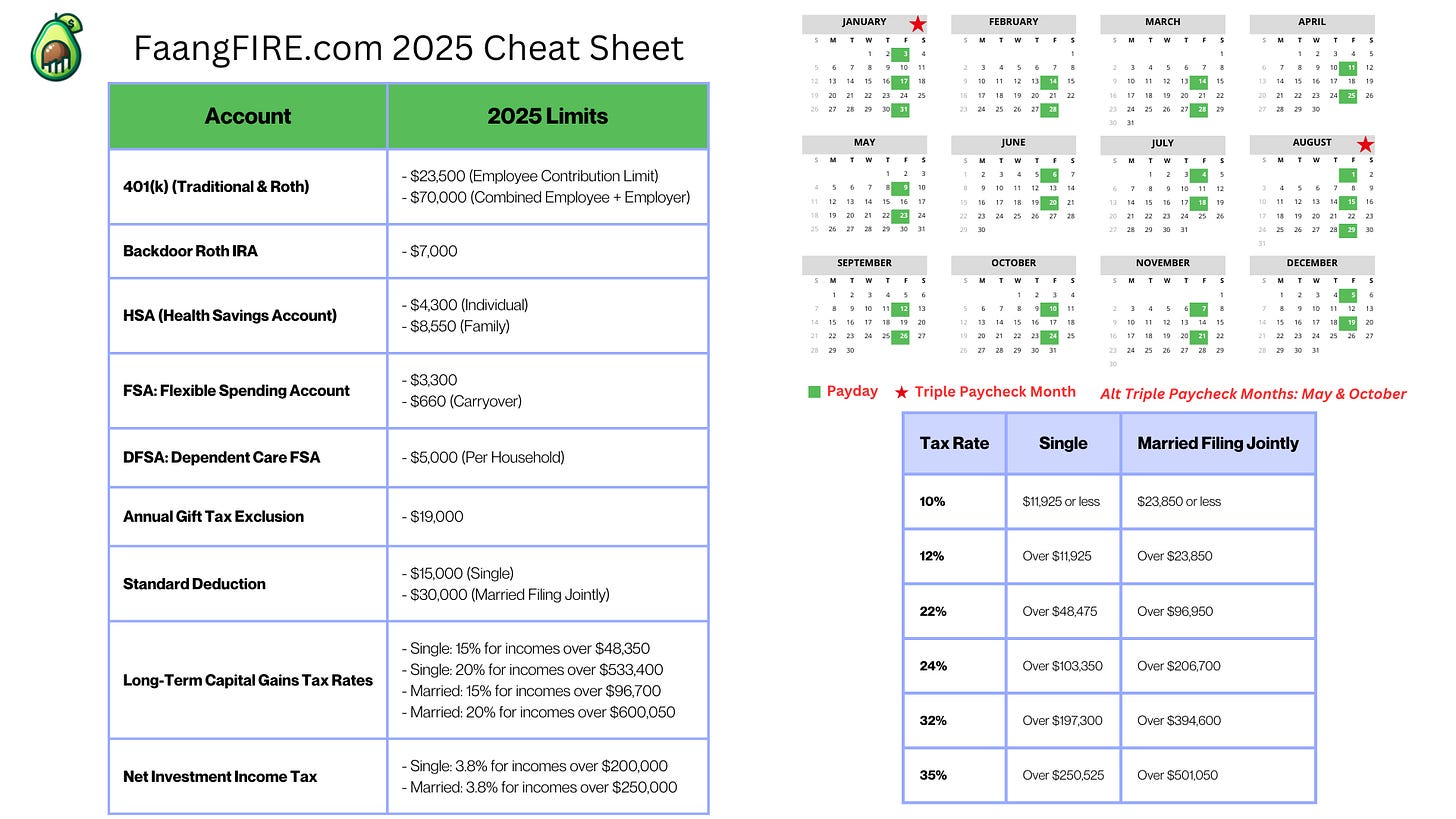

2025 FAANG FIRE Cheat Sheet

Happy 2025! By popular demand, here is the 2025 FAANGFIRE.com Cheat Sheet.

Let’s walk through a few of the sections, so we are all starting 2025 on the same page! There are also additional items below that are not included in the cheat sheet that I personally wanted in one place to reference!

