What is a Backdoor Roth?

Roth IRA’s are pretty cool. Money contributed into a Roth IRA will grow tax free and in retirement you will be able to withdraw the full amount including growth tax free, pretty sweet deal. To sweeten the deal even more, you can withdraw your contributions at any time penalty and tax free.

You can contribute $6,000 into them in 2022 and $6,500 in 2023.

However, most reading this probably can’t contribute directly to a Roth IRA. For 2023, if you earn more than $153k single or $228k married you earn too much to be able to contribute.

Enter the “backdoor” of backdoor roth. It involves making a nondeductible contribution to a traditional ira and then converting that into a Roth IRA.

This is one of those “nice to have” optimizations. If you have access to a Mega-Backdoor Roth (ie the ability to make After-Tax contributions to your 401k and convert it to a Roth) I would prioritize that first. The Megabackdoor Roth contribution limits are much higher, and typically it is going to be easier to take advantage of.

If you already max out your 401k, max out your mega backdoor, and you still want to save even more, the backdoor Roth is a great next target, followed by simply investing in a taxable brokerage account.

The full process is simpler than it sounds. But there are a handful of nuances, particularly if you have an existing Traditional IRA or Rollover IRA.

Lucky for you, I documented my entire process (typed up so you don’t need to decipher my handwriting).

Disclaimer: Make sure to do your own research and you may want to consult with a CPA or investment professional if you are not sure of something. There can be real tax implications to doing some of these things incorrectly.

Warnings If you have a Traditional IRA or Rollover IRA

If you have an existing Rollover IRA you run into something called the Pro-Rata Rule.

“The pro rata rule states that taxation of IRA accounts when converted partially or fully to Roth accounts will be calculated proportionally to the fraction of after-tax vs. before-tax contributions.” - Advanced Retirement Strategies

It is a pain in the ass and should be avoided. Luckily it can be easily fixed by moving all your Rollover IRA money into your employer 401k before the process! This is exactly where I find myself today with my partner's account. I’ll walk through the process of how I am fixing this.

One More Edge Case

When talking with friends I have run into a few instances where they contributed money into a traditional ira even though the contributions were not deductible because they earned too much. The income limits are low to be able to make a deduction on your taxes for a traditional ira contribution, $66k in 2022.

So if you are in this camp where you made too much to deduct your traditional ira contributions but didn’t do a backdoor roth you have essentially already done half of the backdoor roth. In some cases you may have intended to perform a backdoor roth, but just forgot halfway through.

The fix here is very easy. Assuming you don’t have any other Rollover IRAs or Traditional IRA’s that you did take a deduction on, you can jump straight to the “backdoor” part which is converting your traditional ira to a roth.

Finishing 2022 Backdoor Roths in 2023?

Step 7 of my 2023 Financial FIRE plans are to contribute to my 2023 backdoor Roth.

Before I can actually get to step 7 I need to get my house in order and first finish my 2022 backdoor roth contributions.

You may think that I always have my own financial house in order, but oftentimes there are small optimizations that I occasionally skip over.

In this case, it is setting up my partner’s Backdoor Roth for last year (2022)! The reason is simple… sometimes these things are a pain in the ass. My partner has an old Rollover IRA from back when the general guidance was to roll over old employer 401ks into independent Rollover IRA.

The reason this is an issue is because you shouldn’t do a backdoor roth if you currently have a traditional IRA or a rollover IRA due to running into the “Pro-rata” rule mentioned previously. I wouldn’t worry about what the exact rule is, but if you want to sound smart at parties you can bring up getting around the “Pro-rata” rule in order to execute a backdoor Roth.

The fix is pretty easy in principle. If you are currently employed, you can roll over your traditional IRA and Roll over IRA into your current workplace 401k.

In reality… it can be a pain in the ass. Requiring multiple phone calls, mailed checks, and more phone calls.

What do you get after all this? The ability to add $6,000 more into a Roth IRA for 2022 and $6,500 for 2023. This is why I always make sure people max out their “Mega Backdoor” before doing this.

My Partner's Current Situation:

1 Existing Rollover IRA with Fidelity

Uber 401k with Fidelity

By the end of this post the goal is to have $0 in the rollover IRA with all the funds moved over to the Uber 401k and execute a backdoor roth.

You have until you file your 2022 taxes to make 2022 contributions, which for me and many other California residents could be all the way until October 16th. April 18th for the rest of you.

This is a multi-day process and may require at least 2 phone calls with multiple transfers. Hopefully after reading this walk through you will be able to breeze through it with confidence.

I’ll share how I originally did it and then offer suggestions on what I think could have made it faster.

How to Rollover a Traditional IRA into a 401k with Fidelity

This is walkthrough is specific to Fidelity where both our 401k and Rollover IRA are located.

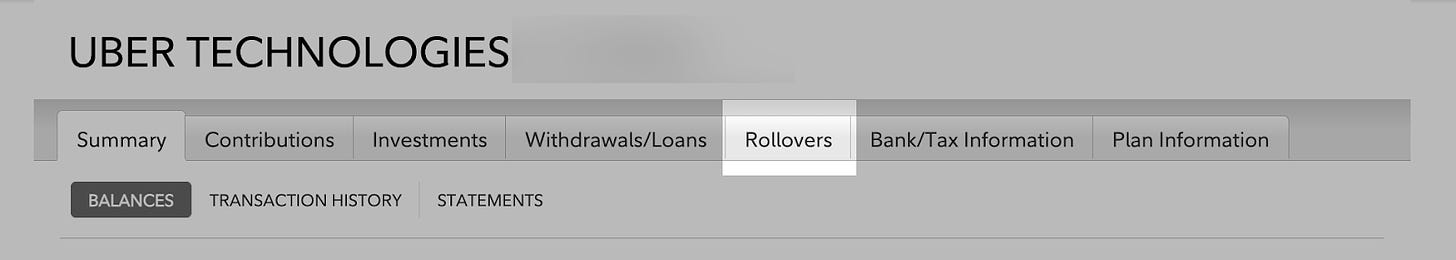

Step 1: Go to Fidelity Netbenefits

To start this process you will want to go to your workplace 401k. The easiest way is to login directly to the Netbenefits portal and click on your workplace 401k. Once there you will want to click on the “Rollover” tab as seen below within Uber’s 401k.

