Hey FAANG FIRE!

This is the final FAANG FIRE post of 2024!

I’ll be hosting my in-laws in San Francisco for the first time after a decade of Texas Christmas trips! Wish me luck!

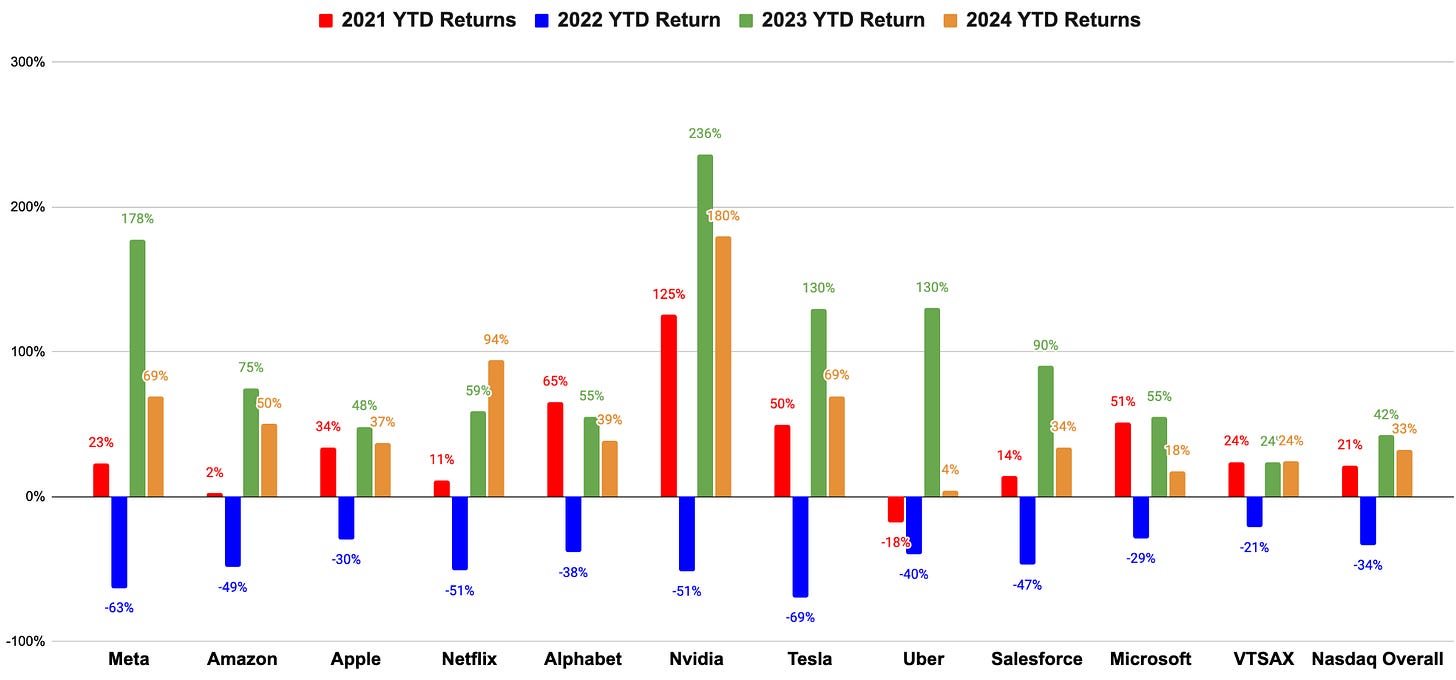

From the whiplash drops in 2022 to the major increases in 2023, it seemed like the party just kept rolling through 2024.

The overall US market (VTSAX as a proxy) is once again up 24% year to date, which makes the last 4 years of overall US market returns: 24%, -21%, 24%, and 24% (without factoring in dividends or distributions).

The arithmetic average annual return is ~12.8%. As you can see, only looking at the average doesn’t always tell the full story.

The geometric average annual return is ~9.4%.

