Hey FAANG FIRE!

I was on vacation the past week during my daughter’s spring break. It featured beaches, boardwalks, and baby goats. It was my 38th birthday last week too!

Did I miss anything?

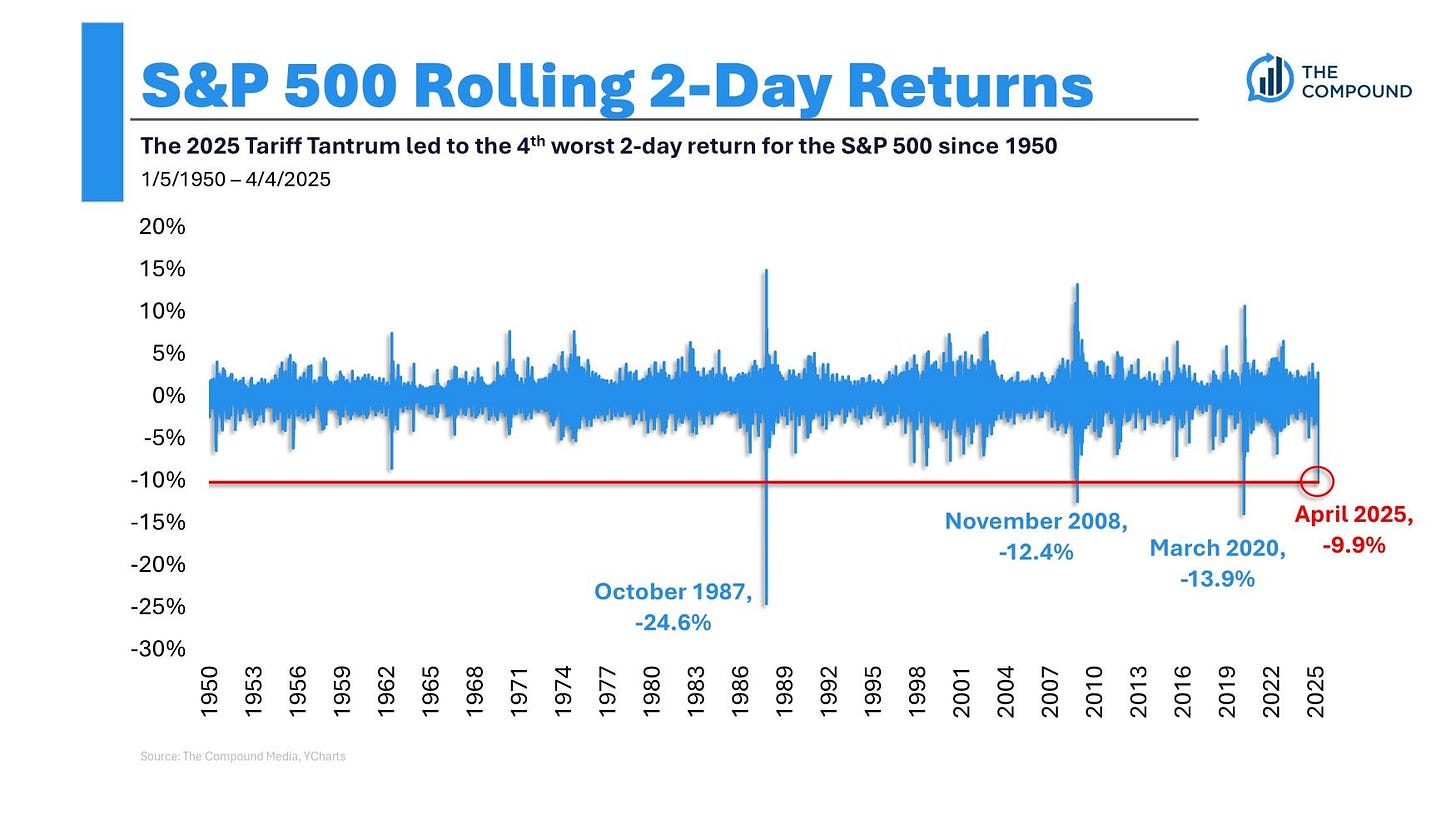

Oh, so you’re telling me I missed the 4th worst 2-day market drop since 1950s? That sounds fun.