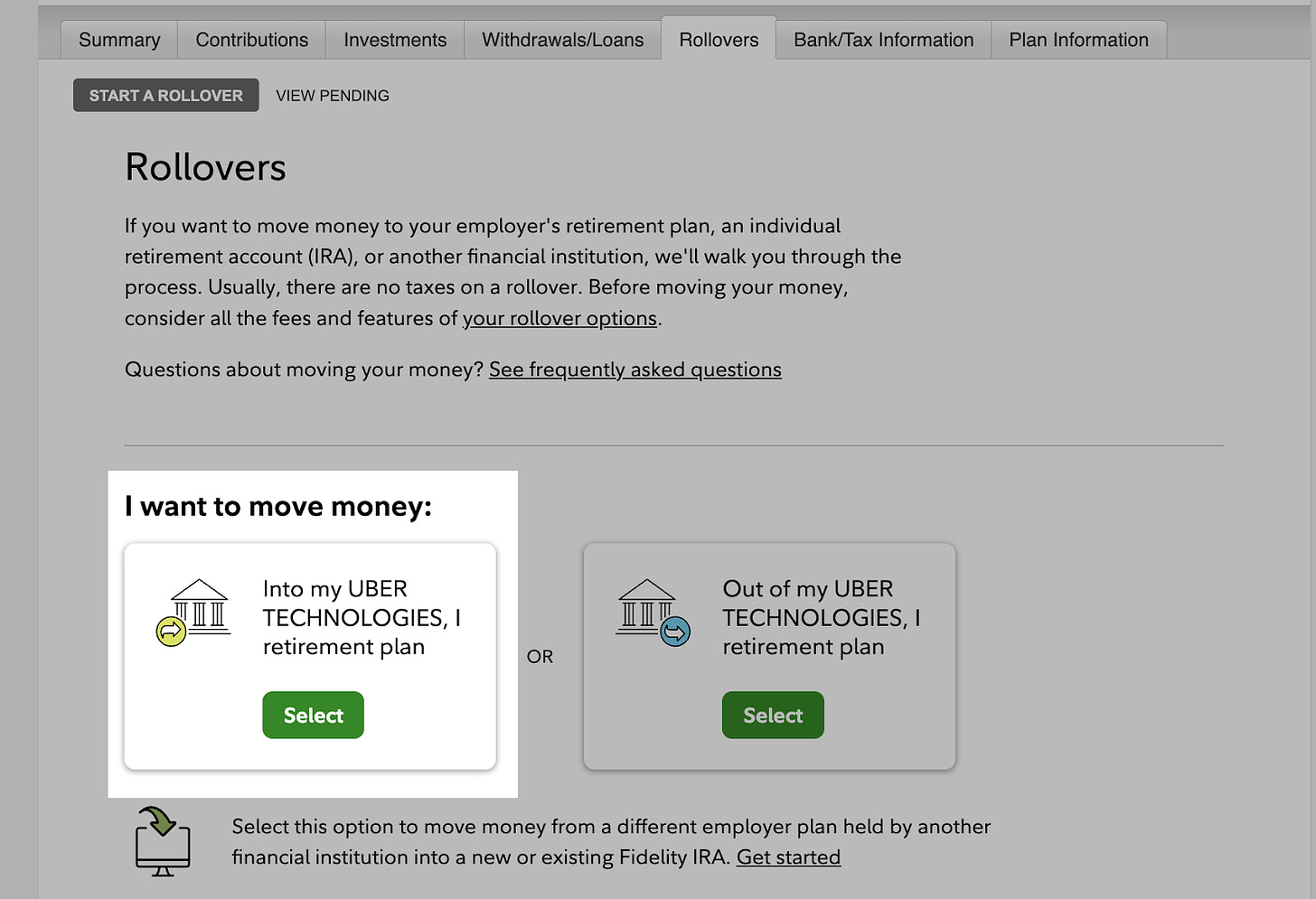

Step 2: Select “I want to move money Into…”

Select “Into my XXX retirement plan” since my goal is move money from my Traditional IRA into the Uber 401k.