Both META and TSLA are up 69% ytd…

2024 End of Year Tasks

Task 1: Estimate Your Tax Bill (Seriously)

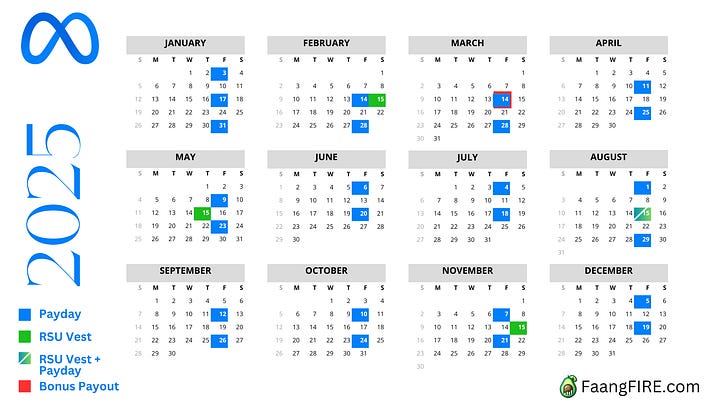

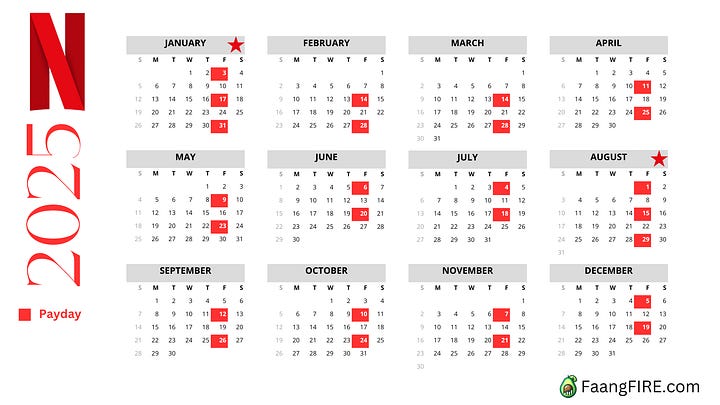

Most of you with W2 incomes have at most 1 paycheck left in the year. You already have the vast majority of information you need to quickly estimate your tax bill. I created a simple tool to estimate your federal taxes. If RSUs make up a significant portion of your income, and you don’t know what supplemental withholdings are, this is extra important.

While having a $50,000 tax bill might be fine, being surprised by a $50,000 tax bill kinda sucks.

Task 2: Look at Calendar Year Based Investments

Backdoor Roth IRA: It might be too late to make adjustments to this year’s 401k but you can still contribute to a Back Door Roth (please don’t do this if you have a traditional IRA with a balance, it will lead to a pain in the ass otherwise known as the Pro Rata Rule). You can contribute $7,000 in 2024. You technically have until you file your taxes to execute this.

Note: If you are using Fidelity, they are taking up to 3 weeks to clear transfers initiated from Fidelity. I needed to separately wire additional funds to get everything finished. Very frustrating.

Task 3: Look for Tax Gain/Loss Harvesting Opportunities

The following is not tax advice! Things can get a little hairy, make sure to do your own research, and even consult a tax professional who understands this stuff.