Tariff Confusion

By now you are all aware that the Trump administration announced sweeping tariffs on every single country (and a few non-countries). Depending on which political team you are cheering for, it is either the biggest own goal of all time or some kind of 4d chess move that will save the future of the free world.

The own goal argument: A tariff is a tax. A tax increases the cost of goods. An increase in cost of goods increases prices of the goods. Compound that by the extreme uncertainty around whether the tariff levels are real or just a negotiation tactic. It is hard to imagine having confidence to invest in bringing manufacturing into the US if the tariffs could disappear in a few weeks, months, or even years later. It has the potential to deal the lethal combination of killing jobs while increasing prices, i.e. stagflation.

The 4d chess argument: The Trump team is intentionally crashing the economy to force the fed into a corner where they must lower rates. The lower rates will translate into lowering the 10-year T-Note allowing the US to roll over more of our debt at lower rates saving us trillions of dollars in interest payments. Add to that more companies moving manufacturing back to the US while also seeing a lowering of reciprocal tariffs, after the short term pain, we are in a better position for the future.

Time will ultimately tell whether the Trump tariff gamble will pay off, but I’m not holding my breath for a consensus. Truthfully I don’t think anyone knows, so I won’t pretend to have an answer.

Do you know what I do know? The market hates uncertainty.

