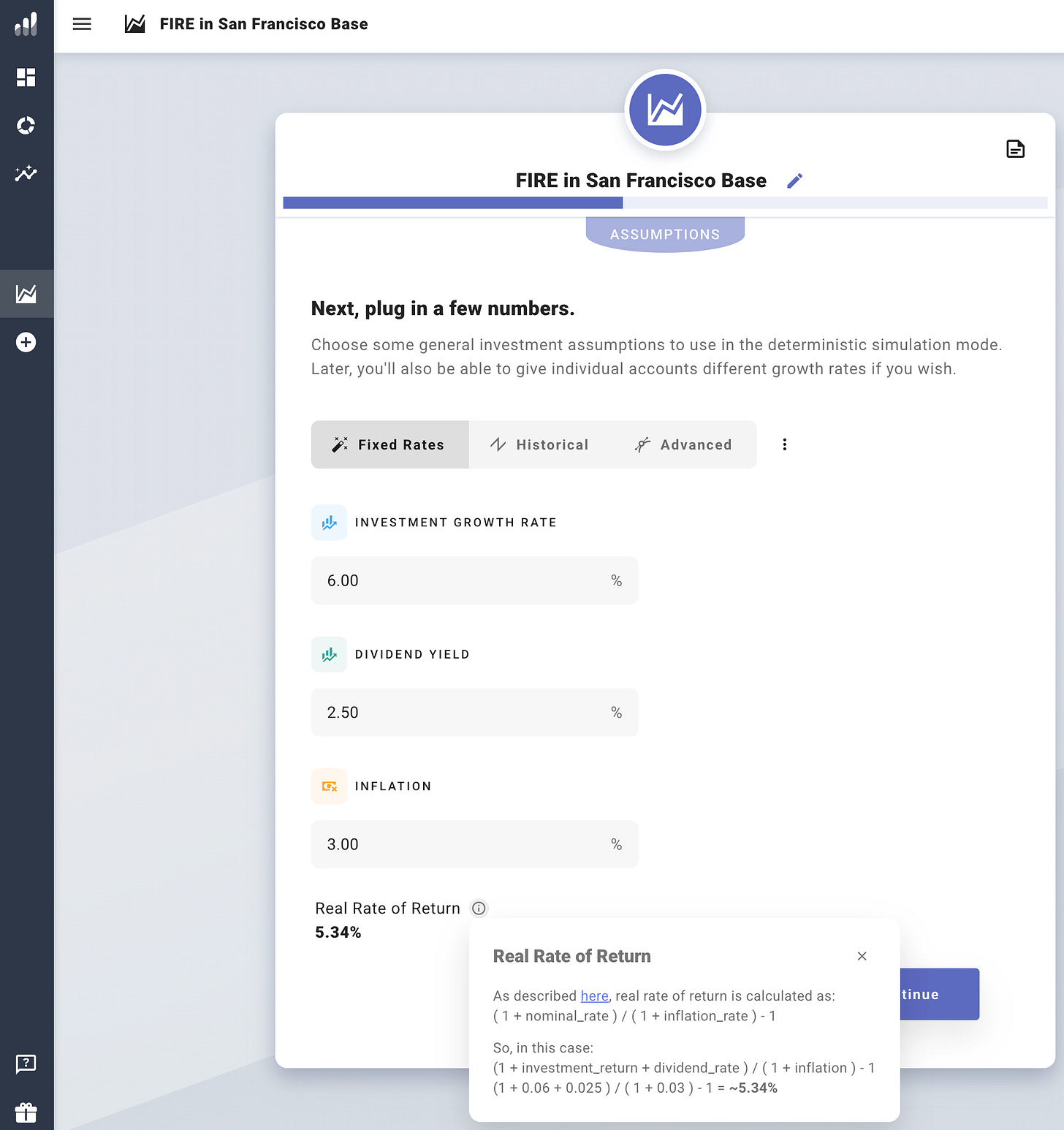

Adding in Default Assumptions

We will look at more historical data modeling later, for now we are setting the investment and inflation assumptions at 6% investment growth, 2.5% dividend yields, and 3% inflation to give us a Real Rate of Return of 5.34%. Already more granular than my hard coded 5% real rate of return I typically use in my spreadsheets.

$0 in income for FIRE

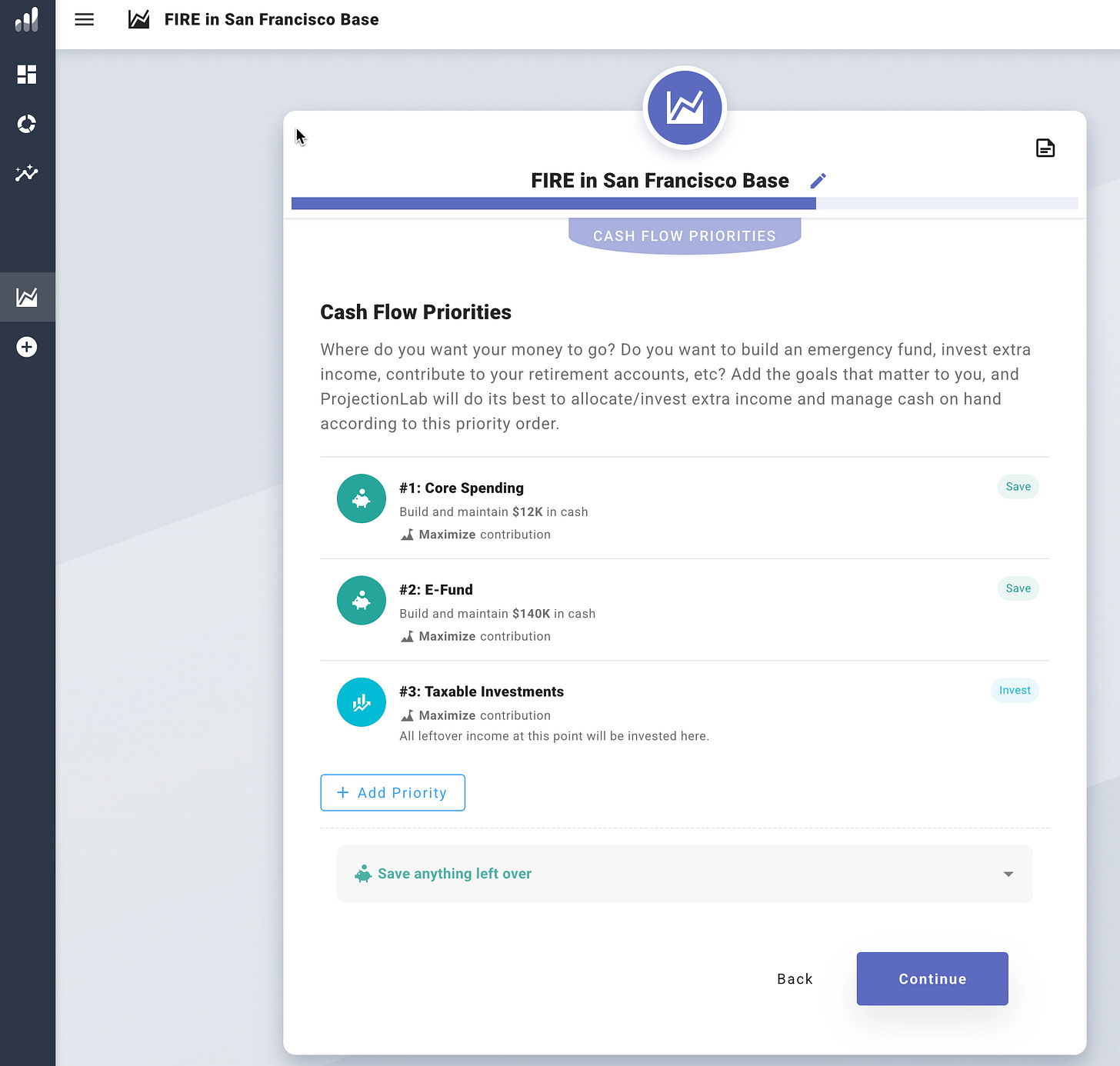

Set the Cash Flow Priorities to maintain $140k in emergency fund, $12k in spending, with any remaining amounts going into my taxable accounts.