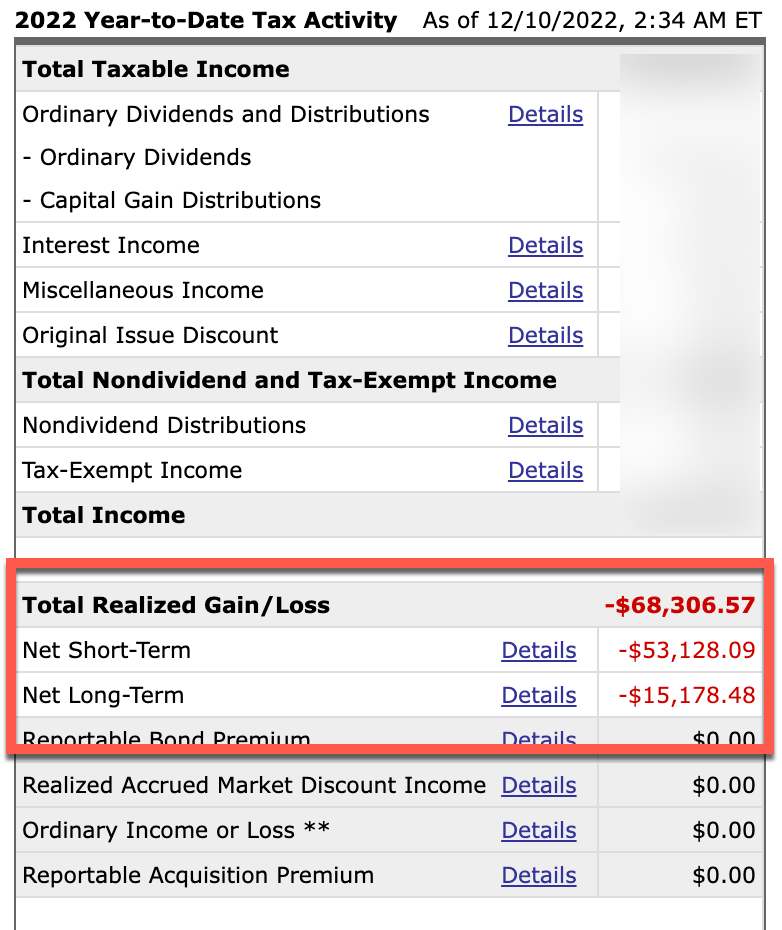

In 2022, I was able to harvest nearly $70k in losses. This offset any capital gains I had that year, in addition to reducing my taxable income by $3,000. This amounts to more than a $1,400 savings for a California couple earning > $500k. You can read in detail how I approached this last year in “Is Tax Loss Harvesting a Waste of Time?”.

I used up most of those losses in 2023 when I reduced my partner’s concentrated UBER holdings.

One very important thing I want you all to understand! Losses can carry forward into future years. Since I didn’t use them all in 2023, they reduced my taxable income by $3,000, with the remaining following me into 2024.