Trump Team is Apathetic Towards FAANG Stocks

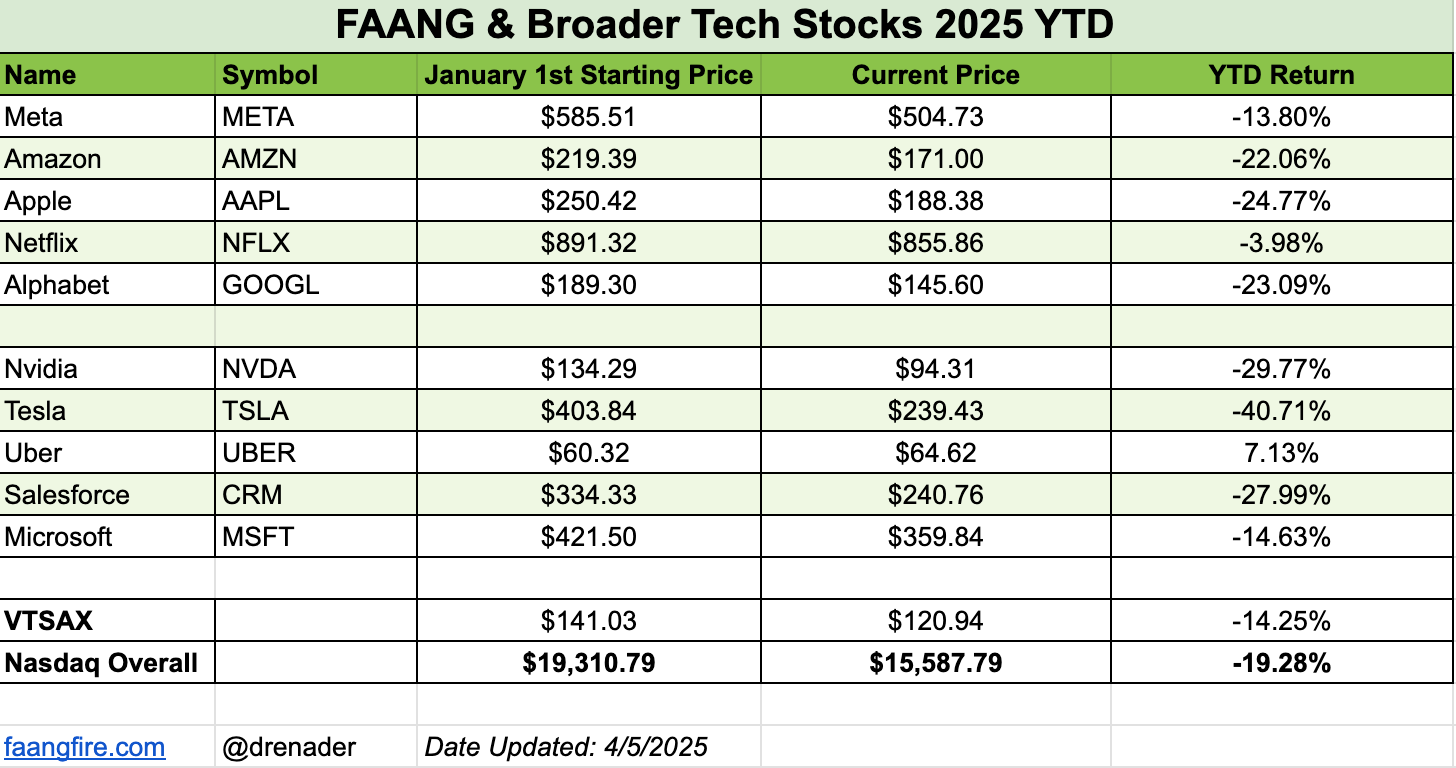

The tech heavy NASDAQ has already entered bear market territory, down more than 20% from recent highs. The broader S&P 500 isn’t far behind, already down more than 14% year to date.

You won’t find the Treasury Secretary Scott Bessent sympathetic though. He had a drop kick of a quote on Wednesday:

“I’m trying to be Secretary of Treasury, not a market commentator. What I would point out is that especially the Nasdaq peaked on DeepSeek day so that’s a Mag 7 problem, not a MAGA problem” -Bessent w/ Bloomberg TV

He’s repeated the line “Mag 7 problem, not a MAGA problem” a few times across interviews. This seems to be one of the lines he is workshopping. Essentially putting the blame on the tech markets being overvalued from AI hype and not the economic decisions of the administration.

Once again big tech seems to be an easy punching bag. That conveniently ignores the rest of the market also being down, with roughly 75% of the companies in the S&P 500 negative year to date.

What am I doing?

You might be tempted to cut your losses and sell everything to wait until things recover. But this is actually one of the worst things you could do. Some of the highest return days tend to happen shortly after big corrections, when volatility is still high. It turns out that those high return days really matter in terms of overall portfolio performance. If you sold and waited until things looked better, and missed just five of the best days, you could end up cutting your overall growth in half.

It always feels like this time is different. You will see some saying the sky is falling while others enthusiastically tell you to buy the dip. I am not going to tell you either of those things. I am going to share what I have done so far and what I plan to do going forward.

Step 1: Take a breath, focus on the plan

A simplified version of my personal plan:

Maintain a 12 month emergency fund to weather any potential financial storms.

Continue to contribute as much as possible to tax advantaged accounts: my partner’s employer 401k, ESPP, my solo 401k, and our backdoor Roth IRAs.

Aim to fund 50% of a four year state college education through a 529 plan.

Invest any remaining excess into a taxable brokerage account.

All investments (excluding the 529) should combine to my overall target asset allocation goals (58/27/15 US/INT/Bonds).

If you are constantly changing your plan with every change in your company stock or market drop, then it is a good gut check that your plan isn’t great. Constantly adjusting your asset allocation is just a silly way to convince yourself that you are not trying to time the market.

Step 2: Audit my Emergency Fund

Please please please prioritize your emergency fund. At minimum 3 months of expenses. If you have kids at least 6 months. I personally target 12 months of normal expenses since we are a single income household with a kid.

12 Months of Normal Expenses: This means an entire year of spend as usual. Still spending $15k annually on vacations, still doing the usual extracurriculars, still living my ideal lifestyle.

If shit really hit the fan, that amount could last closer to 18+ months since much of our spend is discretionary (can be scaled back).

A key action item here is that you know your normal expenses and how much of it is discretionary.

Step 3: Opportunistically Tax Loss Harvest & Continue Investing

I hate the phrase “it’s not a loss, unless you sell”.

When the market crashes, I often sell a lot! That doesn’t mean I sell and put the money under my mattress. Whenever I sell my losses, I immediately buy a similar (but not identical) investment to maintain my overall target asset allocation.