I changed the default withdrawal order to not utilize excess cash first

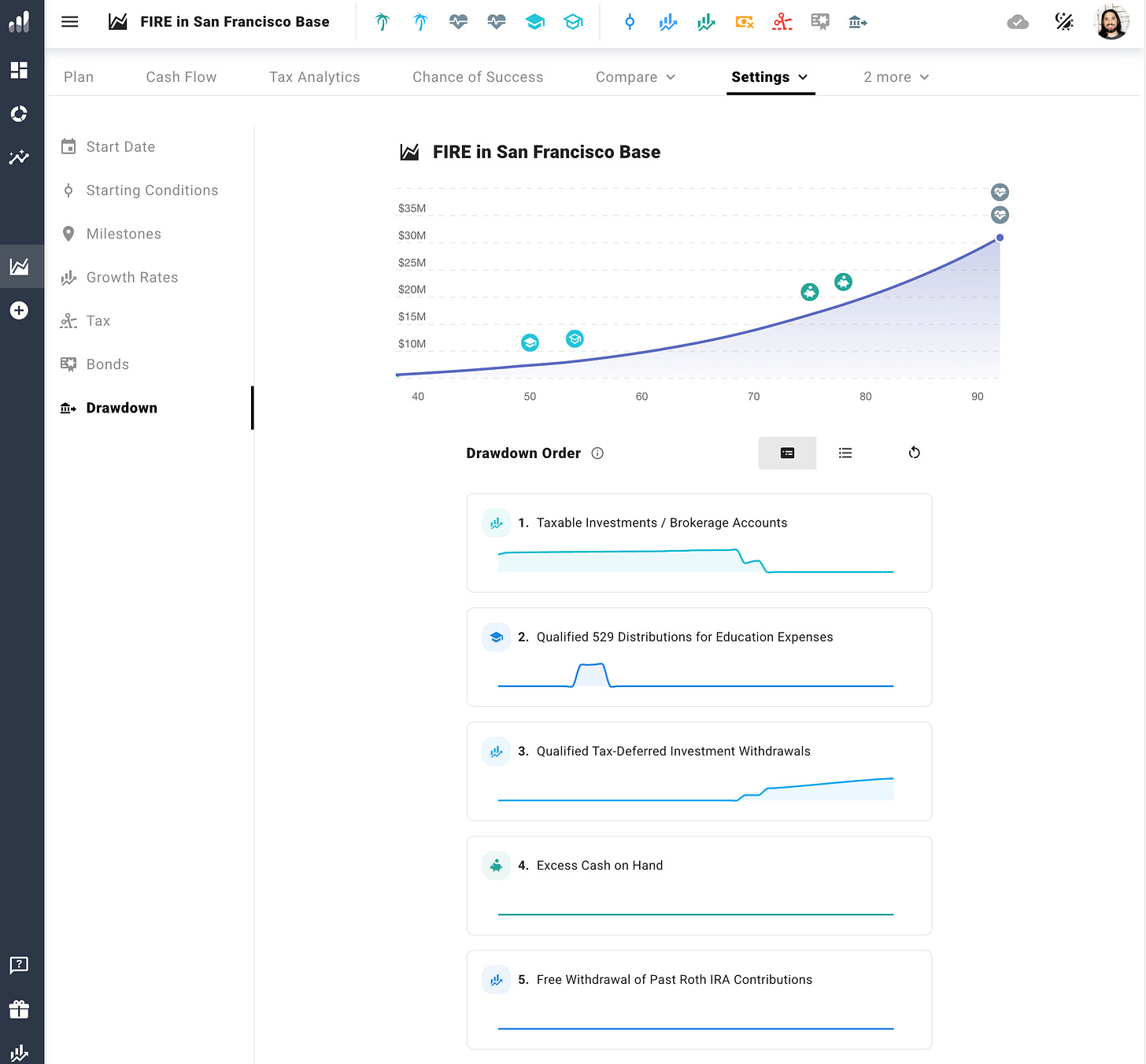

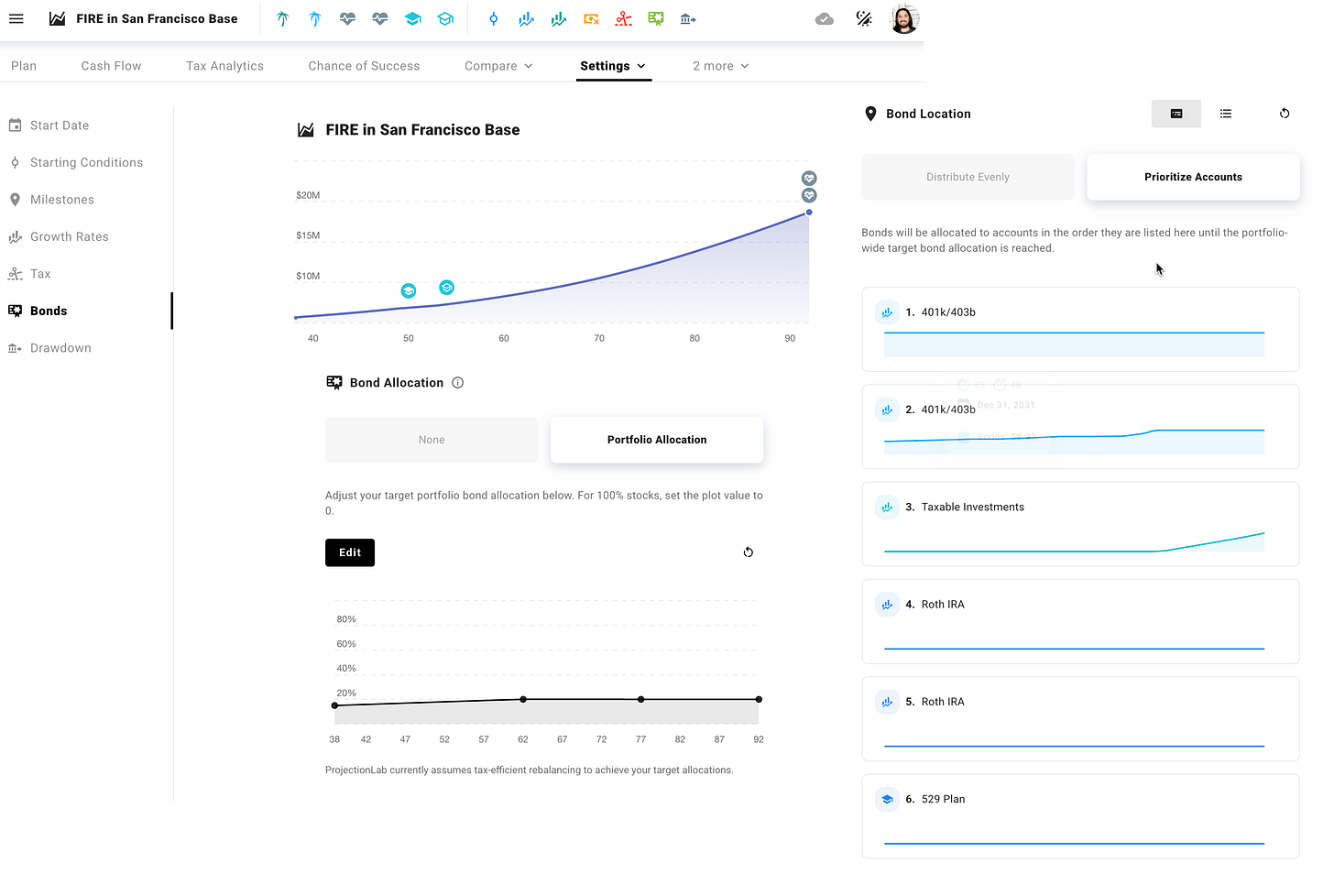

Another change I made was adding details on my bond holdings and bond location. I set to have 15% bonds until I am 62 and then 20% from there on out. With my bond allocation set to prioritize my Pre-Tax accounts, then my taxable, followed last by my Roth accounts.