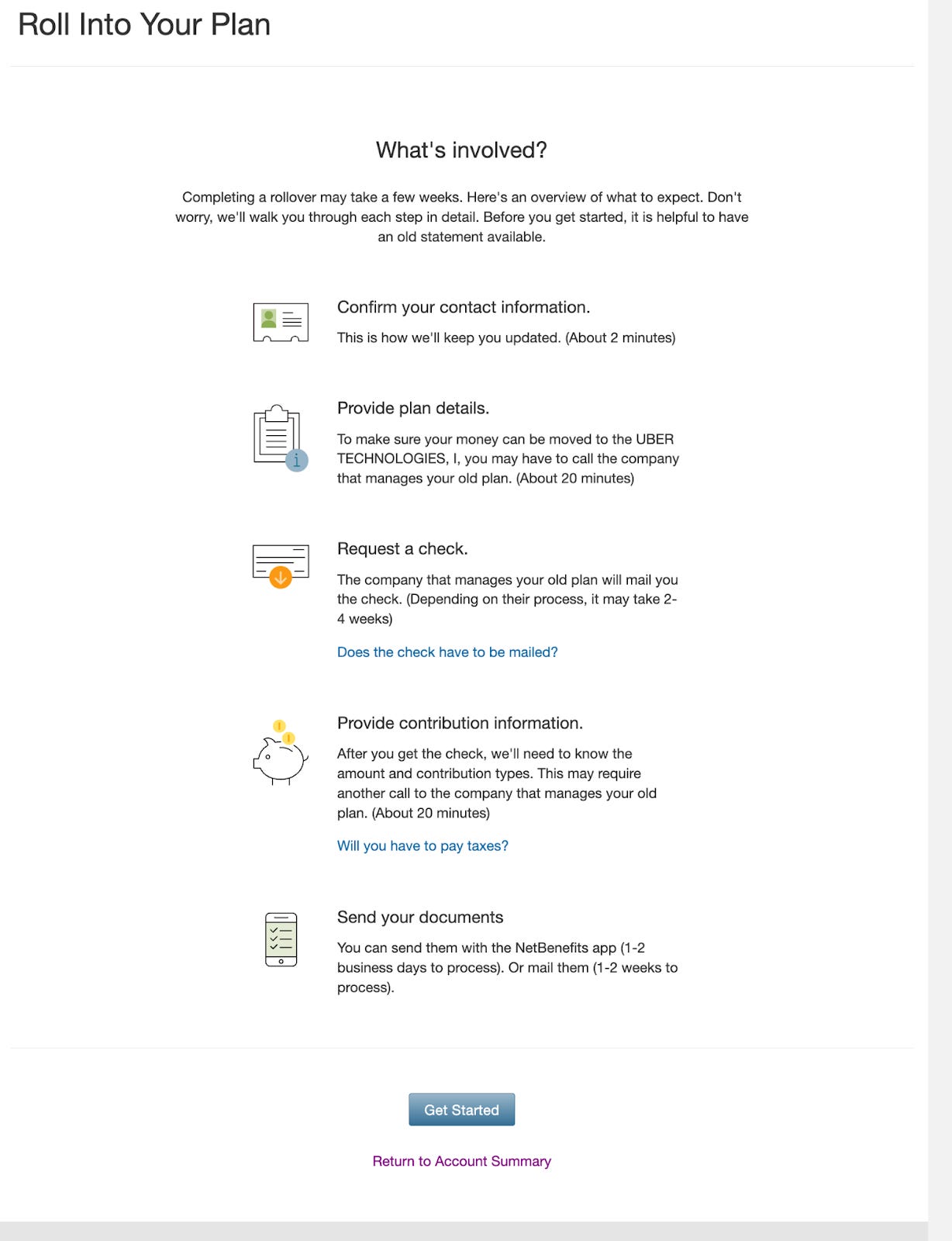

Step 3: Click “Get Started”

This screen shows you the full process. I am hoping that since both my accounts are with Fidelity that the overall flow would be simpler.

Step 4: Realize that they still want you to call.

So I bribed my partner w/ promises of future tax free money to call fidelity with me. This is a good step regardless to fully confirm that your plan will allow you to roll your Rollover IRA into your 401k. Not all plans allow.

Step 5: Call Fidelity Retirement Specialists at the number listed.

This is what I asked my partner to say “I have a Rollover IRA with Fidelity that I want moved into my Uber 401k”.

Note: Since I am helping out it is also helpful to say “I am also on the line with my partner Andre Nader, I want to give permission for him to make account decisions while we are all on the phone together”.

The representative confirmed that the option was available in my plan. They transferred us to the non-401k team to set up the rollover.

Step 6: Road Block

The Fidelity Rep transferred me to a specialist who could help with the Rollover IRA. We ran into two roadblocks here. The first was that my Rollover IRA was still invested in mutual funds. In order to complete the process the funds needed to be in cash. The second issue was that even though the previous form we were initiating said to call Fidelity, they still needed us to submit the form before the Rollover IRA team could complete the rollover.

Step 7: Sell Everything in the Rollover IRA

I got off the phone with Fidelity and proceeded to sell the holdings in my Rollover IRA into cash. This would take a few days for the full transaction to clear.

Step 8: Try again!

Call Fidelity Again! I started with the 401k number that I had in the Rollover Step. I told the automated system “I have an IRA rollover I want to transfer into my 401k”.

When I am transferred to a representative I again tell them “I am trying to finish moving my rollover IRA to my workplace 401k with Uber”.

Before transferring you back to the Rollover team they will help you complete the rollover form.

Step 9 Complete the Rollover Form

This time they will want you to select “Yes” to the question of “Do you have a check from your former employer’s retirement plan?”

Then under “What company manages your old plan?” they had us enter “Fidelity” along with our account number.

Step 10: Finish The Process!

After filling out the form with the 401k Administrator, they will transfer you to the Rollover IRA team to complete the process. They will complete an internal wire and the money will be transferred from your Rollover IRA to your Employer 401k. This happened the same day for me.

Step 11: Residuals

Because there were a few days that the entire balance of my Rollover IRA was sitting in cash, there was “residual interest” accrued that would be deposited at the end of the month. The entire goal of this process was to have $0 in my rollover IRA so this residual would end up being a pain. They gave me two options.

I call them again at the end of the month after the interest was paid.

They close the account and mail me a check with the interest.

If they mailed me a check I would have 60 days to mail the check back to fidelity to be deposited into my employer 401k. Otherwise I would need to pay taxes and penalties on the residual amount.

I opted for the check since this would result in being able to fully close out my Rollover IRA immediately.