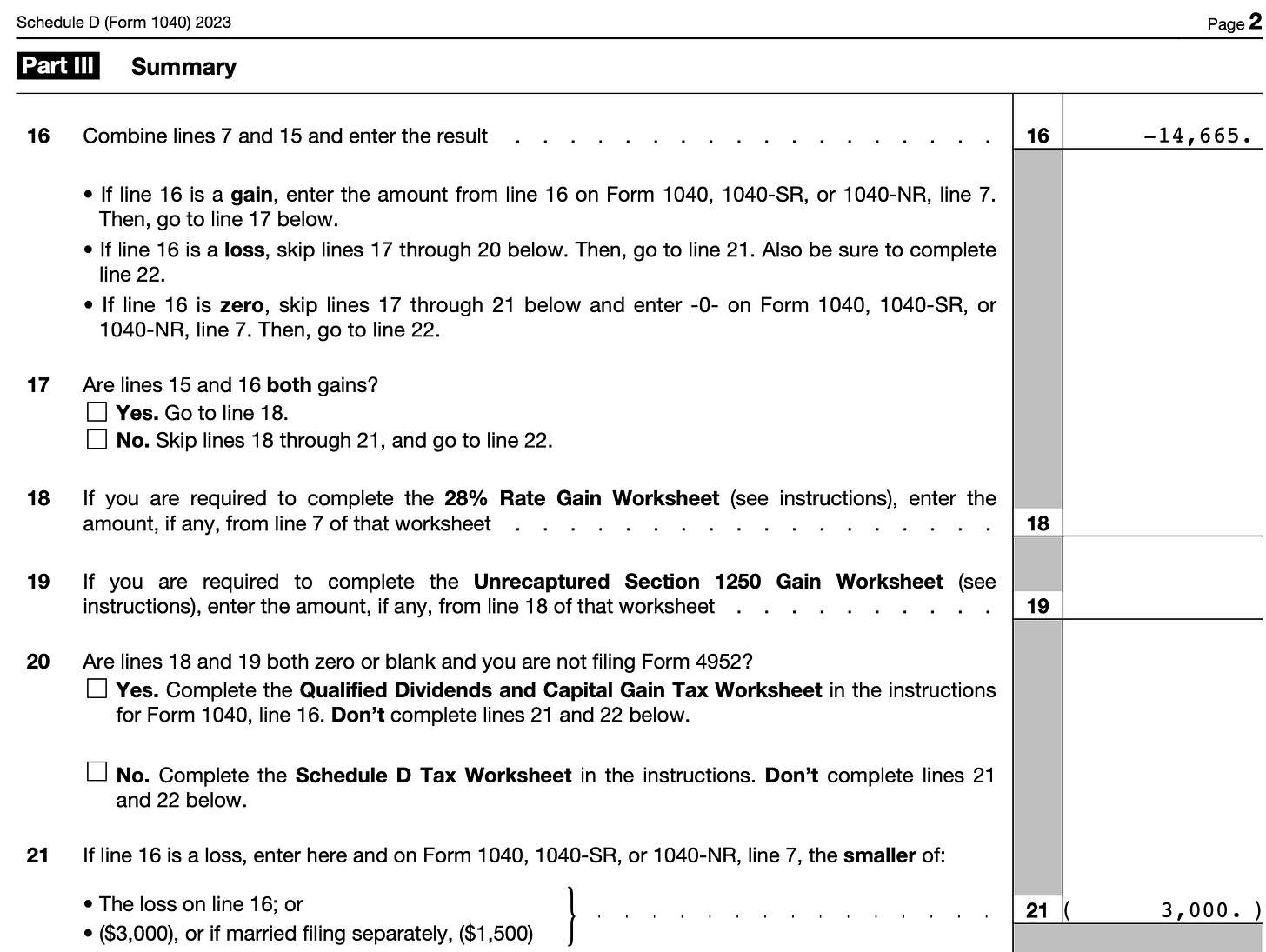

If I look at my 2023 tax returns, I can go to my Schedule D and look at lines 16 and 21.

This is telling me I still had $14,665 in losses in 2023 after factoring in any gains that were offset. Line 21 shows that $3,000 will go towards reducing my ordinary income (since I am married, $1,500 if unmarried). That means in 2024 I still have $11,665 in losses that were carried forward!

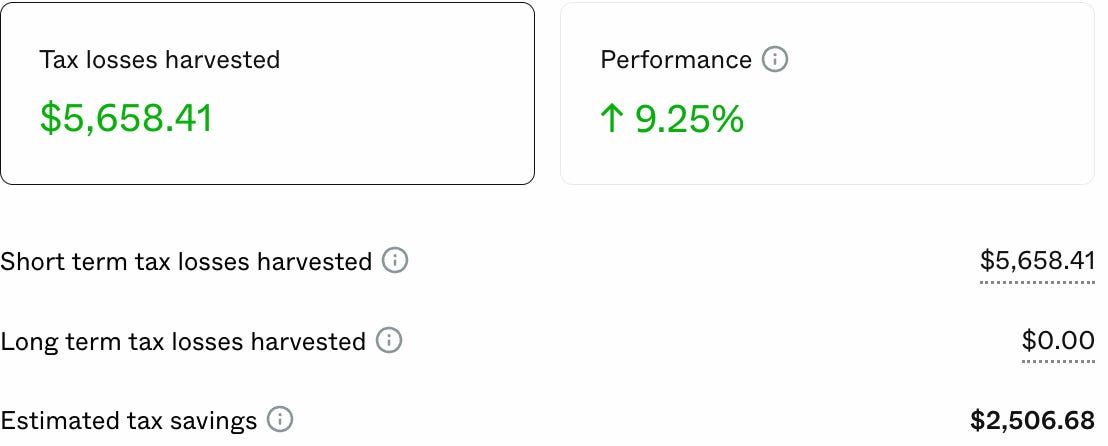

In July I also contributed $100,000 to my Frec Direct Indexing Portfolio. While my portfolio is up 9.25%, Frec was able to harvest $5,658 for me so far.

This brings my total losses in 2024 to ~-$17,323.

This means I can sell positions with up to $17k in capital gains without any additional tax implications! This is really useful if you have some concentrated positions you want to get out of but have been hesitant because of the tax implications.

If I don’t use the full $17,000, $3,000 will be used to reduce my taxable income, with the remaining carrying forward once again into 2025!

To be clear, I think tax loss harvesting is often over-hyped. But I am definitely a fan of reducing my taxable income by the $3,000 and having the built up losses to help get out of a concentrated position. At the end of the day, tax loss harvesting should be viewed as a tax deferral and tax arbitrage strategy.

Task 4: Join the FAANG FIRE Book Club

One of my 2025 goals is to read more and build community within FAANG FIRE. We are starting the year with a book I am really excited about, Money for Couples by Ramit Sethi. Grab your partner and join us as we plan to discuss the book on Valentine’s Day!