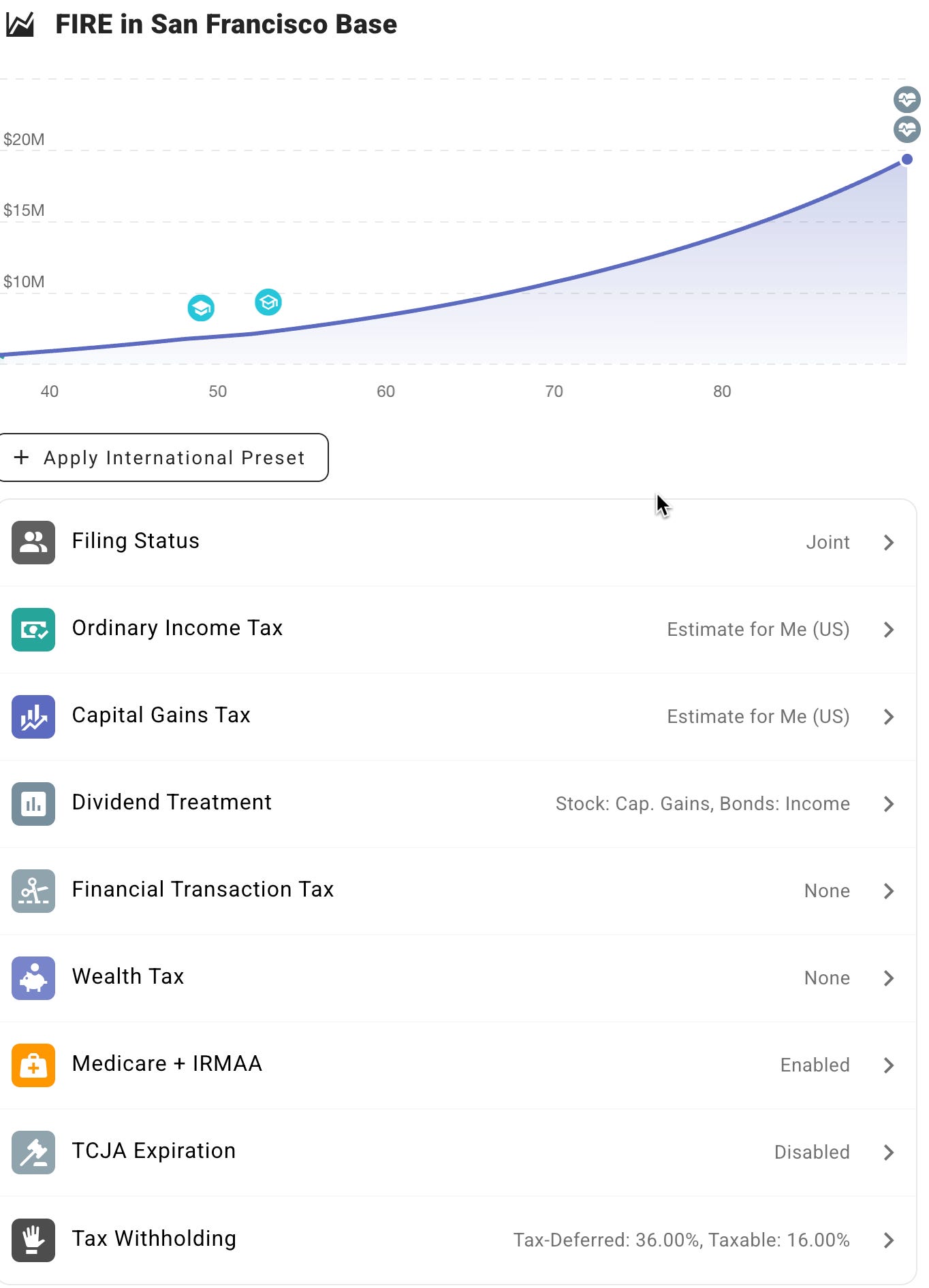

I am letting ProjectionLab calculate the taxes for me (we will look at this closer). I optimistically assumed that the TCJA (Trump 1.0 Tax Cut and Jobs Act) wouldn’t expire this year (this is just a drop down that can be changed).