Speed Run

If I were to go through this process again it seems the fastest method would be:

Call your Fidelity 401k # and verify that they allow rolling over your Rollover IRA into your Employer 401k. Both Meta and Uber plans allow this.

Sell all assets in my rollover ira so they are settled in cash

Fill out the entire rollover form within the Fidelity 401k, state that I have the check and use Fidelity + Account number as the company that manages my old plan

Call Fidelity 401k to verify and finalize. They will transfer you to the rollover team and you will be done!

Start the Back Door Roth Process

Finally, we can get to the actual Backdoor Roth!

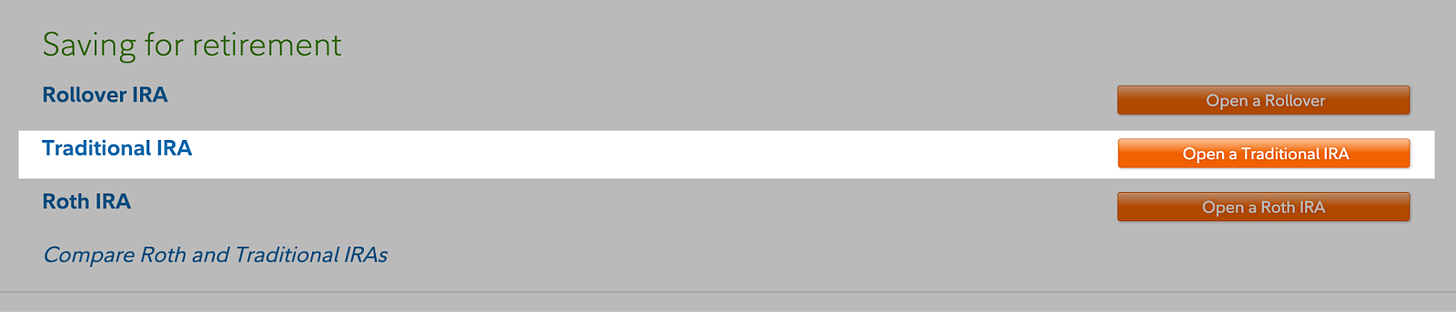

Step 1: Create a new Traditional IRA

In Fidelity you go to https://www.fidelity.com/open-account/overview

And click “Open a Traditional IRA”

It took a few clicks and now I have a shiny new Traditional IRA Ready to go.

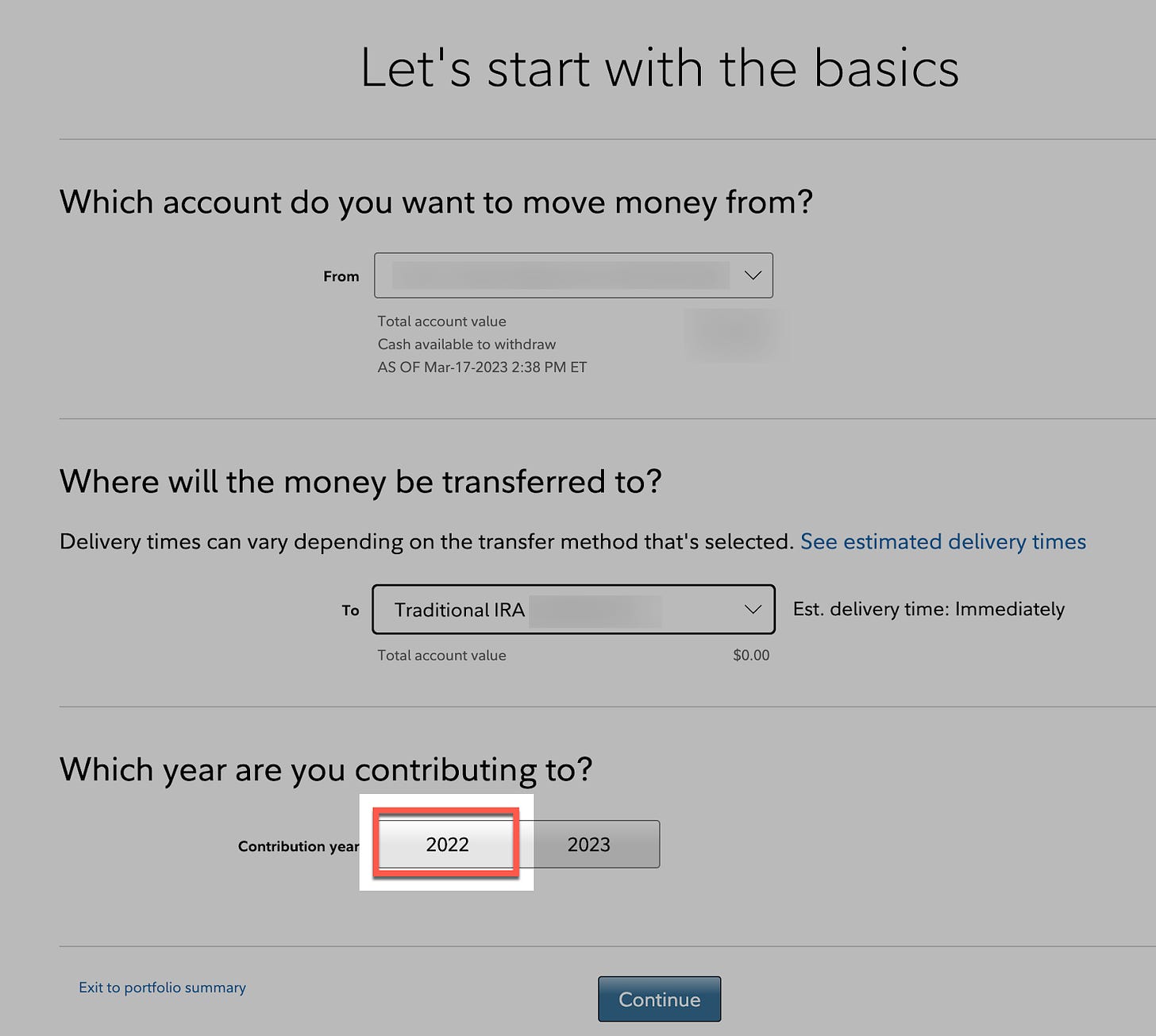

Step 2: Contribute to Your Traditional IRA

Next, click into your Traditional IRA and click “Contribute to this IRA?”