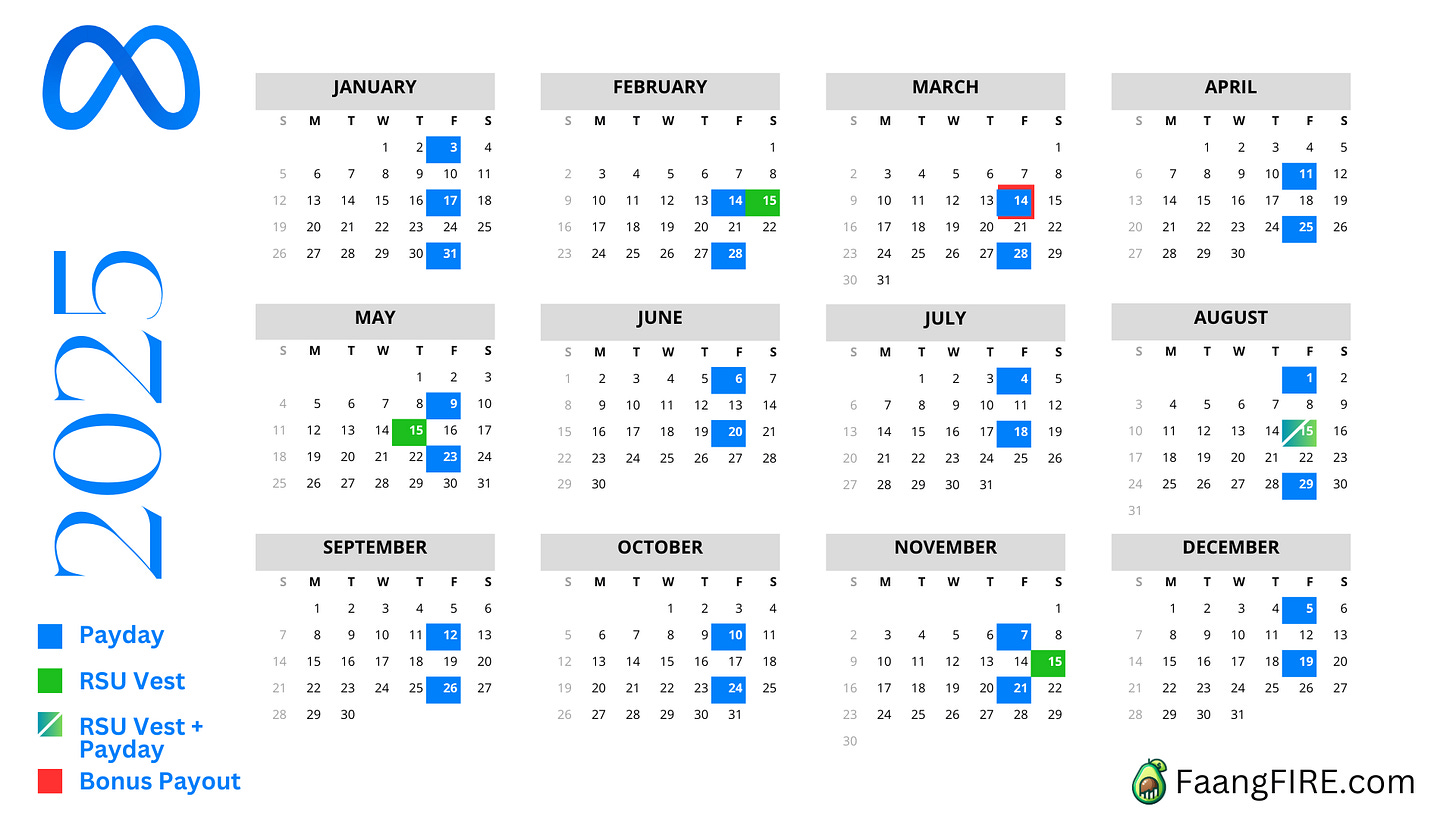

Bi-Weekly Pay Schedule for most FAANG

All of FAANG seems to be on the same bi-weekly pay schedule. The only exception is non-California-based Amazon employees who are paid monthly!