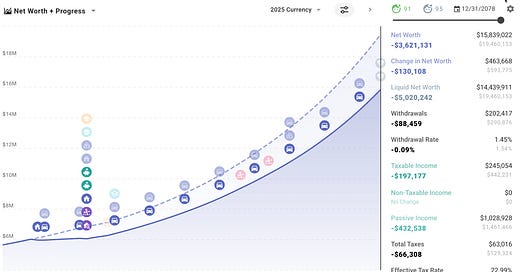

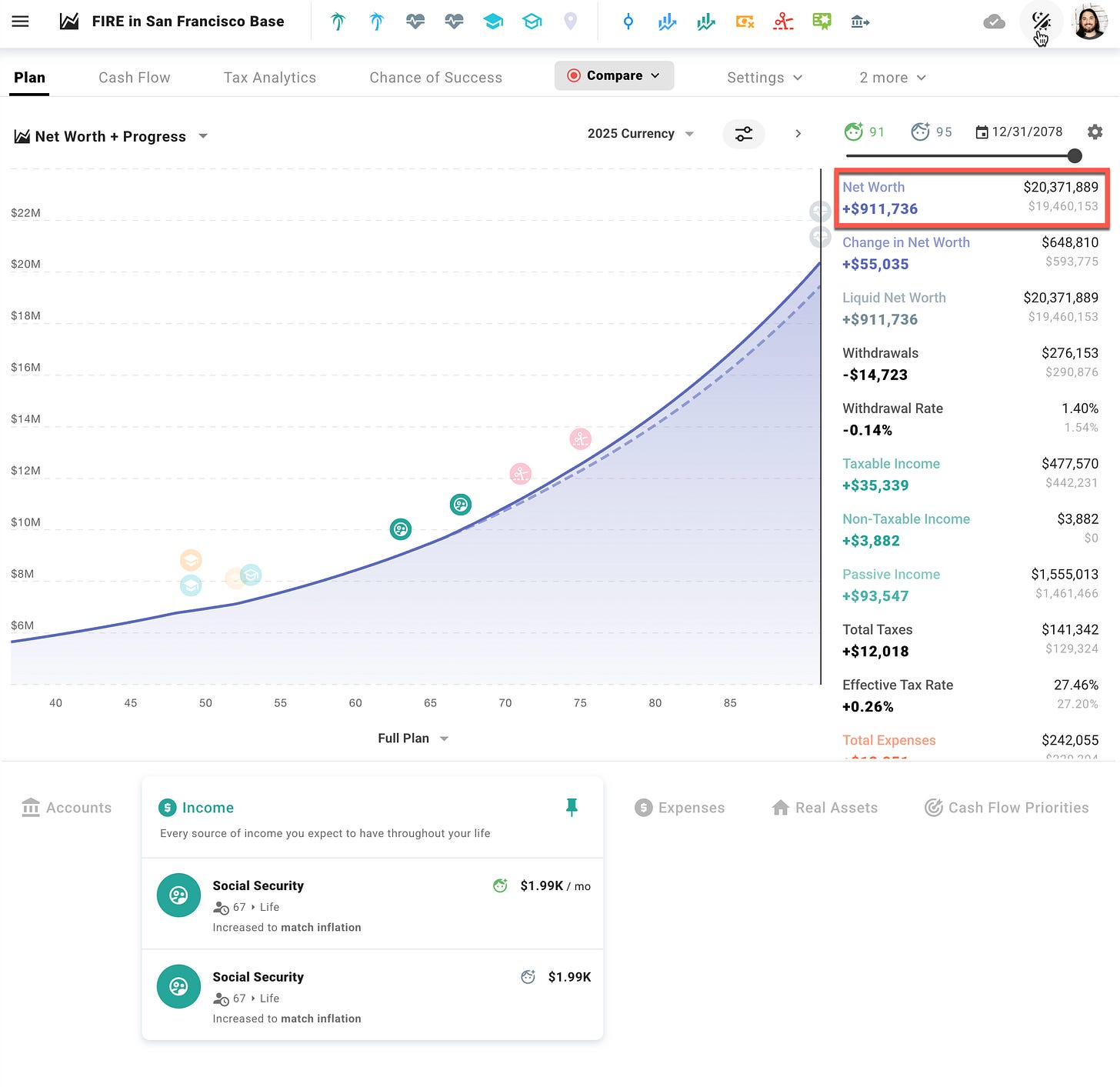

Now it gives me a very simple year by year output using all the provided assumptions:

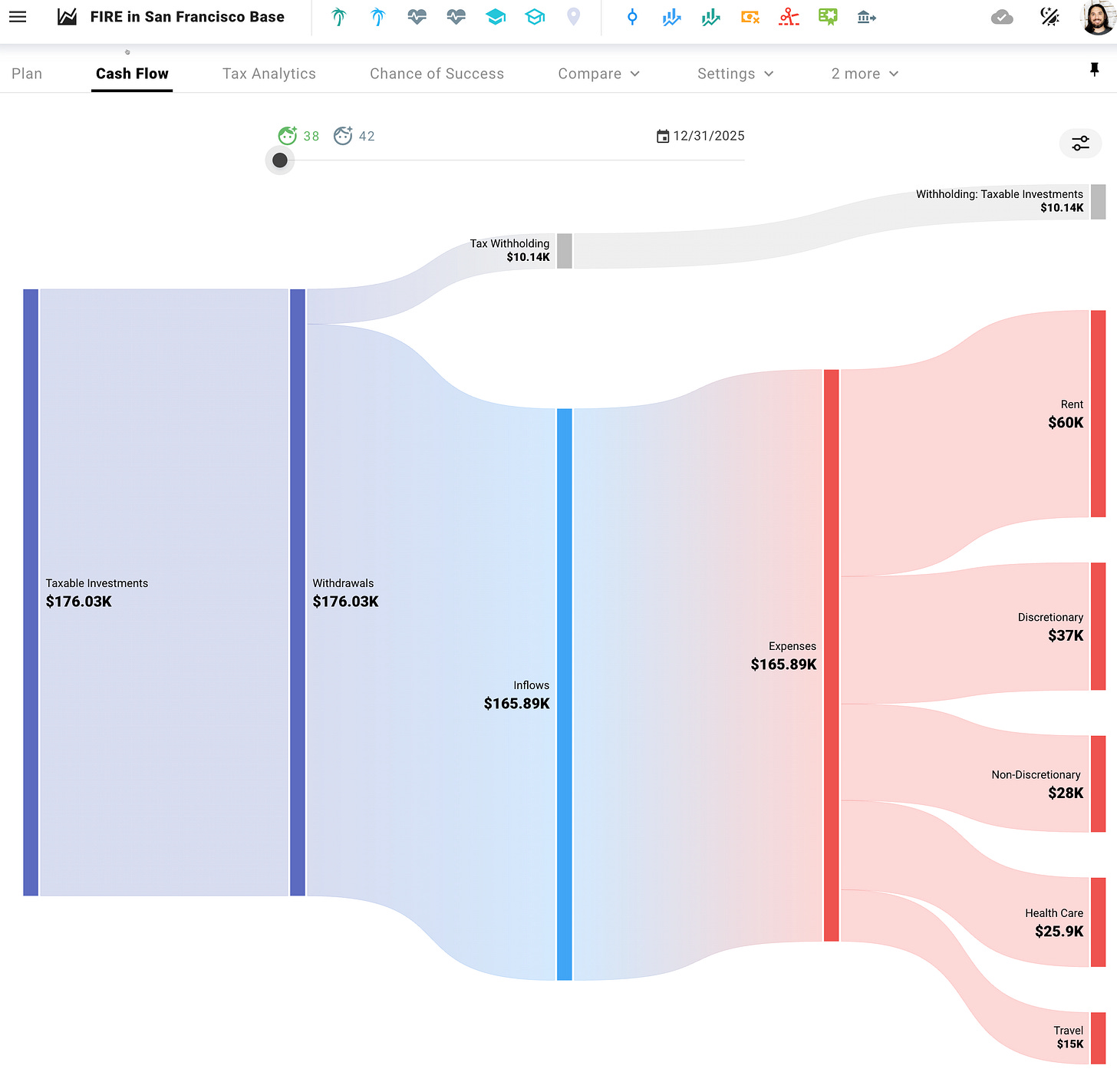

We can see various breakdowns like the expenses modeled out for every year in the Cash Flow tab. For example, here is year 1, including taxes withheld:

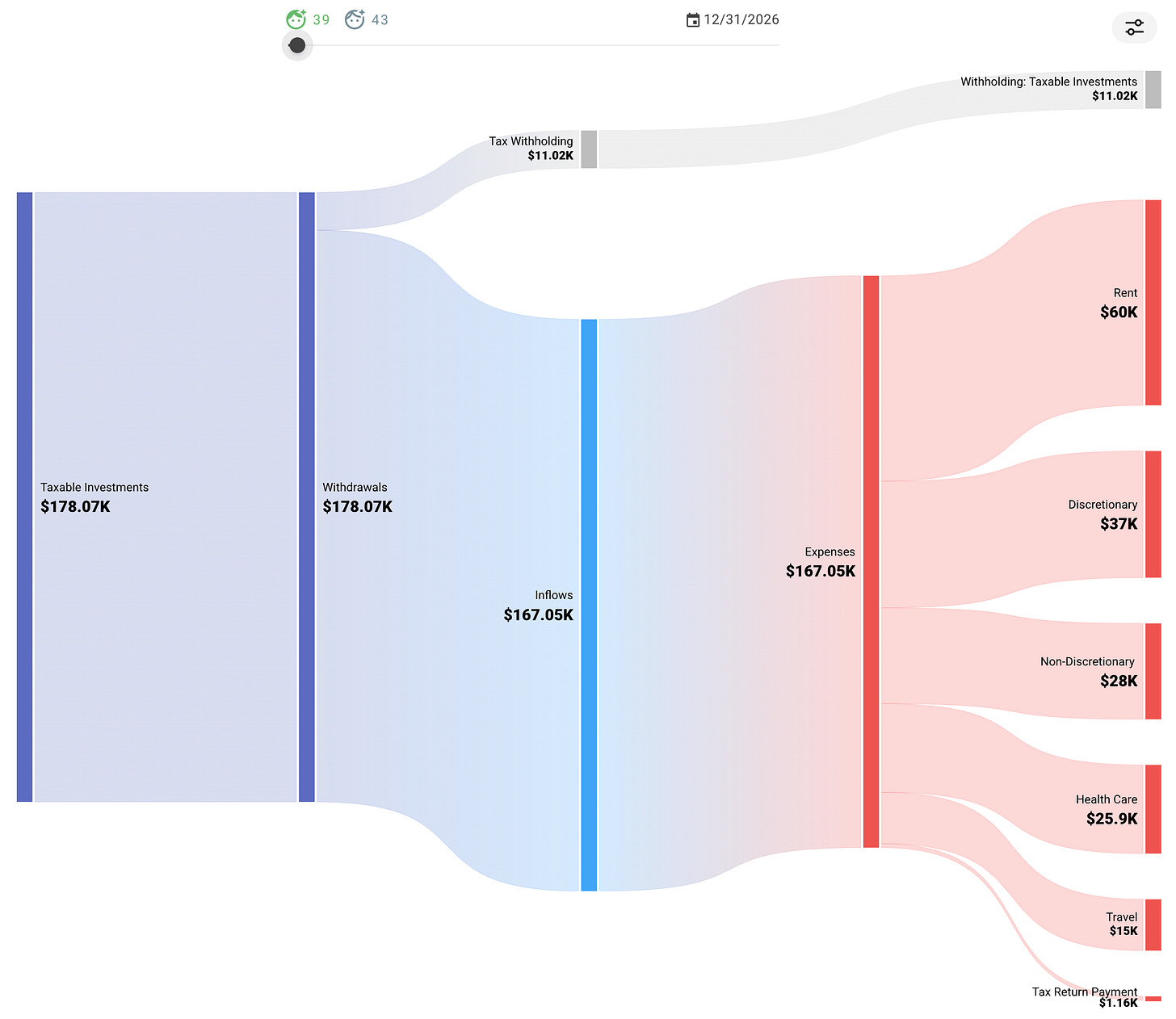

In year two you can see the Tax Payment added to factor that my withholdings were not enough to cover my actual tax obligation for that year.