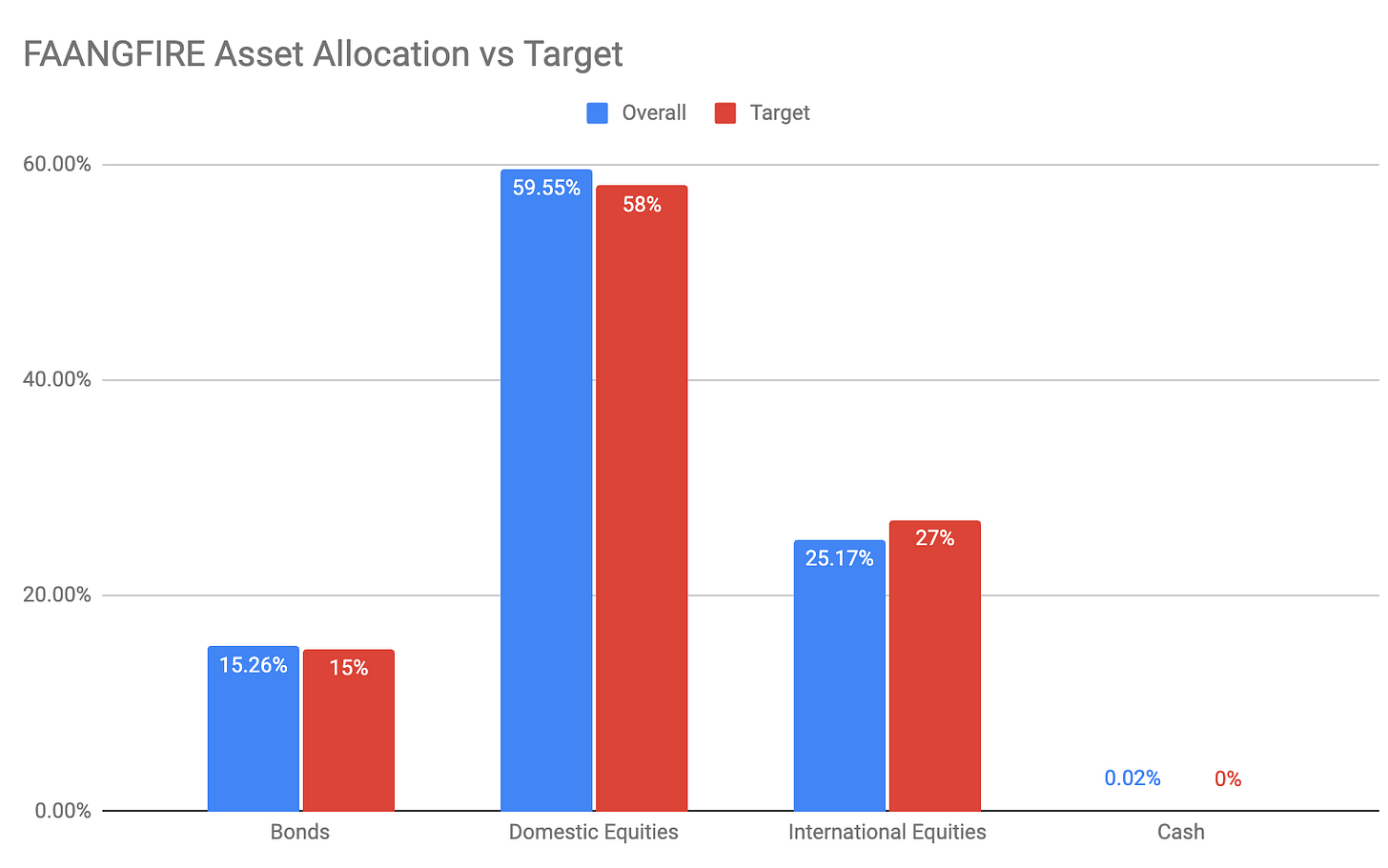

Task 5: Check Your Asset Allocation/Potentially Rebalance

I like to check my asset allocation a few times a year and make adjustments primarily through new contributions (rebalancing). Sometimes though, the market moves so quickly that new contributions alone make it hard to get back to your goal allocation.