Here is a more detailed breakdown of 2025 for Meta employees that is part of my more comprehensive Meta specific post:

FAANG Triple Paycheck Months 2025: January and August

A bi-weekly pay schedule results in 26 pay periods per year. This means that there are typically 2 months per year where a FAANG employee will receive 3 paychecks! Since humans are creators of habit, we tend to mentally budget based off two pay checks per month. So the “Triple Paycheck Months” can sometimes make it easier to save those “extra” paychecks.

If your first paycheck of 2025 is 1/10/2025, then your triple paycheck months would be May & October.

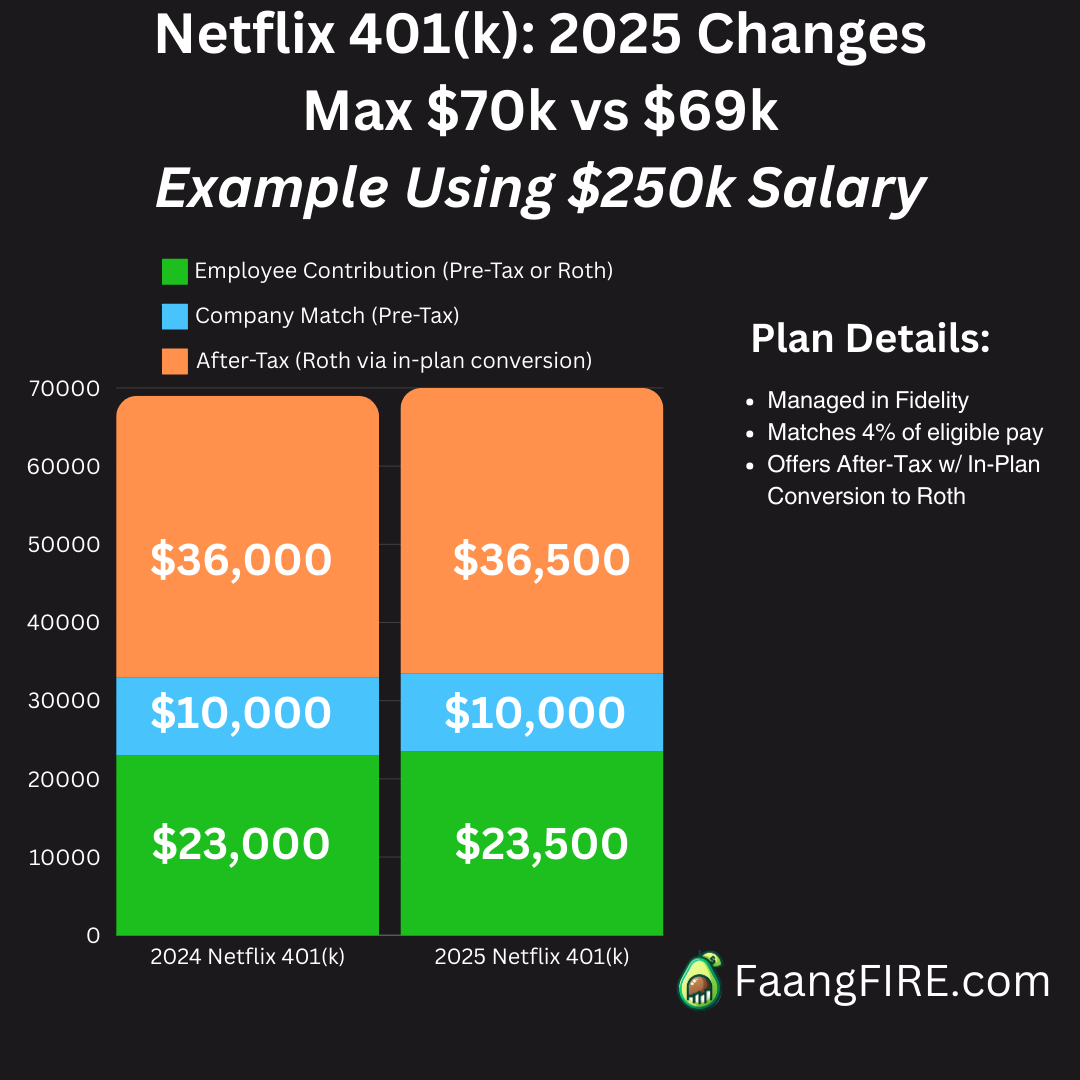

401k 2025 Contribution Limits

$23,500 Employee Contribution Limit (Roth or Pre-Tax)