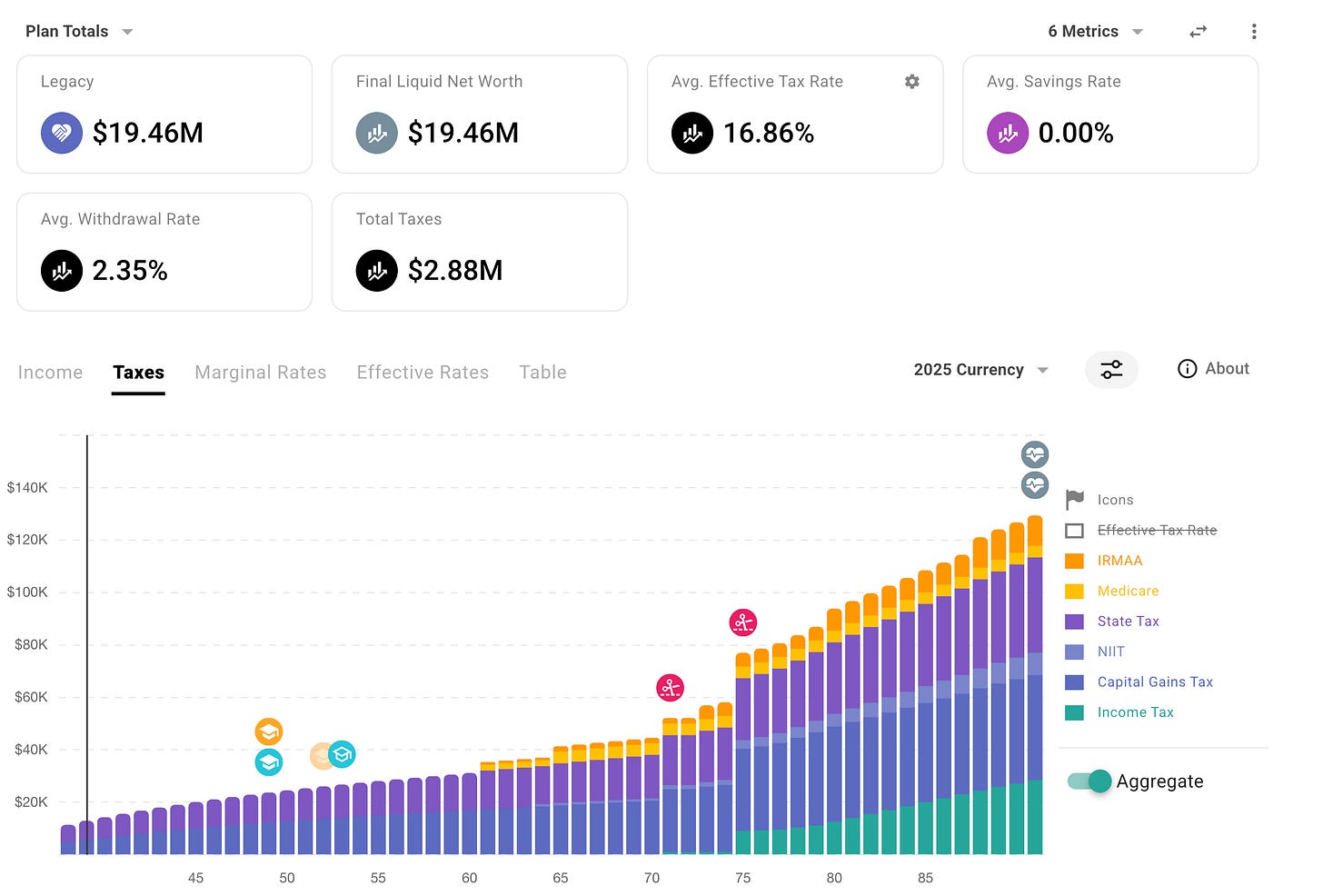

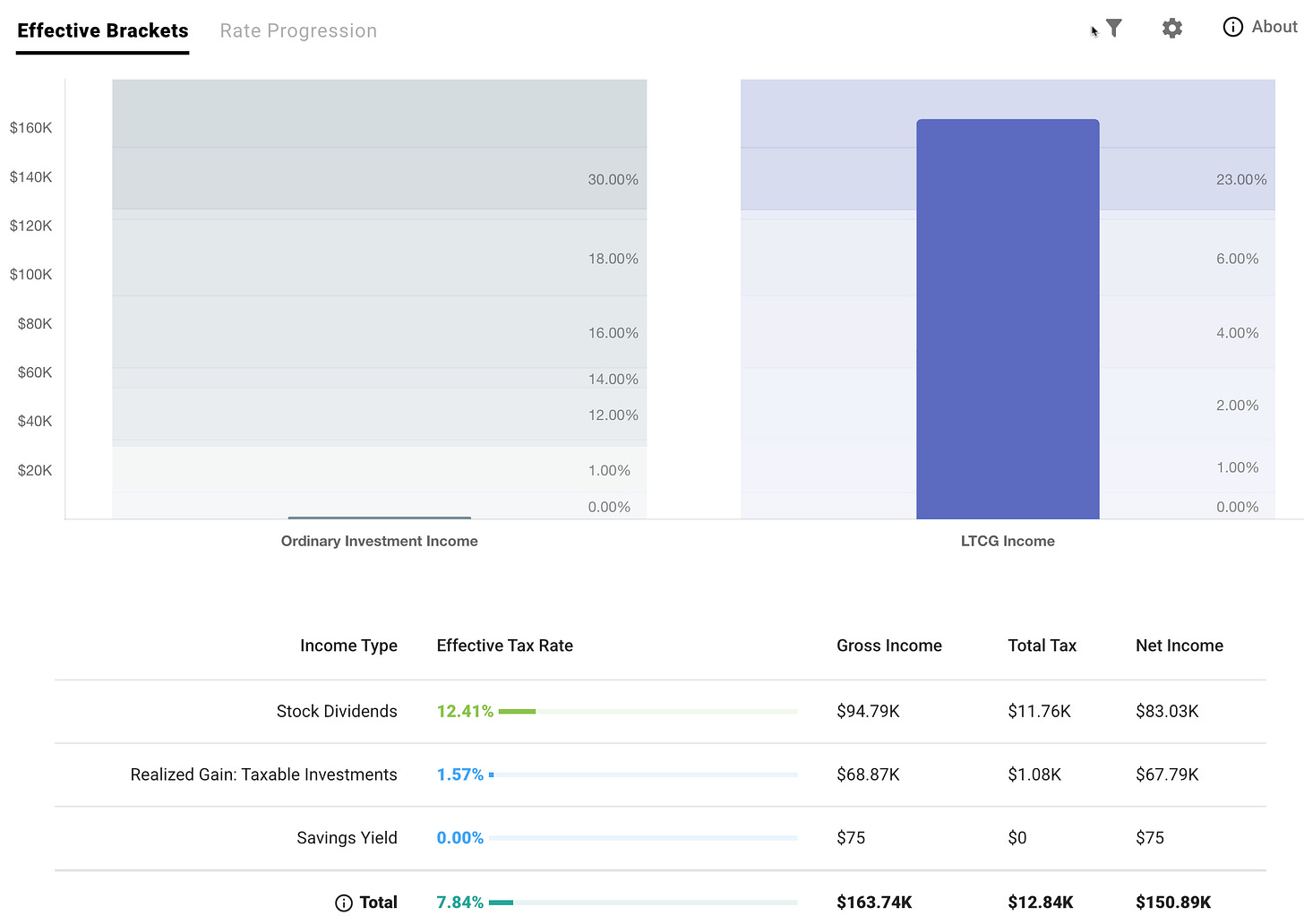

We can see this tax breakdown in more detail through the Tax Analytics tab. Where you can see the year by year taxation over the full duration of the plan! Fully factoring in taxes. Including the lifetime taxes estimated to the tune of $2.88M (in 2025 dollars).

These are just the assumption based projections though. We know reality isn’t nearly as predictable or prone to follow the same rules year after year.

We can also remember that the entire basis of using a 3% withdrawal rate is to make sure I don’t run out of money during my more than 60 years of potential early retirement by falling prey to bad initial sequence of returns.