I just wrote about my most recent rebalancing process in August. I am mostly still on target so I don’t feel the need to rebalance right now.

These asset allocations represent my entire household’s portfolio, which I view as one large, unified portfolio. It includes only my FIRE-allocated investments. It excludes my emergency fund, bank account balances, my daughter’s 529 account, and any individual stocks I hold. The exclusion of individual company shares is very unconventional. I primarily use it as an extra forcing function to consistently sell RSUs that vest (META and UBER previously, now only UBER via my partner). The one recent exception to my individual company exclusion is the $100,000 I have invested with FREC’s Direct Indexing Product (which is lumped into my US Equities allocation).

Task 6: Check Company Perks, FSA, Gym, Medical, Choice Benefits

FSA: If you contributed to an FSA in 2024, you can roll over up to $640 this year. Anything above this amount vanishes into thin air (or into your company’s pockets).

DFSA: While the FSA allows a $640 carryover, if you set up a dependent care FSA, it’s all use it or lose it. Be sure to submit those childcare, camp, afterschool care expenses to cash out this pre-tax benefit!

Vision Benefits: Make sure to order contacts/glasses before the end of the year to utilize your benefits tied to the calendar year. One special perk of the Meta plan is that you can get 2 pairs of free sun glasses up to ~$200. VSP’s online store www.eyeconic.com can verify all your benefits and has a decent selection.

Meta Specific Benefits: I made sure to use all of these prior to the end of my severance period. For those still at Meta, be sure to use those Choice Benefits. You have $2,000 to use each year for an extensive number of things (including ahem Financial Coaching). Many other companies have versions of this specific to Gym or Childcare.

Task 7: Start Budgeting and Tracking Your Investments

Do future you a favor and start tracking your expenses and investments. If you get things set up in the next few weeks, you’ll start 2025 with a clean slate!

For many of you, 2025 will start off with a mystical Triple Paycheck Month as seen below in my Meta & NFLX calendars.

Quick excerpt from my longer post on Mint Alternatives (Note: This includes affiliate and referral links where available; all of these recommendations are tools that I’ve personally used over multiple years.):

Top Free Tool: Empower. If you are looking for a free alternative to track your overall net worth, Empower is my recommendation. Great investment tools and net worth tracking, more lackluster if you want granular spend tracking, and budgeting.

Top All-In-One Paid Tool: Monarch. If you care about strong categorization of your spending, goal setting, smart automation, good design, and are willing to pay, Monarch is an easy option to recommend.

Top Paid Budgeting Specific Tool: You Need a Budget aka YNAB. If you really want to go deep into your cash flow, to change your behavior, to actually budget, are willing to put up with an opinionated way of giving every dollar a job, and don’t care about overall net worth tracking, YNAB is really hard to beat...

