Hey FAANG FIRE,

Happy Monday. US stock markets are closed today in observance of Presidents’ Day.

Don’t miss tomorrow’s FAANG FIRE RSU Office Hours.

Wow. I am a little late in posting this… but wow.

Meta stock jumped 20%, increasing in value by nearly $200 billion. This is the largest single day value increase ever. Fittingly, they stole the record from fellow FAANG companies; Amazon and Apple.

“The stock rose 20% Friday to close at an all-time high of $474.99 per share. The gain added $197 billion to its market capitalization, the biggest single-session market value addition, eclipsing the $190 billion gains made by Apple Inc. and Amazon.com Inc. in 2022.”- Bloomberg

If you zoom out to November 2022, just before the first Meta layoff, you can see the full upward swing.

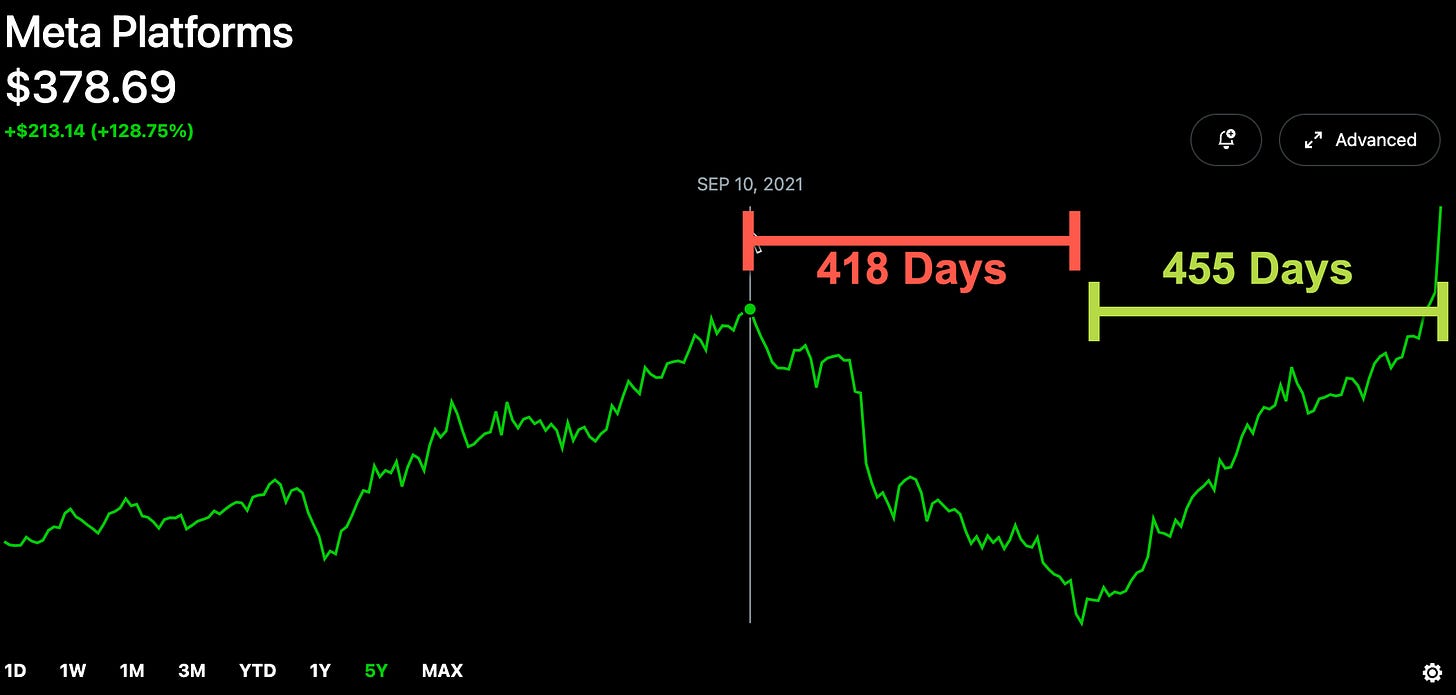

Don’t let Meta get too cocky though. Let’s zoom out a little more.

Now we see that Meta has only just passed their prior all time high from September 2021. So the rise down was hard and fast while the rise back to the top was just as fast.

Looking at the total Meta headcount from the 2021 High to the 2022 low back to the 2024 high (pulled from earnings reports closest to the date).

Headcount was 68,177 as of September 30, 2021

Headcount was 87,314 as of September 30, 2022

Headcount was 67,317 as of December 31, 2023

FAANG FIRE RSU Office Hours

Looking for some post-earnings clarity? Join the FAANG FIRE community for our RSU FIRE-side Chat & Q&A Tomorrow, February 20th.

I will be hosting a free RSU office hour. Anyone can drop in with their questions and I will share how I would approach it and give you the education to help you have the confidence in your own decisions. Be sure to register ahead of time to get the link and ask your questions.