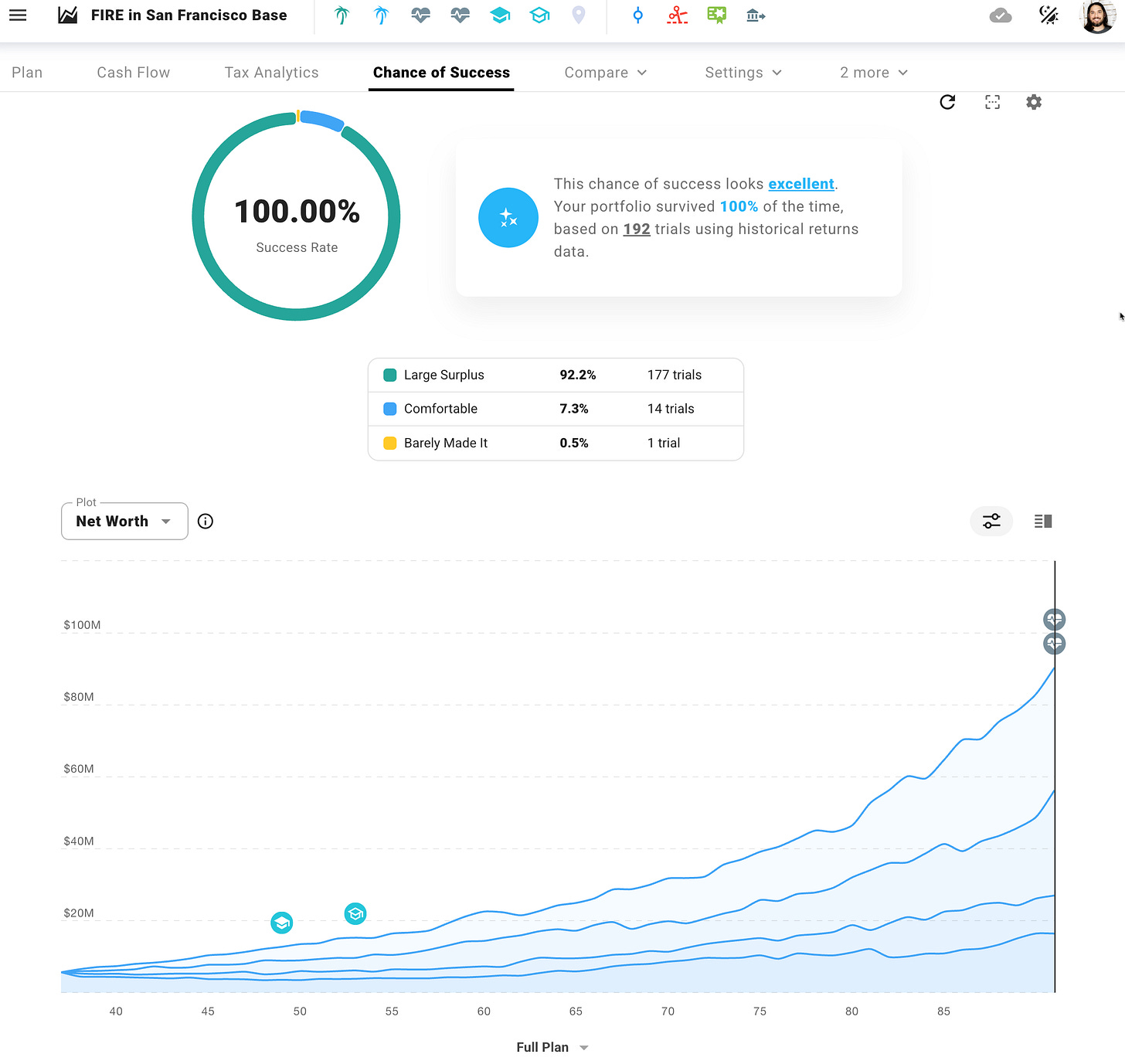

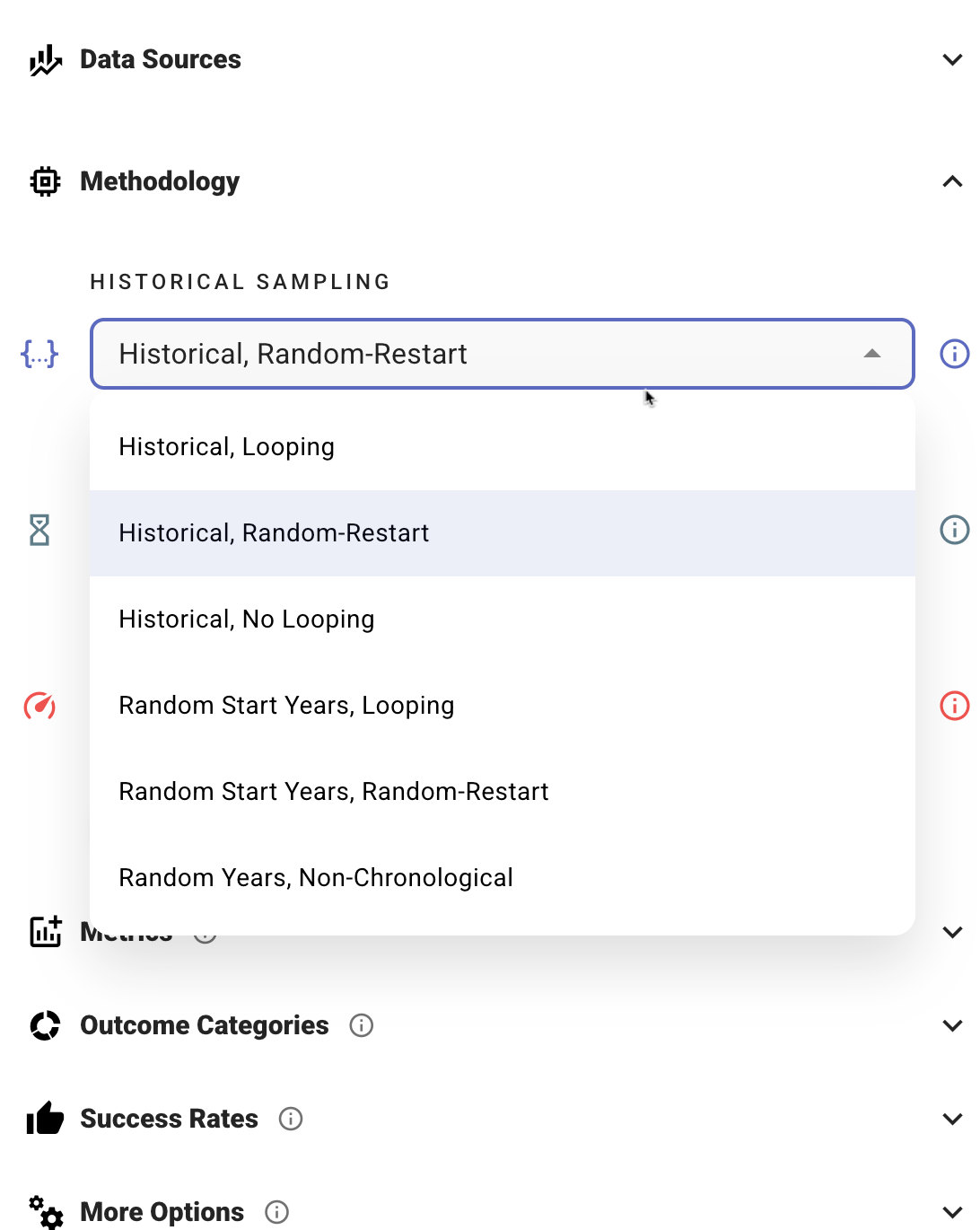

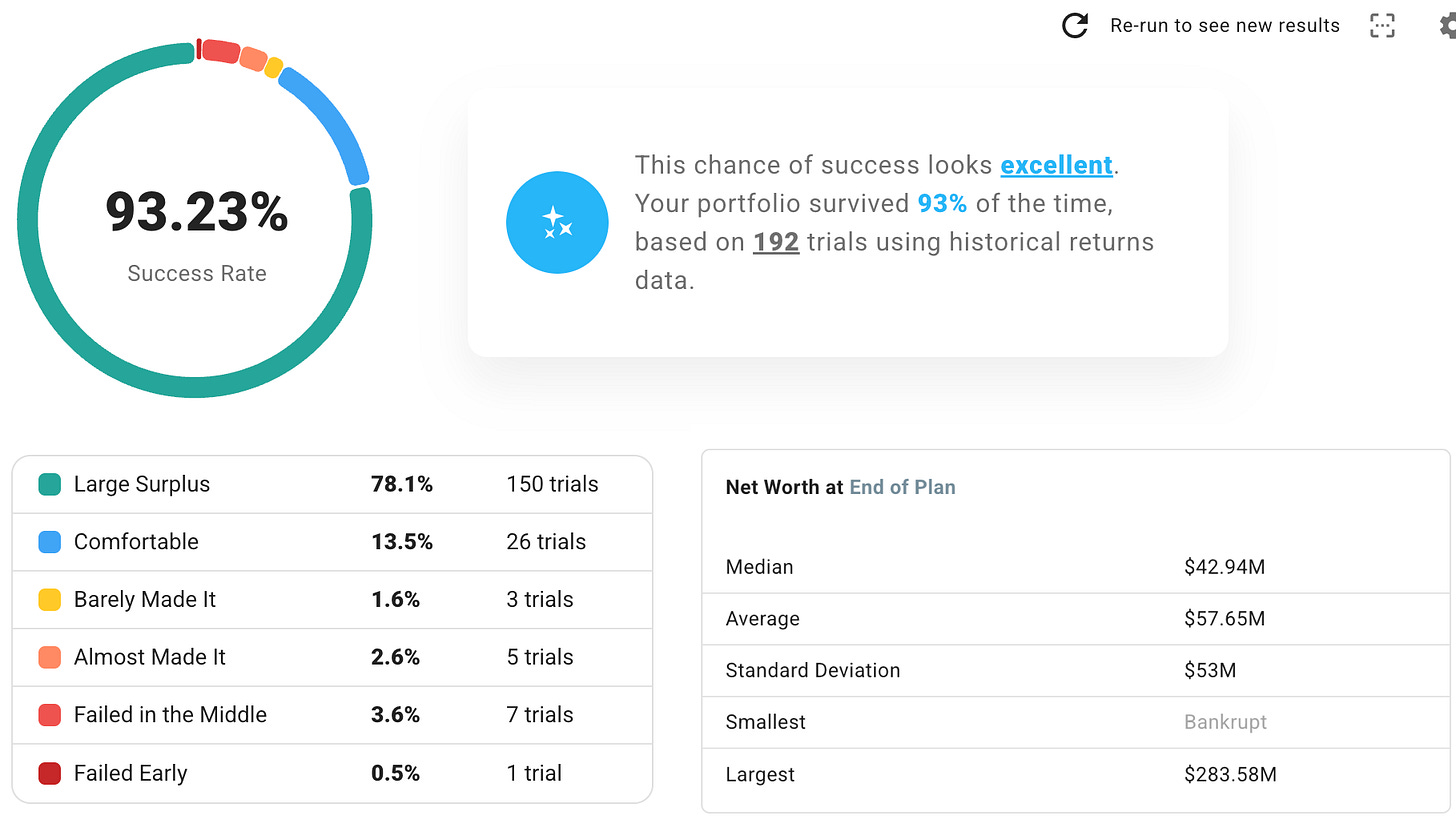

Fortunately, even more powerful analysis is available when you go to the Chance of Success tab where you can run simulations against randomized historical datasets with the ability to influence how the historical sampling is done.

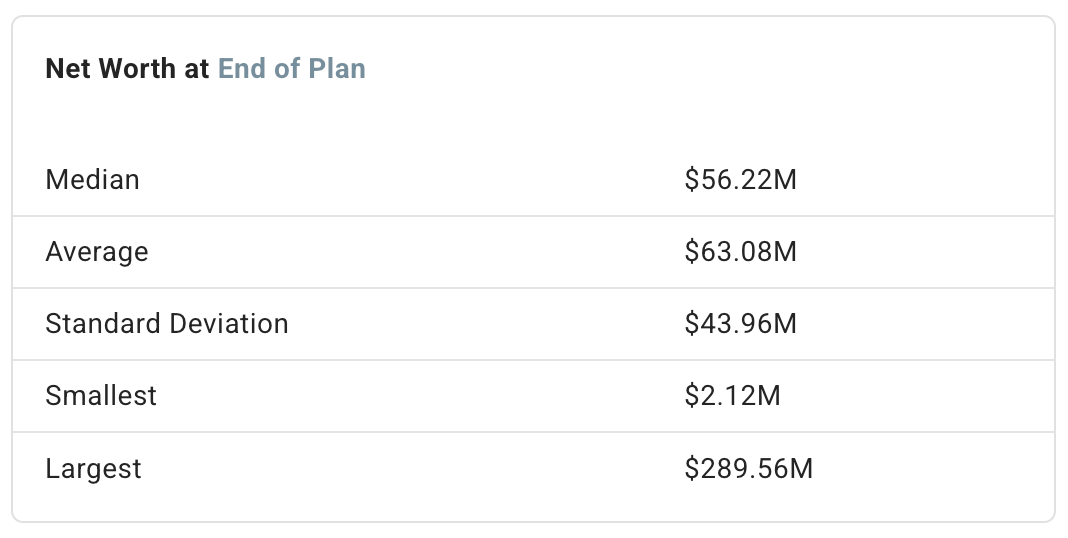

So it seems clear that even when I factor in taxes, my initial Enough in San Francisco number, $5,654,000 is very conservative. With a median net worth of $56,220,000 at the end of the plan (2025 dollars).