This is called “Tax Loss Harvesting” and is the act of selling the lots of stocks you have lost money on and “harvesting” the losses to offset gains (either now or in the future). This can offset your ordinary income by up to $3,000 per year and can carry forward into future years. The important thing here is that I am selling the lots in my taxable brokerage and then buying a different mutual fund or ETF.

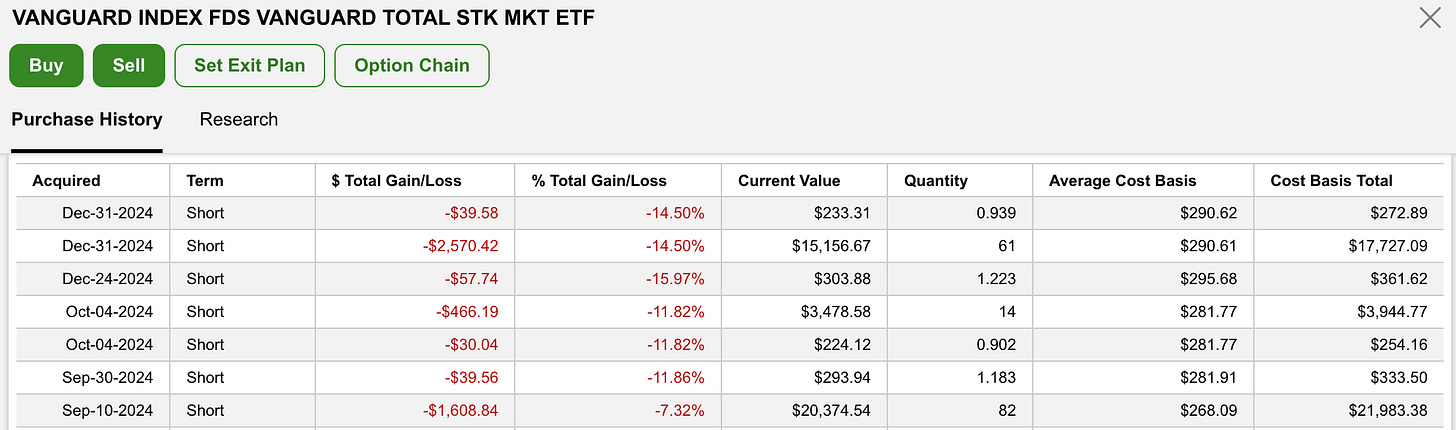

For example, if I look at the individual tax lots of VTI, I have a bunch of positions currently sitting at a loss.

It looks like I can sell ~$40k worth of VTI and capture ~$4,800 worth of losses that I can use to offset gains elsewhere in my portfolio, reduce my taxable income by $3,000, and then carry forward into future years.

I still want to stay invested in the US market though. So if I sell I could continue direct indexing w/ Frec or buy a similar ETF that tracks the overall US market.

I can’t just buy VTI, that would be a wash sale.

A few posts on this topic:

Closing Thoughts

Nobody really knows what will happen. It is times like this where having a plan you can stick to whether the market is up or down becomes key. If you can’t sleep at night, it is a good gut check that your current asset allocation or tech concentration is too high. The most important thing right now is honestly to focus on staying employed while having an emergency fund in place in case you do end up laid off.

If you are able to maintain your income, continue investing per your plan, rebalance as needed, then you could come out better off in the long run.

This doesn’t mean BUY THE DIP. Because if you have that much excess capital, beyond your emergency fund, that probably means you have been sitting on too much cash and in the long run will be worse off. If you want to cut back on expenses and increase the amount you can invest monthly, go for it.