Meta Adds a Dividend

Another very interesting thing to come out of Meta’s earnings is that they are the second of the FAANG group to begin issuing dividends (Apple has had a dividend since 2012).

“Today, Meta … declared a cash dividend of $0.50 per share… payable on March 26, 2024 to stockholders of record as of the close of business on February 22, 2024. We intend to pay a cash dividend on a quarterly basis going forward”

Key Dates and Terms:

February 20th: If you hold Meta through this date you will receive a dividend.

February 21st: Ex-Dividend Date. If you buy Meta on or after this day you will not receive the next dividend. If you sell on this date, you will still get the dividend. This date is set by the stock exchange.

February 22nd: Record Date. This is the date the company sets. It really is only important because the stock exchange will set the ex-dividend date before this date.

March 26th: Dividend Payment Date. The day the dividend shows up in your account if you owned the stock before the ex-dividend date.

In plain english: If you hold Meta stock through the end of the day tomorrow, Tuesday February 20th, you will receive $0.50 per share dividend on March 26th. If you sell on February 20th, you will not receive a dividend.

In the case of Meta: The dividend shouldn’t play any role in when/if/how you sell your Meta Shares.

In theory, when a company pays a dividend, the stock price will drop by the amount of the dividend on the ex-dividend date. The ex-dividend date is the day before the record date.

Because the Meta dividend represents such a small amount in terms of % of Meta stock price, 0.1%, I don’t think you would even notice a $.50 drop that would be expected on February 21st, the ex-dividend date.

This presents the perfect opportunity for me to remind all FAANG FIRE readers of a very important fact: Dividends are not free money!

Dividends and Taxes

If you have spent any amount of time in investment communities you are bound to run across a fanatical dividend worshiping group. I want to warn you dear FAANG FIRE reader, do not fall for their siren call. A dividend isn’t free money.

When a company pays a dividend, the stock should drop by the amount of the dividend on the ex-dividend date. Creating a net-zero gain. However, you now need to pay taxes on the dividends!

How Are Dividends Taxed?

When referring to taxes on stock you often talk about short term and long term gains and losses. With dividends the terminology is slightly different. You have “Qualified” and “Non-Qualified” dividends.

Let’s break those two down:

Qualified Dividends: If you held the stock for >60 days then your dividends would be subject to the same tax rate that applies to net capital gains.

Non-Qualified Dividends: A dividend is non-qualified if it is from a stock that you purchased (or vested) less than 60 days before the vest. Non-qualified dividends are taxed as income.

If you buy a stock within 60 days of the stocks ex-dividend date, you will pay taxes as if the dividend payment was income.

If you held the stock more than 60 days, the dividends you generate will be “Qualified” and thus get treated just like long term capital gains.

Most FAANG FIRE readers fall into the 15% and 20% long-term capital gains tax rate buckets.

It doesn’t stop there though. Many states, including California, New York, and New Jersey treat dividends and capital gains (long and short) as income.

Did you think the fun stopped there?

Don’t forget about the Net Investment Income Tax, or NIIT for short. The majority of you will also need to pay an additional 3.8% tax if you are earning more than $200k single and $250k married.

This means that a couple earning $500k in California would pay a 28.1% tax on qualified dividends and ~48.1% on non-qualified dividends.

Quick Note: The higher tax rates also applies to interest earned from your high yield savings accounts! Make sure you are factoring that into your planning decisions.

Controlling Taxes

Taxes are a part of life, especially if you are a high earner. That is why it is particularly important to avoid unnecessarily adding to your tax bill if you can prevent it.

The issue with dividends is that if you hold those funds in a taxable account you will be required to pay taxes on those dividends thereby reducing the amount of money that would have otherwise stayed invested in the market. Dividends are a forced taxation.

I just don’t think it makes very much sense for a high earner to focus their taxable investments on dividend earning stocks. As a FIRE focused investor with a sizable taxable portfolio, I prefer that my market returns come from gains in the stock price vs dividends which I can’t control the timing of and need to pay taxes on.

This is the same reason why in my post detailing my Asset Allocation and Asset Location I talked about why you should try to avoid holding your Bonds and REITs in your taxable brokerage.

To be clear, I am not telling you to avoid all dividends. Dividends are an important part of the growth of even an index fund investor’s portfolio. Last year, my main taxable holding VTI had a dividend yield of 1.37% and paid $3.41 per share. You should definitely be re-investing your dividends on a regular basis. You can set your brokerage to do this automatically, although I prefer to manually do it to give me more control in the event I want to tax loss harvest while avoiding wash sales.

If you made it all the way to the bottom, how about dropping an 🥑 in the comments to let me know?

🥑

I agree with all that and am not a card carrying member of DOD. My sense is that their position comes from a belief that CEOs are bad at recognizing or admitting when they've reached that point where just giving money back to the shareholders is the best use of cash.