You will then select the funding source and the new Traditional IRA as “Where the money will be transferred to”.

Now, it is important to make sure you select which year you are contributing for. My partner did not yet contribute at all for 2022 yet since we first needed to deal with rolling over the Rollover IRA into their 401k.

Since we have not yet filed our taxes for 2022, we can still contribute in 2022! Important for those in California, you may be able to delay filing all the way until October. This means that you would have until then to contribute to your 2022 IRAs.

So in this instance we are selecting “2022”. We will come back later and do 2023 for both our accounts.

After you select your Year, you can then fill in the amounts. The 2022 limits are $6,000 and the 2023 limits are $6,500. Fidelity will also confirm the limits as seen below.

We have now successfully completed the first part of the Backdoor Roth process. Successfully opened a Traditional IRA and made a nondeductible contribution.

Now for the Backdoor Roth portion!

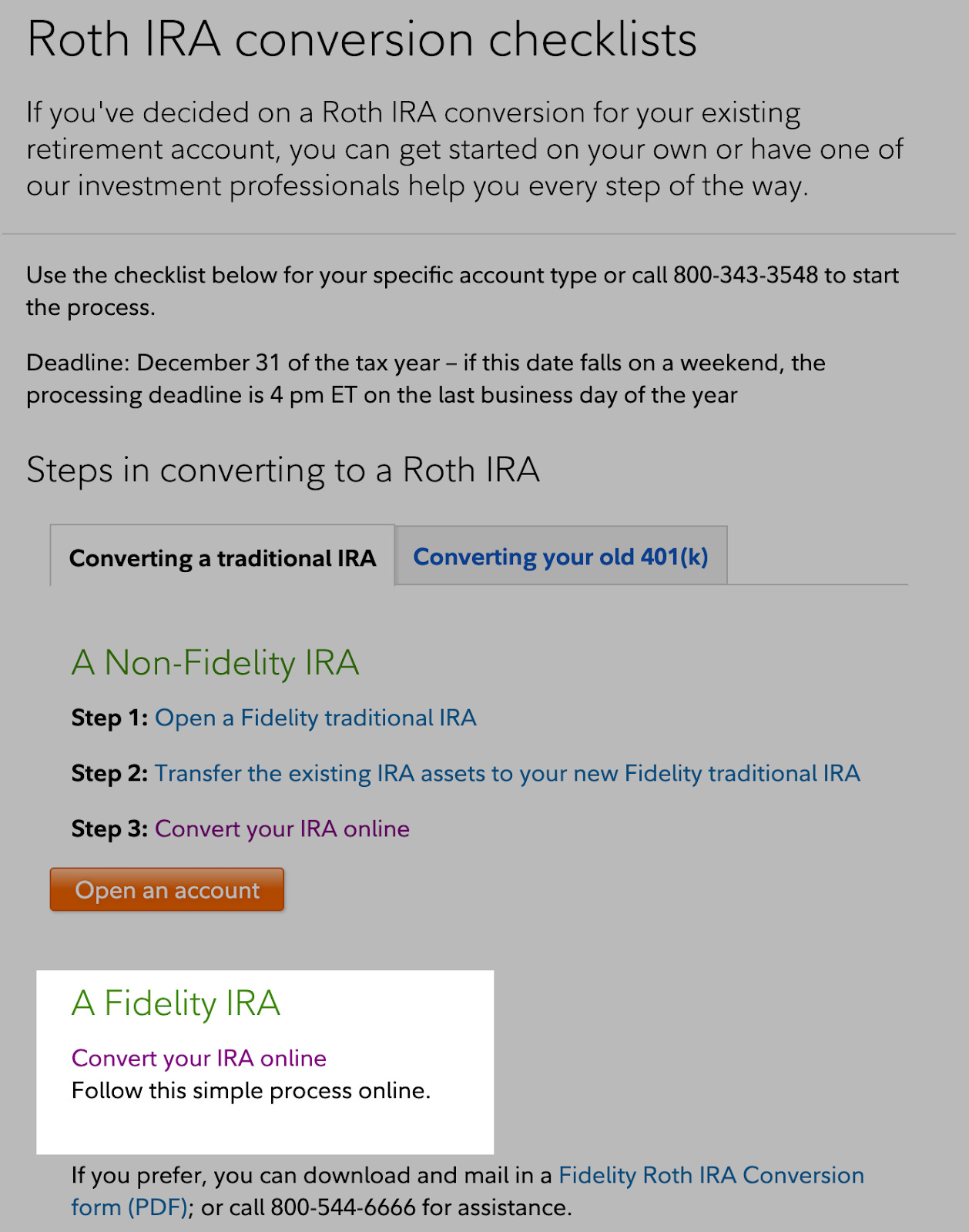

Backdoor Roth is not the technical name. Fidelity will refer to the process as a “ROTH IRA conversion.

If you don’t already have a Roth IRA you may need to return to https://www.fidelity.com/open-account/overview and open one. If you already have one, you can skip this step and use the one you already have. Do not make any contributions directly to your Roth IRA after creating the account!