One Last Thing:

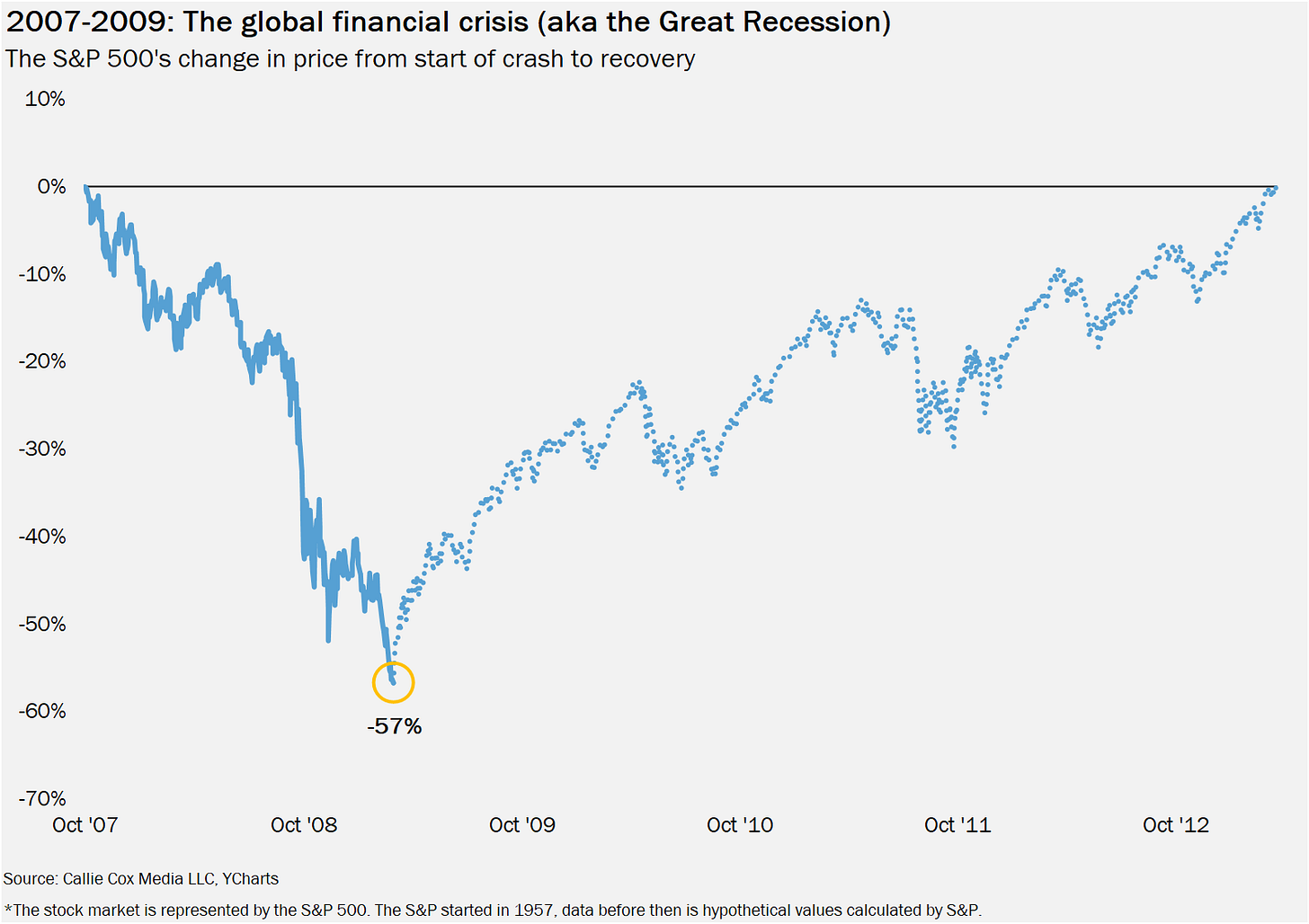

A look back all the way to… the summer of 2022 when we saw tech stocks drop more than 50% and the overall economy enter into a bear market. Which then transitioned into significant FAANG layoffs that seem to continue to the present day.

I also really like this series by Callie Cox that breaks down every US bear market.

How is your plan holding up? Any other questions?

-André

Great write up! I love your commentary about taking a look at your plan during times of tumult and the futility of trying to time the market by buying the dip or "adjusting your asset allocation". These can be hard concepts to grasp in tranquil markets, so it's nice to take a second to consider these things while stocks are lower.