The following is a series of posts I made on my LinkedIn that all started with “Dear High Paid W2 Tech Workers”.

It is ok to rent.

Dear High Paid W2 Tech Workers (except Rohan),

Please know that it is ok to rent. You are not throwing money away. The math in expensive cities often favors renting to buying. You are not losing or falling behind just because you rent.

I personally rent and invest the difference. I enjoy the optionality. When my daughter started school, that optionality allowed me to move within walking distance.

I have never been certain that I would be staying in San Francisco for >7-10+ years.

Buying is also perfectly fine, even if the pure numbers don't make sense. There are a tremendous number of non-math reasons why buying can be the right decision for your family, or the numbers were different when you bought.

I just don't think you should feel bad about your decision to rent, especially in a city like San Francisco where the rent vs buy calculations are out of whack.

Boring is ok.

Dear High Paid W2 Tech Workers (except Rohan),

Please do not play silly games trying to reduce your W2 taxes. You shouldn't pay more than you need, but as you chase "tax reduction" you begin optimizing for the wrong thing.

I have seen so many "short term rental" this, "solar credit" that, "oil & gas exploration", "farm land depreciation"......

Some of these have their place, but in so many cases you would be better off ignoring the games, paying the tax, and investing the boring way.

It isn't as cool to talk about at the holiday party, but sometimes, the boring way is the best way.

Big numbers don’t mean big complications

Dear High Paid W2 Tech Workers (except Rohan),

Just because the numbers in your accounts are getting larger, doesn’t mean your investing strategy needs to get more complicated.

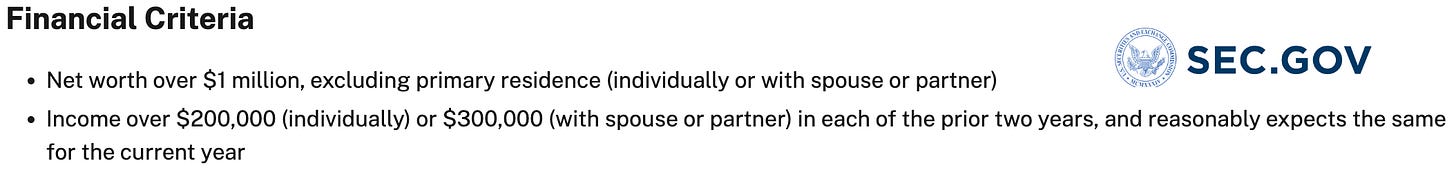

Just because you passed the “Accredited Investor” definition, doesn’t mean you should start writing Angel Investing checks.

Beware of the insurance pitch

Dear High Paid W2 Tech Workers (except Rohan),

You probably don’t need to buy complicated insurance products.

If you are having a conversation with an “advisor” and the first recommendation they have for you is an insurance product… you probably want to excuse yourself.

Your old high-school friend probably doesn’t have your own interests at heart.

There are use cases for complex insurance products, but the odds of them being the first recommendation are astronomically rare. You are just being sold a high commission product.

Return on Hassle

Dear High Paid W2 Tech Workers (except Rohan),

Sometimes you will run into financial optimizations that are just not worth the time required. Is the juice worth the squeeze? Is the hassle worth the extra headache?

I think HSAs are one of the best account types for investing. I think financially the ROI + company match would be the financially optimal decision.

But I hate thinking about the financial implications before any health interaction. Saving receipts for years is an annoyance.

At this point in my life the return on hassle just isn’t there.

Make it sustainable

Dear High Paid W2 Tech Workers (except Rohan),

You might be better off spending more.

Working at a FAANG can be a grind. Find ways to make it sustainable. This can include things like spending more money on making it sustainable.

Imagine ways that you could spend an extra $1,000 per month that would make your life more enjoyable. If spending that extra $1,000 makes it so you can work your FAANG job two weeks longer, it would be worth it.

This includes using your damn vacation. There are too many burnt out tech workers sitting on a maxed out PTO balance.

Your Turn

Dear High Paid W2 Tech Workers (except Rohan),

Who is Rohan? Haha, I think I misses the backstory

👏🏻👏🏻👏🏻