To begin the process to the Fidelity’s Roth IRA conversion checklist: https://www.fidelity.com/retirement-ira/roth-conversion-checklists

Because the Traditional IRA we are wanting to convert into a Roth is with fidelity we want to select the “Convert your IRA online” option under “A Fidelity IRA” as shown in the screenshot.

You will now select your newly funded Traditional IRA that you would like to convert and then the Roth IRA you want to convert to.

You will also get the default tax withholding information. The key piece here is “You may need to pay taxes on funds that haven’t been taxed when you convert”. Since we are doing a conversion from a Traditional IRA which used funds that have already been taxed and didn’t have any additional gains there isn’t any additional tax.

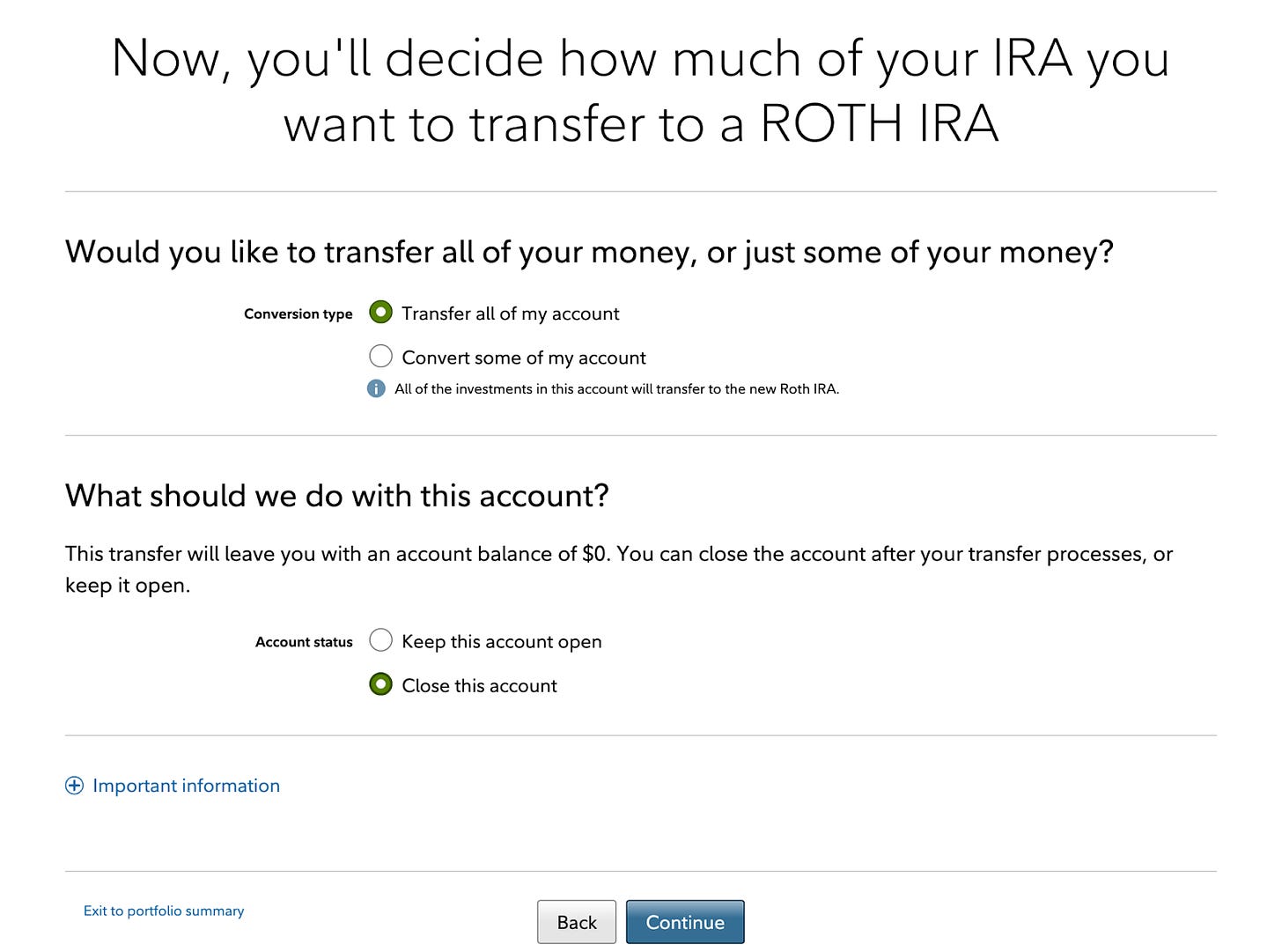

The next step is confirming that I want to transfer all of my account and to have fidelity close the traditional IRA after the conversion. I could keep it open, but to keep things simple I like to close them so there is a clearer line of each new traditional IRA that gets converted then closed.

Sometimes you will run into an error at this step. Fidelity’s errors tend to not be helpful. I think the issue is that the conversion was too fast and the money being transferred to the Traditional IRA needs to settle (even though it says it is already available to withdraw).

Try to wait for the transfer to fully clear by giving it 24 hours. In my case it cleared at the end of the day. This was transferring from a Fidelity Cash account which may have been faster than if I used an external account.

If you are wanting some extra reading material while you wait I would recommend Kitces post on the “Step Transaction Doctrine”. He goes over the specific IRS details that some very conservative accountants/advisors use as justification for not doing the conversion process right away.

“the reality is that current reporting systems for IRA contributions and conversions generally do not track (in the automated reporting to the IRS on Form 1099-R and Form 5498) the exact days on which a non-deductible IRA contribution and Roth conversion occurred, nor from which accounts (and whether it was related to the same account). Which means the IRS has no real way to detect potentially abusive backdoor Roth contributions, short of discovering them by some other means (e.g., a random audit) and then raising the issue. As a result, it is fair to acknowledge that the actual risk of getting “caught” with a questionable backdoor Roth contribution is low.”