The worst sequence resulted in a final net worth of more than $2,000,000 (these are in 2025 dollars) if I retired right before the dot com burst 1999-2023, followed by 1969-1998. Note: every time you run the simulation the results will be different as the randomized selection of historical returns gets utilized. You can change all of these settings:

Conclusion: Taxes are a major expense. Understanding your tax mix is important. 3% withdrawal rate is so conservative it doesn’t seem to matter.

Q:“What if you added social security?”

Since the plan had a 100% success rate without social security, I think it is safe to say nearly ANY additional income, whether social security or otherwise would lead to even high net worth balances.

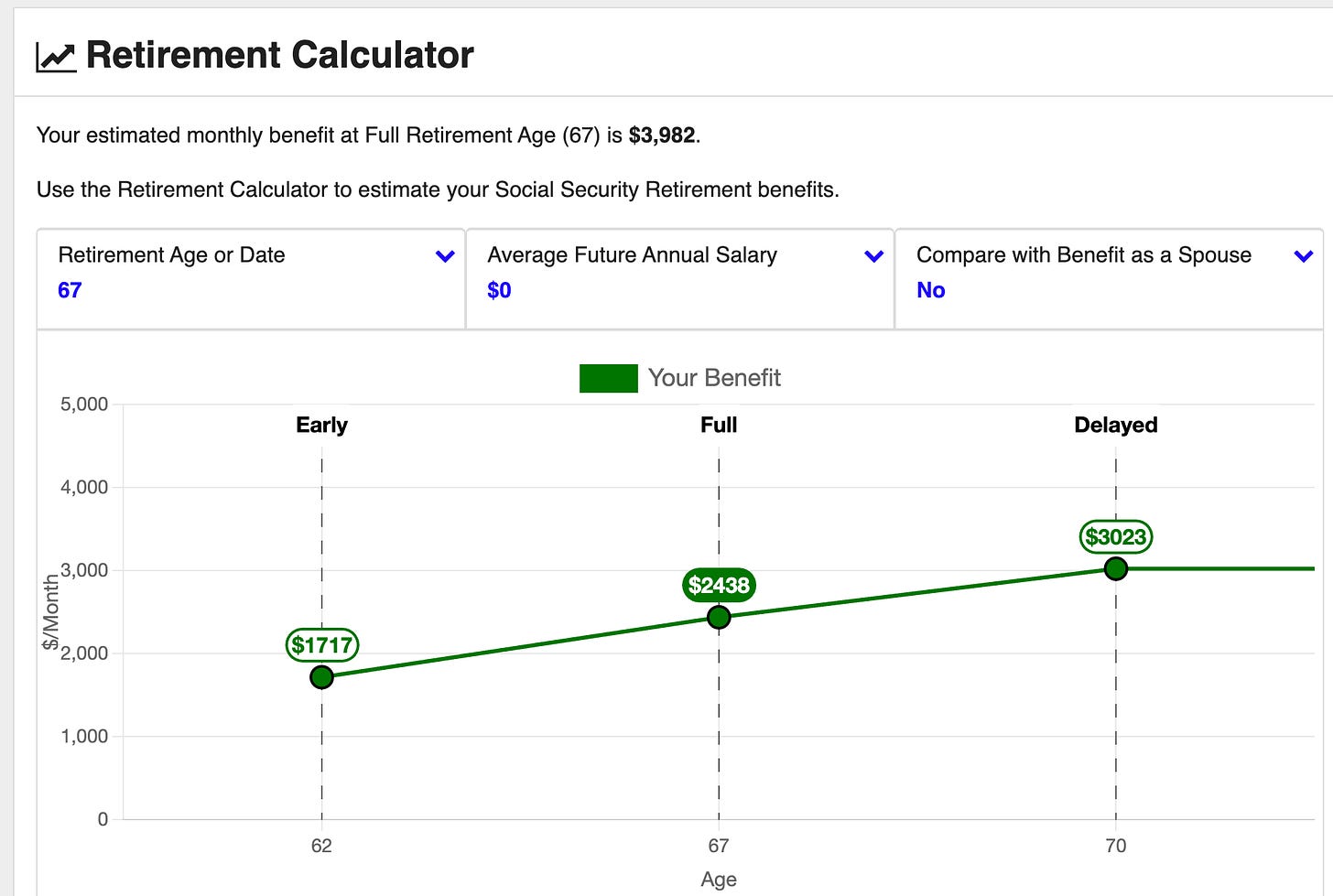

What? You want me to add it anyway? Fine. If I go to SSA.gov, I can change my average future salary to $0 and receive my actual estimated monthly social security benefit of $3,982 when I turn 67.

I am going to cut this in half, just for fun (this is fun right?).

Using the “Compare” tab on ProjectionLab, I added the $1,991 monthly benefit for both me and my spouse (we each had similar lifetime earnings). So with a 50% cut in social security and a non-optimized start at 67 will lead to more than $900,000 in net worth at the end of the plan.

Conclusion: I am reasonably confident that I will receive at least 50% of my estimated social security payment at full retirement age. I should factor this in and reduce my enough number further.

What if….

You buy a $2M house in San Francisco, buy a $50,000 car every 5 years, move to Florida when your daughter goes to college, buy a $1M house in Florida, and the Trump tax cuts expire….

chill out please.

But ok, let’s add them all in:

Conclusion: Actually, that is kinda impressive the success rate is so high still (sorry mom, still not moving to Florida).

Q: Please Make it Fail

Let’s increase rent to $8,500 instead of $5,000. Let’s buy a $4M house that only appreciates 1% per year before downsizing to a $1M house in Florida. Let’s buy $80,000 cars every 5 years. Increase travel to $36k per year…

We now run out of money when I am 70. The move to Florida did almost save us…

Takeaways

This was actually really fun. It helps solidify just how conservative an initial 3% withdrawal rate is. Another key element is that my initial plans are built with the assumption of $0 of additional income. This is my personal preference. I want to ensure my “Enough Number” is such that I don’t need to work or earn another dollar. Not that I will actually never earn another dollar in the future.

It is also very clear that if I hit my enough number and continue to have income (whether through my partner or I working, or a little side income from FAANGFIRE), I should focus more on actually increasing my spend to optimize my lifetime happiness. (Might be time to re-read Die with Zero? Maybe the next bookclub book?)

I’ve already started doing this. In August, I moved from my $5,000 per month rental to a much more expensive single-family home about a mile away, within walking distance to my daughter’s school. I also started looking for other areas where spending more could improve my family’s life (topic of a future post).

The Extra Guac Tools Used

This post also gives you a glimpse into how I use a few of the tools within the Extra Guac package.

LunchMoney: To add logging into my life and track my spend.

Kubera: For robust net worth tracking that I can slice across multiple dimensions and makes it easy for me to export data out to use in personal AI tools

ProjectionLab: For building out projections that can handle nearly every what if I throw at it.

With the Extra Guac subscription ($200), you will be getting all of these tools and more free for an entire year (>$1,000 value).

Meet Extra Guac: A Free Year of ProjectionLab, Lunch Money, Kubera, Mezzi, Carry Solo 401k, Discounts on Frec, and More

Since February 4th, I’ve been thinking about what a “FIRE Bundle” could look like. There are so many tools out there and it is hard to figure out which ones will best help you on your path to FIRE.

Andre is nibbling around the edges of economics-based financial planning. If he optimizes the lifetime living standard, spending and saving is calculated and includes taxes, SS retirement benefits, etc. Andre, I wish you were one of my students!