$70,000 Maximum Contribution Limit (Pre-Tax/Roth + Employer Match + After-Tax)

Example of the 2025 changes for a Netflix Employee:

401k 2025 Catch-Up Contributions1

If you are 50+ you may contribute an additional $7,500 Pre-Tax or Roth

If you are between 60 and 63 there is an odd extra $3,750 catch up in addition to the $7,500

Past Posts for Reference:

Backdoor Roth IRA 2025 Limits

If you earn more than $150k filing as single or $236k married filing jointly your ability to contribute directly to a Roth IRA is phased out. You would still be eligible to contribute to a backdoor Roth IRA.

$7,000 ( If you are over 50 you can add an additional $1,000 catch-up)

Federal Marginal Tax Rates2

For tax year 2025, the top tax rate remains 37% for individual single taxpayers with incomes greater than $626,350 ($751,600 for married couples filing jointly). The other rates are:

35% for incomes over $250,525 ($501,050 for married couples filing jointly).

32% for incomes over $197,300 ($394,600 for married couples filing jointly).

24% for incomes over $103,350 ($206,700 for married couples filing jointly).

22% for incomes over $48,475 ($96,950 for married couples filing jointly).

12% for incomes over $11,925 ($23,850 for married couples filing jointly).

10% for incomes $11,925 or less ($23,850 or less for married couples filing jointly).

Standard Deduction

The majority of tax filers take the standard deduction when they file their taxes. This is essentially the amount of income that isn’t subject to federal taxes by default.

$15,000 if Single and $30,000 for Married Filing Jointly

Long Term Capital Gains Tax Rates for 2025

Long term capital gains are typically applies to gains on assets that were held for more than 1 year. LTCG also apply to qualified dividends.

15% for incomes over $48,350 ($96,700 for married couples filing jointly).

20% for incomes over $533,400 ($600,050 for married couples filing jointly).

Net Investment Income Tax (NIIT)

This NIIT surtax applies to investment income above the specified thresholds, impacting capital gains, dividends, and rental income.

3.8% above $200k Single, $250k Married

Medicare Tax Rate

All employees contribute 1.45% of their payroll income to fund Medicare, with no upper wage limit for this portion of the tax.

1.45% of payroll income

Medicare Surcharge

In addition to the 1.45% Medicare Tax, if you earn more than $200k in wages you would be subject to an additional 0.9% surcharge.

.9% of additional Medicare Tax for income above $200k

Social Security Wage Base

Only the first $176,100 of wages is subject to the 6.2% Social Security tax, though self-employed individuals pay both the employee and employer portions.

The first $176,100 of wages are subject to a 6.2% Social Security Tax (double if self-employed)

HSA 2025 Contribution Limits

Additional Reading: HSAs are 🔥 for FIRE.

$4,300 for individual coverage, $8,550 if your family is covered by a HDHP.

FSA 2025 Contribution Limits

Unlike the HSA, the FSA is a use it or lose it account. Any amount remaining above the $660 carry over limit will be forfeited!

$3,300 with up to $660 allowed to be carried over into 2026

Annual Gift Tax Exclusion Limits: $19,0003

For 2025 you can gift $19,000 per individual without needing to cut into your lifetime exception ($13.99M in 2025 but could be reduced in 2026).

This is useful to know since it can impact things like 529 contributions.

Looking to accelerate your 2025 Financial Goals?

Accelerate your financial goals by partnering with me 1:1 to identify your FIRE goals and create an action plan on how to achieve it. Each coaching plan is personalized, confidential, and the best way to get my thoughts on the specifics of your situation. From on-going accountability, setting up a path to fire, and one-off deep dives. All from a fellow tech worker who has been there.

401k Contribution Source: https://www.fidelity.com/learning-center/smart-money/401k-contribution-limits

Federal Tax Rate Source: https://www.irs.gov/newsroom/irs-releases-tax-inflation-adjustments-for-tax-year-2025

Tax Foundation has an Excellent Tax Resource: https://taxfoundation.org/data/all/federal/2025-tax-brackets/