I personally don’t wait longer than a week, but then again… by writing this post and sharing the details with you I am going against one of Kices recommendations.

“But perhaps the most important to step avoid the step transaction doctrine is the simplest one: do not, in any notes or records, indicate that you are doing to do a “backdoor Roth IRA contribution” in the first place!”.

Backdoor Rant

Let me rant for a minute while we are on this subject. This entire “Back door” process is ridiculous. “Backdoor Roth” and “Mega backdoor Roth” should either be something available to everyone or only those under a certain income. It makes no sense to me that these ‘backdoor’ processes are a thing. All it does is add confusion and gate keep the ability to save more in a tax sheltered way to those who have resources or time to learn about these processes. I sincerely with that congress would just remove the income caps on all Roth contributions since they have kept this “backdoor” process open even though they are very away (and occasionally pretend to be closing it).

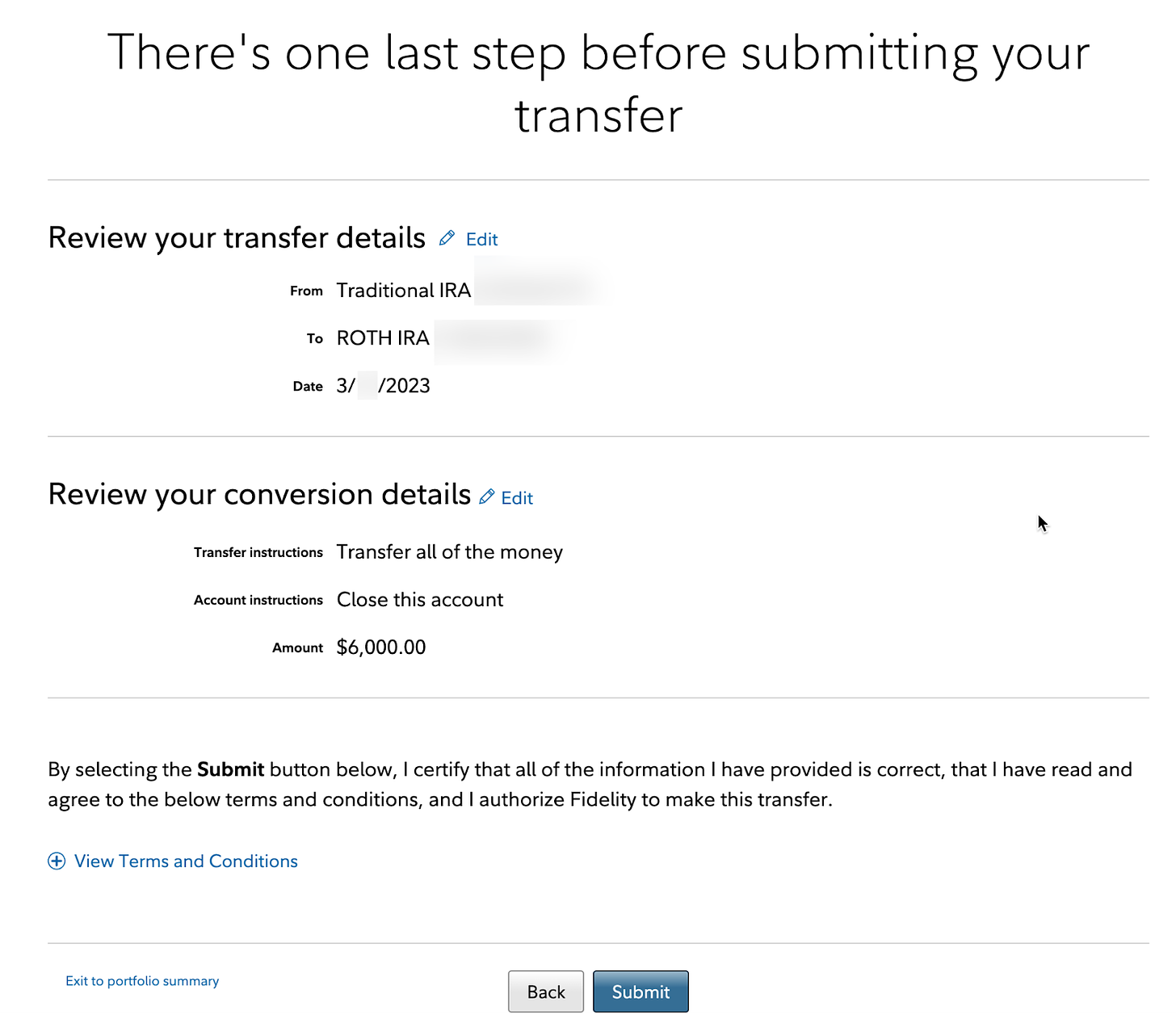

After the transfer is cleared, simply go through the same flow on https://www.fidelity.com/retirement-ira/roth-conversion-checklists again. This time after clicking continue you will be taken to the final review screen. This is a good time to confirm that all the correct accounts are transferred in the correct order.