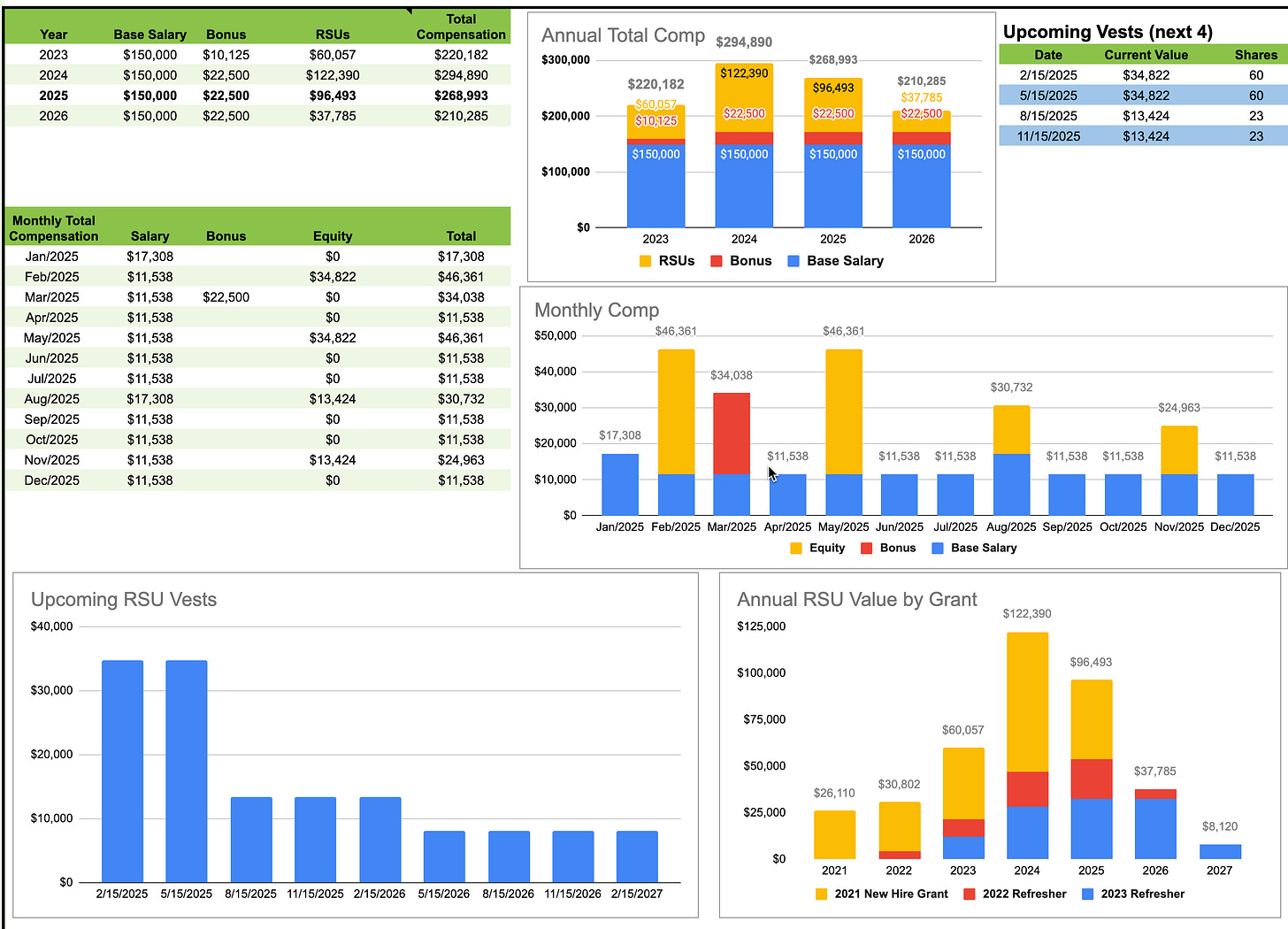

Task 8: Start Projecting Your Income and FIRE Journey

Everyone should understand their total compensation. Get a jump start on 2025 by making a copy of my in-progress 2025 RSU Total Compensation Dashboard. It isn’t 100% ready yet, but if you want to get it set up, you can follow the guide from 2024.

For those who are closer to their FIRE numbers, I also really like two tools that I am personally utilizing right now to plan my own FIRE journey:

Projection Lab: A newcomer in the FIRE tool space. Projection Lab is a solo-project that is gaining a strong following within the FIRE community. The developer is actively making improvements and I am really excited about the trajectory and power this tool is providing.

Boldin: There isn’t a better paid tool out there that allows as much deep scenario planning and projections as Boldin. Their Roth Conversion calculator is one of my favorite features and helps me answer the questions around how I would optimally access my FIRE nest egg when I finally pull the trigger and retire early.

Closing Thoughts

In January, I’ll be putting together a full Mission Statement update along with sharing how I am approaching my personal goals. This was my first full calendar year of being “Semi-FIRE”. I have been spending time on projects that give me purpose without needing to factor in the financial implications. This is what FIRE is all about to me: optionality.

My Substack goals were to reach 15,000 subscribers with 100 paid subscribers, and I exceeded those expectations.

Writing is one way I process my own thoughts. I appreciate you being here with me on this journey.

From Around the Web

Podcasts:

I recently spoke with Jake and Arun on the Techonomics podcast. We dove into my favorite topic, FIRE in tech!

Listen on Apple, Spotify, or wherever you get your podcasts.

In the News: I appeared a few times in Business Insider over the past few months:

Happy Holidays!

-André

TLH is totally over-hyped

On Boldin, please see https://open.substack.com/pub/larrykotlikoff/p/boldins-new-retirement-roth-conversion?r=15iqid&utm_medium=ios