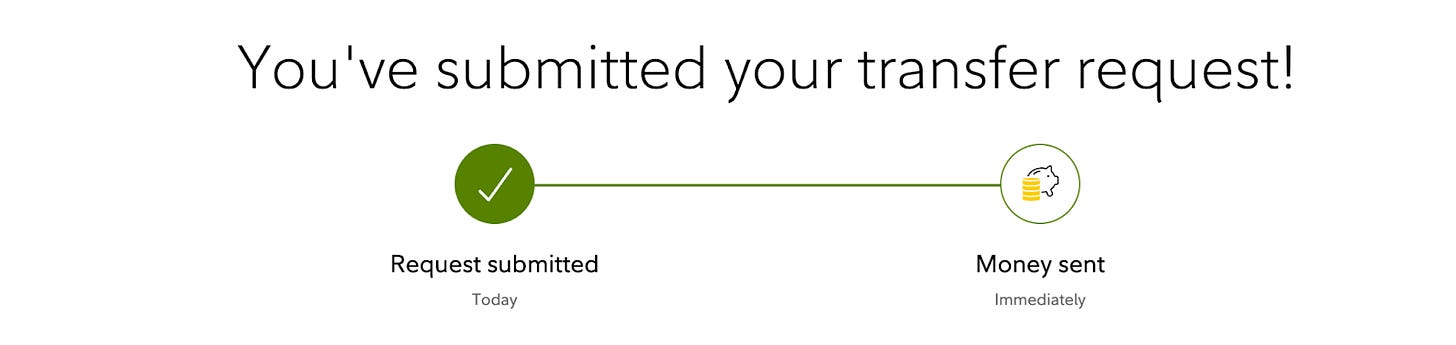

After hitting submit your transfer is complete! You have now successfully completed a backdoor roth.

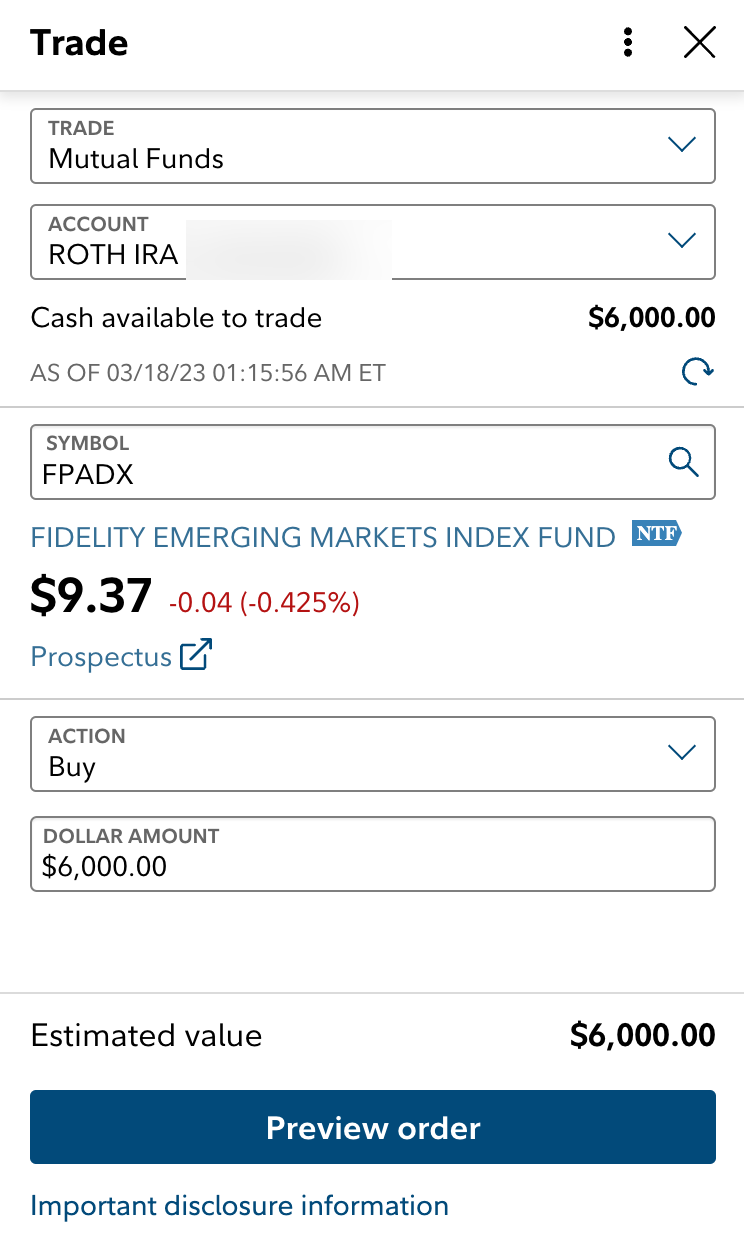

Before you run off to brag to your friends, go to your Roth IRA and actually invest the money! You would be surprised how often people celebrate too early and miss this step!

The best part about all this is that this was just to finish off all of 2022! We get to do this again for both myself and my partner for 2023.

Note: You can do both 2022 and 2023 contributions on the same day. I would go through the contribution steps shown above but stop at the rollover step. After making your 2022 contribution, simply go back to your Traditional IRA and make another contribution, this time selecting 2023. After both of those transactions clear, you can convert everything into a Roth at once.

Beware of Tax Pitfalls!

The one warning I like to emphasize (beyond prorata) is to be extra careful when entering in your backdoor roth when filing your taxes. It is very easy to incorrectly enter everything in a way that will cause you to pay taxes on the amount rolled over.

I have made this mistake twice! Both times it involves amending my return and physically mailing in your entire amended return both for federal and state.

So now when I file my taxes I watch the “Amount Owed” in turbo tax very closely. It shouldn’t change at all when entering in your backdoor roth. If it does, you likely made a mistake. I also have FinanceBuff’s guide bookmarked to walk me through the process.

Will the 100% pretax funds in a traditional IRA from an old 401k be subject to prorata if you rollover the traditional IRA account into your current employer's 401K plan?

Hi Andre - I didnt quite understand how my non-working spouse can contribute to IRA.

She is a stay at home mom for long time now and never had any IRA or 401K account in US.